Pretty GREEN out there

- Hong Kong: Hang Seng closed up +0.97%

- China CSI 300 +0.65%

- Taiwan KOSPI +1.66%

- India Nifty 50 +0.48%

- Australia ASX -0.51%

- Japan Nikkei -0.54%

- European bourses all in positive territory so far this morning

- USD -0.20%

TOP 5 STORIES OVERNIGHT

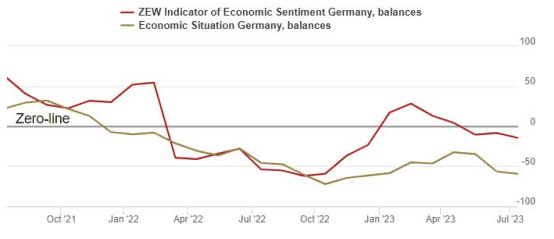

- ZEW German Investor Outlook Falls More Than Expected On Growth, Interest Rate Concerns -Livesquawk

A monthly poll of financial market experts continues to send warnings about the health of Europe’s largest economy.

Germany’s ZEW economic thinktank said Tuesday that its July expectations measure for the coming six months dropped to -14.7 points, the lowest mark since December. This month’s result fell short of both the forecast of -10.6 and the -8.5% reading from June.

The current conditions reading fell to its lowest point since January, dropping to -59.5 points, which was better than the -62.0 market forecast and down from-56.5 last month.

Results for the Eurozone were also lower, the ZEW said.

EUR/USD dropped below 1.10 following the news.

- China Signals More Economic Aid After Property Debt Relief-BBG

China signaled more economic support measures are imminent after authorities took a small step toward supporting the ailing property market by extending loan relief for developers.

Top state-run financial newspapers ran reports Tuesday flagging the likely adoption of more property supportive policies, along with measures to boost business confidence.

“The move signals that regulators consider it’ll take a year and a half more for developers to see their fundraising and operations normalize,” said Liu Shui, a research director at China Index Holdings Ltd. “It means the housing market downturn and developer risks have been worse than they expected earlier.”

A Bloomberg Intelligence gauge of Chinese property shares rose 1% on Tuesday afternoon, paring this year’s decline to 26%. Iron ore futures in Singapore rose as much as 2.5%. Chinese high-yield dollar bonds, dominated by developers’ notes, were little changed in the morning, according to credit traders.

Besides property, other facets of the economy are also showing weakness. Consumer spending is sluggish, exports are flagging and local government debt is soaring. Data on Monday showed the nation’s consumer inflation rate was flat in June while factory-gate prices fell further, deepening deflation concerns and adding to evidence that the recovery is weakening.

China still not looking that great, so far no real stimulus, but China markets seem

to like this news as they ended green today after a devastating sell-off last week

- UK’s Centrica and Delfin Midstream sign 15-year US LNG supply deal-Reuters

Deal has market value of $8 billion

Centrica will take delivery of about 14 cargoes per year

Subject to Delfin’s planned Deepwater Port going ahead

First LNG expected from the port in 2027

British Gas parent firm Centrica (CNA.L) has signed a 15-year liquefied natural gas (LNG) supply agreement with U.S.-based Delfin Midstream, the companies said on Tuesday.

LNG demand is strong, good to see Europe finally signing some long-term contracts. 2027 should be a huge year for US LNG (this is not the only deal that commences in 2027)

- UBS urges investors to seek refuge in US Treasury, gold on heightened recession concern in second half -SCMP

Investors should add haven assets like bonds and gold to their portfolios as the US is likely to slide into a recession, prompting the Federal Reserve to unwind financial tightening and the US dollar to weaken, according to UBS Wealth Management.

The consensus view is that the recession may occur in the third or fourth quarter after 10 consecutive interest-rate increases by the Fed, which would send bond yields down and pummel the US dollar, said Hu Yifan, chief investment officer for Asia-Pacific at the investment advisory unit of UBS Group, at a webinar on Monday.

Gold may test a high of US$2,000 an ounce in the next six months, while US stocks are likely to come under pressure because of their high valuation and bleak growth prospects, she said.

“The bond market has become pretty attractive now and it may turn into the biggest bull market in a decade,” said Hu. “Gold is another preferred asset allocation. It’s negatively correlated with the US dollar and inflation, and all these positive factors are still out there in the second half.”

Interesting

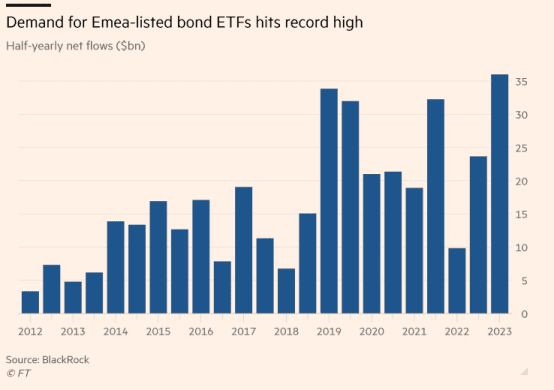

- Demand for European bond ETFs hits record high in first half -FT

Demand for European fixed-income exchange-traded funds hit record levels in the first six months of 2023, as the assets of the global ETF industry hit an all-time high.

Investors poured a net $36bn into bond funds listed in the Europe, Middle East and Africa region in the first half of the year, according to data from BlackRock, surpassing the previous record of $33.8bn set in the first half of 2019.

On a global basis, fixed income ETFs have pulled in a net $165.4bn so far this year, a record start to the year, although just shy of the tally recorded in the second half of 2022.

Karim Chedid, head of investment strategy for BlackRock’s iShares arm in the Emea region, said rising bond yields were luring investors into the fixed-income market.

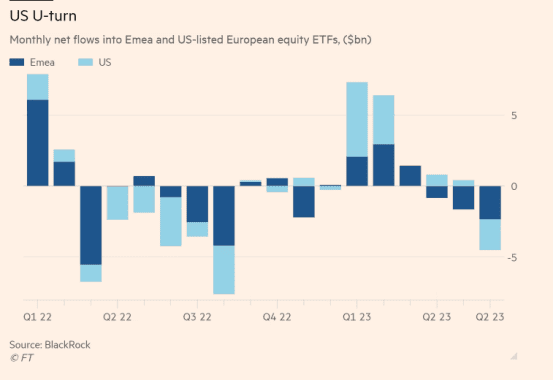

Enthusiasm for equities was not universal, however, as for the first time this year US investors “meaningfully sold” European equity ETFs, potentially signalling the end of a period where “international investor flows into European equities have been stickier versus history,” Chedid said.

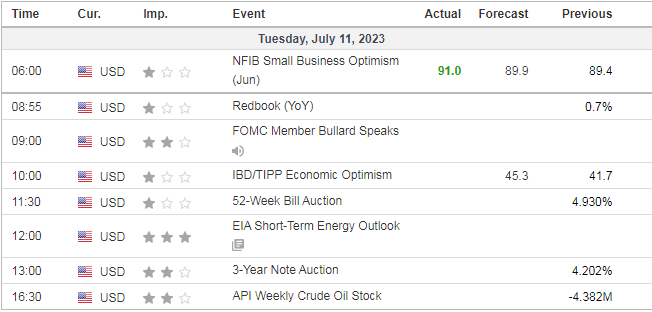

US DATA TODAY