CPI DAY!!

Asia mixed…Europe green

- Hong Kong: Hang Seng closed up +1.08%

- China CSI 300 -0.67%

- Taiwan KOSPI +0.48%

- India Nifty 50 -0.29%

- Australia ASX +1.51%

- Japan Nikkei – 1.37%

- European bourses all in positive territory so far this morning

- USD -0.23%

TOP 5 STORIES OVERNIGHT (slow night)

- China Regulator Asked Banks to Respond to Bearish Goldman Report -BBG

China’s financial regulator asked banks to respond to a bearish research report on the sector by analysts at Goldman Sachs Group Inc., underscoring heightened sensitivity in Beijing toward negative market commentary as the economy slows.

The National Administration of Financial Regulation communicated with several of the largest Chinese banks after Goldman analysts cut ratings on some shares and lowered price targets on others, people familiar with the matter said, asking not to be named discussing private information. The regulator told banks to respond appropriately, without giving specific guidance, the people said.

China Merchants Bank Co. addressed the Goldman report in a clarification statement dated Friday, saying it had “misled some investors” and was “illogical.” The bank’s rebuke followed a similar rebuttal in the state-run Securities Times newspaper last week. One of China’s largest macro hedge funds has also criticized the report.

China being China

- Japan Cost Guard: N. Korea Missile Expected To Fall Outside Its EEZ Around 11:13am JST

Japan Chief Cabinet Sec. Matsuno: No Damages From N.Korea’s Missiles Has Been Reported So Far

- Property insurers’ ratings under pressure as risk rises, Morningstar says

The credit ratings of global property insurers are coming under pressure as rising reinsurance costs force them to cut back on cover and retain more risks themselves, DBRS Morningstar analysts said in a research note on Wednesday.

Reinsurers, which insure insurance companies, have been raising rates in recent years due to growing losses that industry players say are in part driven by the impact of climate change.

Global reinsurance prices were up 27% in January compared to a year earlier, marking the sixth straight year of increases, Morningstar said, citing preliminary data from U.S. risk and reinsurance group Guy Carpenter.

It was the biggest annual increase since 2006, when prices rose in the aftermath of hurricanes Katrina, Rita and Wilma, the brokerage continued.

“We expect the tougher reinsurance market conditions to continue in the short to medium term, putting to the test insurers’ risk management capabilities,” Morningstar said, warning this could adversely affect insurers’ credit ratings.

Global property markets worth keeping an eye on

- Bank of Canada expected to hike rates as economy outperforms-Reuters

– The Bank of Canada (BoC) on Wednesday is expected to hike its key overnight rate by a quarter of a percentage point to a 22-year high of 5.00% as economic growth continues to fuel a tight labor market and sticky underlying inflation, analysts said.

Last month, the Canadian central bank raised its overnight rate to 4.75% – also the highest level since 2001 – after a five-month pause, saying monetary policy was not restrictive enough. It then said further moves would depend on the picture painted by the latest economic data.

While there have been some signs of cooling, economic growth has been resilient and the housing market has shown signs of picking up despite nine rate increases totaling 450 basis points since March of last year. The economy regained momentum in May, likely growing 0.4% on the month, after stalling in April.

The BoC will announce its decision at 10 a.m. EDT (1400 GMT).

- More ECB Hiking Puts Euro-Zone Growth in Peril, Portugal Warns-BBG

Further interest-rate increases by the European Central Bank would add to the dangers for the euro-area economy as it seeks to exit a recession, Portugal’s finance minister cautioned.

Inflation is already on a downward trend following an unprecedented bout of monetary tightening by the ECB, Fernando Medina said in an interview. Meanwhile, the effects of rate hikes to date haven’t yet been fully absorbed by households and companies.

“The risks that further increases could create a more difficult situation for growth at the European level are now higher and should be looked at very carefully,” Medina said this week in Lisbon.

Warnings about the consequences of additional tightening are growing louder as the ECB nears the end of a campaign that began a year ago and has brought its deposit rate to 3.5% from below zero.

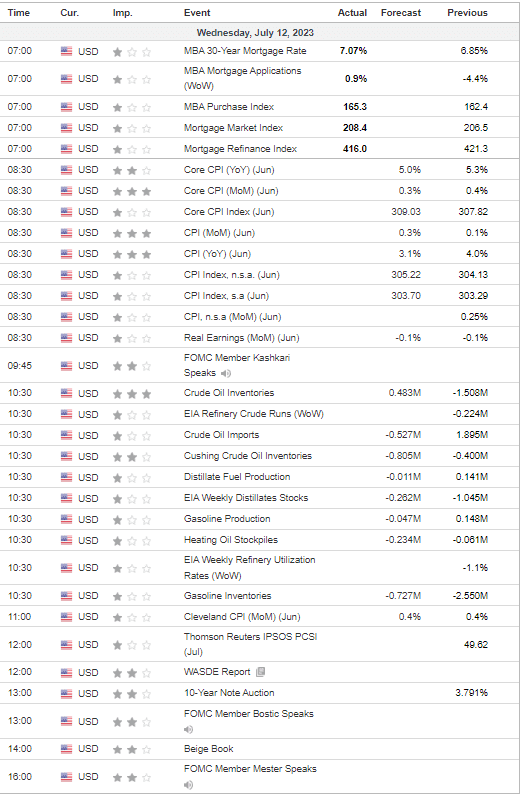

US DATA TODAY