Mixed Markets

- Hong Kong: Hang Seng closed down -0.39%

- China CSI 300 -0.18%

- Taiwan KOSPI -0.79%

- India Nifty 50 -0.06%

- Australia ASX +0.40%

- Japan Nikkei +0.38%

- European bourses in mixed territory so far this morning

- USD +0.22%

TOP STORIES OVERNIGHT

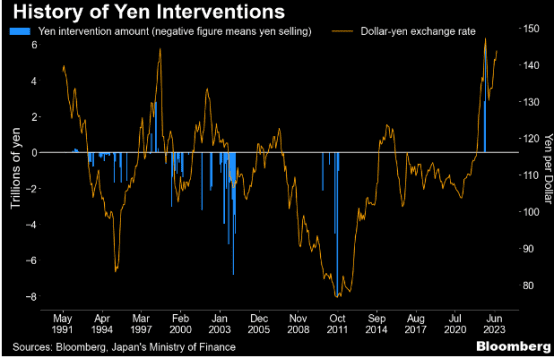

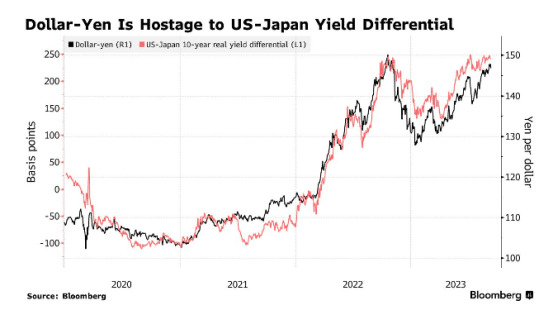

Fed Threat Means Yen Intervention Still in Play After Rally-BBG

The yen remains vulnerable to sharp movements and government intervention even after its rally at the start of this week as key US data and central bank meetings loom large among potential catalysts.

US inflation figures on Wednesday are expected to show price growth accelerating for a second month in August versus a year earlier. If headline price growth outpaces the consensus for a 3.6% gain, reignited speculation of another US interest rate hike might boost the dollar, returning the yen to fresh year-to-date lows.

The pace of any yen slump will likely be the key to whether officials at Japan’s Ministry of Finance respond with ramped-up verbal warnings or consider action.

“But history suggests that levels matter to some degree, so there will be plenty of caution ahead of 150,” said Sean Callow, senior currency strategist at Westpac Banking Corp. “There may be some hints at looming action in terms of the frequency of public comments, but successful intervention usually requires an element of surprise, so the MOF doesn’t want to tip its hand.”

COMMENTS: An intervention could cause an unwind of the carry trade that would ripple through currency markets. If you missed the Place Your Trades Wednesday spaces with Blake Morrow (@pipczar) three weeks ago, I encourage you to go back and listen to it. You can find it on the OnDemand tab on this site

Tech Stocks Fall After Oracle Results-BBG

Tech stocks were in retreat as Oracle Corp. posted slowing cloud sales, while the euro and pound weakened on concern the Europe faces a growing threat of stagflation.

Nasdaq 100 Index futures slipped 0.3%, signaling the index will pare yesterday’s 1.2% rally. In Europe, packaging company Smurfit Kappa Group plunged 11% after it announced a deal to combine with WestRock Co.

Tech stocks are set to be the center of attention on Tuesday, with Apple Inc. preparing to announce a new product lineup and SoftBank-owned chip designer Arm Ltd. gearing up for the biggest initial public offering of the year. Meanwhile, Oracle put a spotlight on the risks of investing in high-flying tech shares.

Oracle plunged 10% in premarket trading, with Morgan Stanley analysts saying the results raise questions about the timing of generative AI demand turning into revenue across the broader business.

Comments: Keep an eye on tech stocks today, and particularly Apple as they have the power to move the indices as they are weighted heavily in the indicies

China Returns to Buy Winter Gas Supply in Risk to Global Balance-BBG

China is looking to stock up on liquefied natural gas for winter, returning to the spot market in a move that risks reducing supply to other importers.

Unipec, the trading arm of Sinopec, released a tender to purchase more than a dozen shipments for this winter, in addition to deliveries through the end of 2024, according to traders with knowledge of the matter.

While it isn’t clear if Unipec’s shipments are to meet domestic demand or for use in its trading portfolio, this is still the biggest push by a state-owned Chinese importer to procure LNG from the spot market since February.

The nation’s potential return to the market could curb the availability of LNG for Europe, which is turning to the super-chilled fuel to replace pipeline gas deliveries from Russia.

Risks from frigid weather to strikes and China’s appetite for fuel threaten to disrupt the LNG market’s delicate balance, according to executives and analysts at the Gastech conference in Singapore last week.

COMMENTS: This is causing a spike in the European and Asian gas market, but it has yet to really impact the US market. This winter may get interesting again.

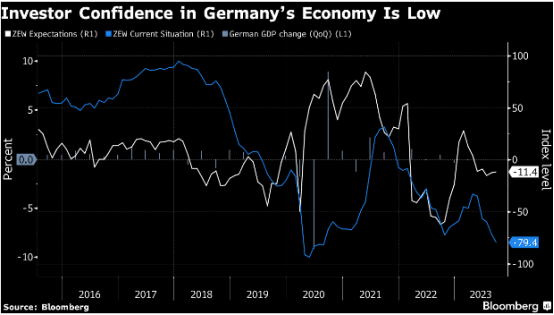

German Investor Outlook Improves But Still Signals Weak Momentum-BBG

Investor confidence in Germany’s economy improved for a second month, while lingering at a level that will do little to dispel intensifying concerns over the country’s status as Europe’s growth laggard.

The ZEW institute’s gauge of expectations rose to -11.4 in September from -12.3 in August. While that’s better than economists in a Bloomberg survey had predicted, it’s still well below a longer-term average for the indicator. An index of current conditions worsened to -79.4.

Treasury Bills Are the Hot Investment. Who’s Paying Up for Them?-BBG

A seemingly insatiable demand for cash is rippling through markets.

Everyone — from moms and pops to corporate treasurers and the mega asset managers — is piling in, won over by a unique opportunity: To lock in a 5% yield, and protect themselves from uncertainty over the US economy.

With rates on cash and cash-like instruments at the highest in more than two decades and offering more income than benchmark US debt or stocks, assets in money-market fund’s have swelled to a record. But nowhere is that appetite for liquid, high-yielding instruments more apparent than in the market for T-bills where investors have snapped up more than $1 trillion of new notes in just the last three months.

“These are attractive yields so it never made much sense for bills to be stuffed with the dealers for long,” said Thomas Simons, senior economist at Jefferies LLC. “It has taken a long time for retail investors to pay attention to bills, and the same motivation is there for institutional investors too.”

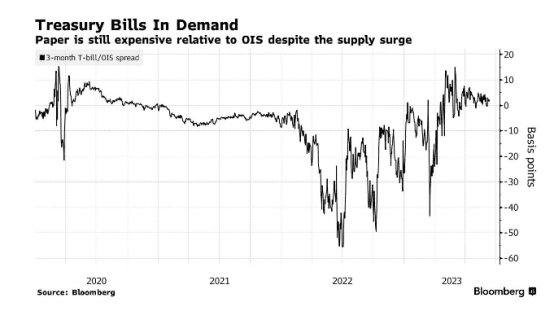

Demand has been so robust, the amount of bills sitting on balance sheets of primary dealers, the first port of call for Treasury debt sales, plummeted to about $45 billion last month after touching an all-time high of $116 billion in July. It has also made the paper more expensive, driving the difference between bill yields and so-called overnight index swaps — which investors use to measure the Fed’s path — back toward zero after climbing into positive territory for the first time since 2020.

COMMENTS: CME Group to Launch T-Bill Futures on October 2, as U.S. Treasury Futures Open Interest Hits Record 19.8 Million Contracts

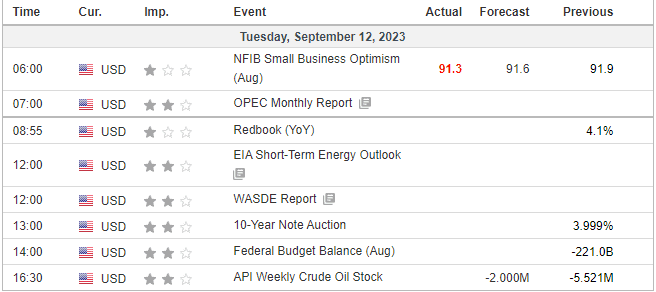

US DATA TODAY