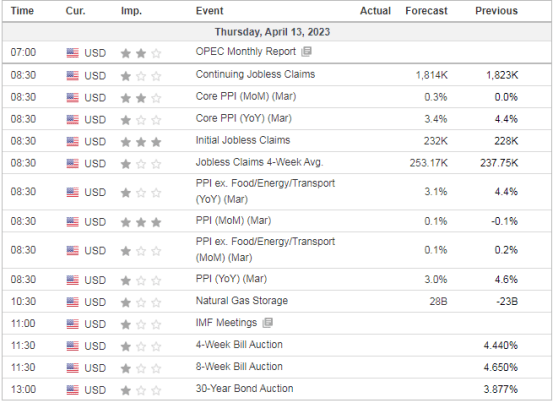

US Continuing Jobless Claims AND PPI at 8:30 AM ET

Asia mostly green…Europe mostly not

- Hong Kong: Hang Seng closed up +0.17%

- China CSI 300 -0.69%

- Taiwan KOSPI +0.43%

- India Nifty 50 +0.08%

- Australia ASX +0.46%

- Japan Nikkei +0.86%

- All European bourses broadly in negative territory so far this morning led by Germany, Italy, Netherlands, Spain, and Switzerland

- US indices slightly pretty flat so far this morning in pre-market, USD -0.18%

Overnight Data/News

- PBoC Sets Yuan Mid-Point At 6.8658 / Dlr VS Last Close 6.8721

- China Jan.-March Imports Rise 0.2% Y/Y In Yuan Terms – Jan.-March Exports Rise 8.4% Y/Y In Yuan Terms – Jan.-March Trade Surplus 1.41t Yuan

- German CPI (M/M) Mar F: 0.8% (est 0.8%; prev 0.8%) – German CPI (Y/Y) Mar F: 7.4% (est 7.4%; prev 7.4%) – German CPI EU Harmonised (M/M) Mar F: 1.1% (est 1.1%; prev 1.1%) – German CPI EU Harmonised (Y/Y) Mar F: 7.8% (est 7.8%; prev 7.8%)

- UK Monthly GDP (M/M) Feb: 0.0% (est 0.1%; prev 0.3%) – UK Monthly GDP (3M/3M) Feb: 0.1% (est 0.0%; prev 0.0%)

- UK Industrial Production (M/M) Feb: -0.2% (est 0.2%; prev -0.3%) – UK Industrial Production (Y/Y) Feb: -3.1% (est -3.7%; prev -4.3%)

- UK Manufacturing Production (M/M) Feb: 0.0% (est 0.2%; prev -0.4%) – UK Manufacturing Production (Y/Y) Feb: -2.4% (est -4.5%; prev -5.2%)

- UK Index Of Services (M/M) Feb: -0.1% (est -0.1%; prev 0.5%) – UK Index Of Services (3M/3M) Feb: 0.1% (est -0.1%; prev 0.0%)

- UK Construction Output (M/M) Feb: 2.4% (est 1.0%; prev -1.7%) – UK Construction Output (Y/Y) Feb: 5.7% (est 1.6%; prev 0.6%)

- Eurozone Industrial Production SA (M/M) Feb: 1.5% (est 0.1%; prevR 1.0%) – Eurozone Industrial Production WDA (Y/Y) Feb: 2.0% (est -0.4%; prev 0.9%)

- Chinese Exports Recover As Number Of Empty Containers Falls – Shanghai Securities News

- Australian Jobs Surge As Labour Market Weathers Rate Hikes – BBG

- Investors Shun Riskier US Corporate Debt As Recession Fears Loom – FT

- Apple Triples India iPhone Output To $7 Billion In China Shift – BBG

- ECB Policymakers Converging On 25-Bps Rate Hike In May – RTRS Sources

- Germany Pushes Intel To Spend More On €17Bln Chip Plant – FT

- China’s March crude oil imports surge 22.5% from year earlier

- RBC Becomes World’s Biggest Fossil-Fuel Bank, Topping JPMorgan

US DATA TODAY