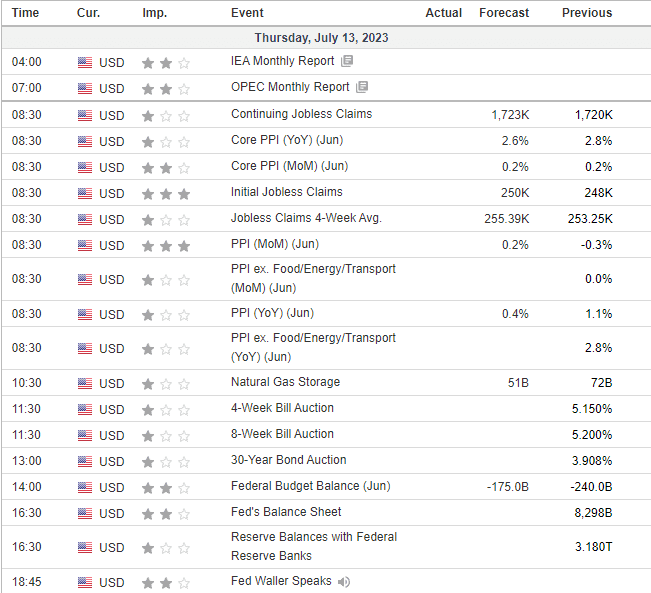

Jobless claims and PPI day!

Green as far as the eye can see….

- Hong Kong: Hang Seng closed up +2.60%

- China CSI 300 +1.43%

- Taiwan KOSPI +0.64%

- India Nifty 50 +0.30%

- Australia ASX +0.35%

- Japan Nikkei +2.22%

- ALL European bourses all in positive territory so far this morning

- USD -0.27%

TOP 5 STORIES OVERNIGHT

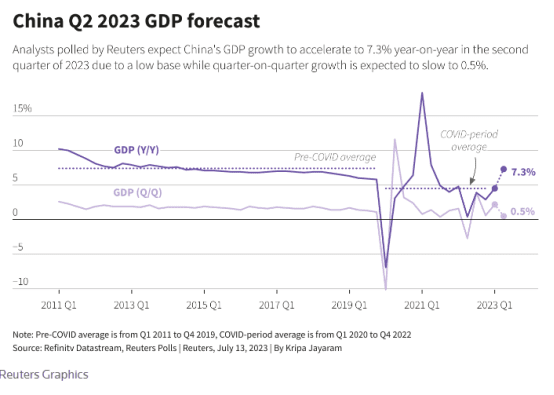

- China’s Q2 GDP seen rising 7.3% year over year but on low base, recovery fades: Reuters poll

China’s economy likely grew 7.3% in the second quarter from a year earlier due to a low base, but momentum is rapidly faltering, a Reuters poll showed, raising expectations Beijing will have to roll out more stimulus measures soon.

While the reading will be heavily skewed by economic pains caused by COVID-19 lockdowns last year, the expected expansion would be the highest since the second quarter of 2021, according to the median forecasts of 56 economists polled by Reuters.

Gross domestic product grew a stronger than expected 4.5% in the first quarter, driven by pent-up demand after three years of COVID curbs, but momentum has faded since April as demand at home and abroad weakens.

Highlighting the swift and sharp deceleration, analysts forecast the economy grew just 0.5% in the second quarter from the first three months of the year, when it expanded 2.2%.

MORE STIMULUS EXPECTED

Authorities are likely to roll out stimulus steps including fiscal spending to fund big-ticket infrastructure projects, more support for consumers and private firms, and some property policy easing, policy insiders and economists said.

- China’s foreign trade in goods up 2.1% in first half -CTGN

China’s foreign trade grew by 2.1 percent year-on-year to 20.1 trillion yuan ($2.8 trillion) in the first half of 2023, data from the General Administration of Customs showed on Thursday.

Exports grew 3.7 percent year on year to 11.46 trillion yuan while imports edged down 0.1 percent from a year earlier to 8.64 trillion yuan, the data showed.

“China has seen its economic performance picking up on the whole despite a severe and complex external environment, while the volume and quality of its foreign trade improved steadily and in line with expectations in the first six months of the year,” said Lyu Daliang, spokesperson of the General Administration of Customs.

China’s trade in goods with countries along the Belt and Road jumped 9.8 percent year-on-year in the first half of 2023, accounting for 34.3 percent of the country’s total foreign trade volume.

In the meantime, the Association of Southeast Asian Nations remained China’s largest trading partner, with total imports and exports expanding 5.4 percent year on year to 3.08 trillion yuan, accounting for 15.3 percent of China’s total foreign trade volume.

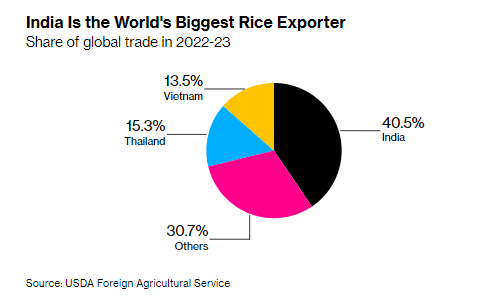

- India Considers Banning Most Rice Exports on Inflation Fears -BBG

India, the world’s biggest rice shipper, is considering banning exports of most varieties, a move that may send already lofty global prices higher as the disruptive El Niño weather pattern returns.

The government is discussing a plan to ban exports of all non-Basmati rice, according to people familiar with the matter. That’s because of rising domestic prices and authorities want to avoid the risk of more inflation, said the people, who asked not to be identified as the information is not public.

If implemented, a ban would affect about 80% of India’s rice exports. Such a move may lower domestic prices, but it risks sending global costs even higher. Rice is a staple for about half of the world’s population, with Asia consuming about 90% of global supply. Benchmark prices have already soared to a two-year high on fears that the return of El Niño will damage crops.

Peter Atwater talked about nationalism in commodities in the spaces yesterday. (was a great listen, recco catching the replay in the ondemand tab)

- Chevron to acquire PDC Energy in $6.3 billion all-stock deal

Chevron Corporation, one of the world’s leading integrated energy companies, has entered into a definitive agreement with PDC Energy, Inc, an independent exploration and production company, to acquire all of the outstanding shares of PDC in an all-stock transaction valued at $6.3 billion, or $72 per share.

Under the terms of the agreement, PDC shareholders will receive 0.4638 shares of Chevron for each PDC share. The total enterprise value, including debt, of the transaction is $7.6 billion.

The acquisition of PDC provides Chevron with high-quality assets expected to deliver higher returns in lower carbon intensity basins in the United States. PDC brings strong free cash flow, low breakeven production and development opportunities adjacent to Chevron’s position in the Denver-Julesburg (DJ) Basin, as well as additional acreage to Chevron’s leading position in the Permian Basin.

More M&A deals in the oil patch (we have talked about this a lot on the Wednesday twitter spaces.

- Bank of Canada’s record tightening campaign exposes lenders’ mortgage risks -Reuters

The Bank of Canada’s interest rate hike on Wednesday and prospects of more increases heighten risks to mortgage lenders as homeowners are likely stay in debt longer as they struggle to make higher payments or pay even the interest portion of their home loans, investors and analysts say.

After urging lenders to tackle the risks from a sharp rise in borrowing costs, Canada’s main banking regulator, Office of the Superintendent of Financial Institutions (OSFI), on Tuesday proposed tougher capital rules for lenders to prevent consumers from defaulting or entering negative amortization.

Negative amortization occurs when variable home loan customers’ monthly repayments are not enough to cover the interest component of home loans. Which means the excess amount gets added to the outstanding loan, thereby lengthening the repayment period.

“All of that is a realization that there is stress in the system,” said Greg Taylor, Chief Investment Officer of Purpose Investments.

“There’s definitely more risk because anytime you hike you never know when it’s going to be the straw that breaks the camel’s back.”

Unlike the U.S., where home buyers can snag a 30-year mortgage, Canadian borrowers have to renew their mortgages every five years at the prevailing interest rates.

On Wednesday, the central bank pushed back its expectations for getting inflation to its 2% target by six months to mid-2025, in a sign interest rates are likely to stay higher for longer.

The cost of a floating rate mortgage has now increased by about 70% from the loans since October 2021, when interest rates hit at a record low, prompting more than half of home buyers took out floating rate loans. Analysts estimate some C$331 billion ($251 billion) in mortgages coming up for renewal in 2024 and C$352 the following year, which underscores the enormity of refinancing challenge.

Oh boy!

US DATA TODAY