Happy CPI day!! 8:30 AM ET

Pretty RED out there

- Hong Kong: Hang Seng closed down -0.09%

- China CSI 300 -0.64%

- Taiwan KOSPI -0.07%

- India Nifty 50 +0.35%

- Australia ASX +0.20%

- Japan Nikkei -0.43%

- European bourses all in negative territory so far this morning

- USD +0.08%

TOP STORIES OVERNIGHT

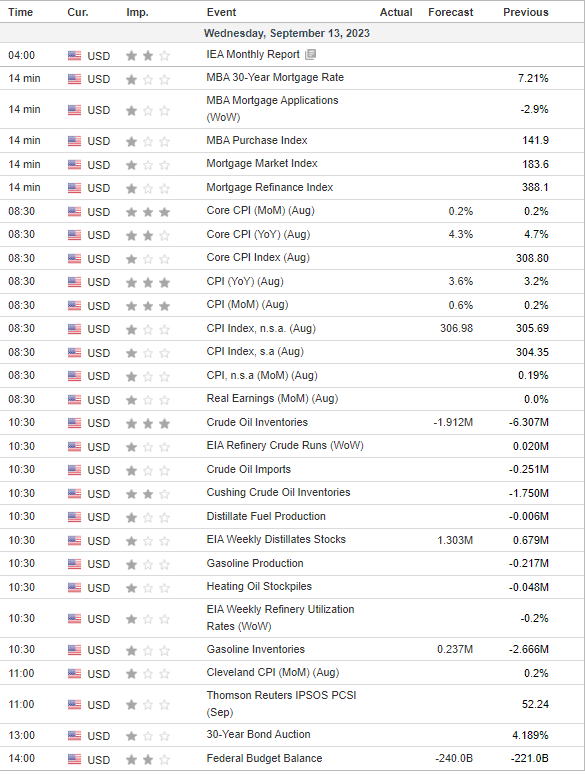

Germany to Predict 2023 Contraction in Updated GDP Forecast-BBG

The German government will predict a contraction for this year instead of sluggish growth when it updates its outlook for Europe’s biggest economy next month highlighting the nation’s plight as its industrial sector struggles.

Gross domestic product is likely to shrink in the third quarter and expand only slightly in the final three months of the year, meaning the economy will contract in 2023 on an annual basis, according to people familiar with the revised forecast, who asked not to be identified ahead of publication.

Instead of growth of 0.4% for the full year predicted at the end of April, the government will downgrade its outlook to a contraction of as much as 0.3%, one of the people said. The Economy Ministry is due to publish its fall forecasts on Oct. 11 and the final figures could still change depending on developments in coming weeks, the people added.

COMMENTS: this has European markets in the red today

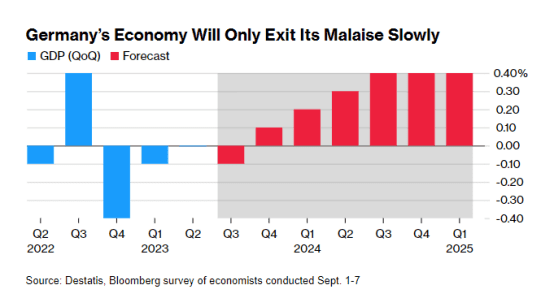

Sharp Decline in UK Economy in July Revives Recession Risk-BBG

The UK economy shrank at the fastest pace in seven months in July as strikes and wet weather hit activity harder than expected, reviving fears that a recession may be under way.

Gross domestic product slipped by 0.5% following a 0.5% gain in June, the Office for National Statistics said Wednesday. Economists had expected a contraction of 0.2%. Services, construction and manufacturing all shrank.

Britain’s economy, which the Bank of England expects to stagnate at best for much of the next two years, is now losing steam in the face of a sharp increase in borrowing costs. That may give policy makers pause for thought when they decide next week whether to raise interest rates again in their fight to tame inflation.

COMMENTS: Rain? It always rains there, also, I thought this was the summer of heat ..lol

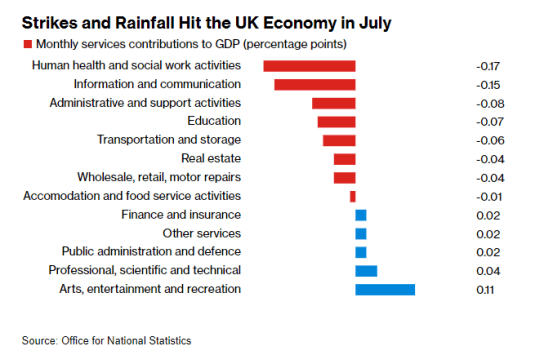

BOJ Watchers Bring Forward Rate Hike Forecasts on Ueda’s Remarks-BBG

Bank of Japan watchers moved forward their forecasts for an end to negative interest rates after Governor Kazuo Ueda touched on that possibility in an interview published over the weekend.

All 46 economists surveyed by Bloomberg over the past week said the BOJ will stand pat on policy at next week’s board meeting, with half expecting authorities to abandon the subzero rate by the end of June.

Last month, 31% predicted a rate hike within that time frame. Some 9% of respondents in the latest survey see the BOJ adjusting or discarding its yield curve control mechanism in October.

Most economists say regardless of timing, the next change for YCC will be its scrapping after the bank essentially widened its ceiling for 10-year yields to around 1% in July.

COMMENTS: Interesting if they do, the last time was in 2007, when coincidentally, USA rates were about the same as now.

If the yen weakens below 150 per dollar it would trigger intervention, according to the median forecast of the economists in the survey. The dollar was trading just above 147 yen Wednesday morning.

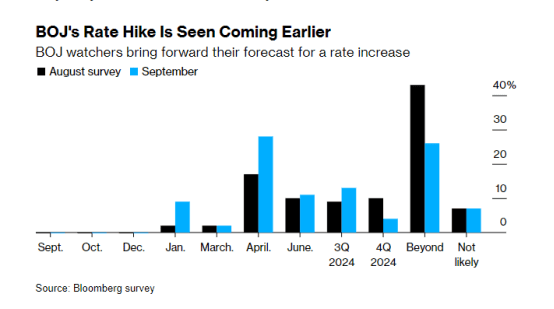

Higher gasoline prices seen boosting US inflation in August-Reuters

- Consumer prices forecast increasing 0.6% in August

- CPI expected to rise 3.6% year-on-year

- Core CPI seen gaining 0.2%; advancing 4.3% year-on-year

U.S. consumer prices likely increased by the most in 14 months in August amid a surge in the cost of gasoline, but an expected moderate rise in underlying inflation could encourage the Federal Reserve to keep interest rates on hold next Wednesday.

The consumer price report from the Labor Department on Wednesday will be published a week before the Fed’s rate decision. It would follow on the heels of data this month showing an easing in labor market conditions in August.

Prices outside the volatile food and energy categories, the so-called core inflation, were likely tame for a third straight month, with the year-on-year increase forecast to have been the smallest in nearly two years.

“It’s going to be a mixed picture, with headline inflation picking due to higher gasoline prices and core inflation remaining contained,” said Sam Bullard, a senior economist at Wells Fargo in Charlotte, North Carolina. “The Fed would be encouraged by the continued moderation trend in core inflation, but it’s still too high.”

COMMENTS: This is why this print is a big deal

OPEC+ cuts to tighten oil market sharply in fourth quarter, IEA says-Reuters

Oil output cuts which Saudi Arabia and Russia have extended to the end of 2023 will mean a substantial market deficit through the fourth quarter, the International Energy Agency (IEA) said on Wednesday, as it largely stuck by its estimates for demand growth this year and next.

OPEC and its allies, known as OPEC+, began limiting supplies in 2022 to bolster the market. This month, benchmark Brent crude breached $90 a barrel for the first time this year after OPEC+ leaders Saudi Arabia and Russia extended their combined 1.3 million barrel per day (bpd) cuts until the end of 2023.

Output curbs by OPEC+ members of more than 2.5 million bpd since the start of 2023 have so far been offset by higher supplies from producers outside the alliance, including the United States, Brazil and still under-sanctions Iran, the agency said.

“But from September onwards, the loss of OPEC+ production… will drive a significant supply shortfall through the fourth quarter,” it said in its monthly oil report.

COMMENTS: I have been warning about this for months and months now…as have our guests on the Wednesday spaces…we will talk about this on today’s spaces

US DATA TODAY