Pretty green in Asia and Europe (so far….)

Bank earnings below $BLK, $PNC. $JPM, $WFC

- Hong Kong: Hang Seng closed up +0.46%

- China CSI 300 +0.57%

- Taiwan KOSPI +0.38%

- India Nifty 50 +0.09%

- Australia ASX -0.24%

- Japan Nikkei +0.12%

- All European bourses broadly in positive territory so far this morning

- US indices slightly negative so far this morning in pre-market, USD -0.08%

Overnight Data/News

- PBoC Sets Yuan Mid-Point At 6.8606 / Dlr VS Last Close 6.868

- German Wholesale Price Index (M/M) Mar: 0.2% (prev 0.1%) – German Wholesale Price Index (Y/Y) Mar: 2.0% (prev 8.9%)

- Swiss Producer & Import Prices (Y/Y) Mar: 2.1% (prev 2.7%) – Swiss Producer & Import Prices (M/M) Mar: 0.2% (prev -0.2%)

- French CPI EU Harmonised (M/M) Mar F: 1.0% (est 0.9%; prev 0.9%) – French CPI EU Harmonised (Y/Y) Mar F: 6.7% (est 6.6%; prev 6.6%) – French CPI (M/M) Mar F: 0.9% (est 0.8%; prev 0.8%) – French CPI (Y/Y) Mar F: 5.7% (est 5.6%; prev 5.6%)

- Spanish CPI (M/M) Mar F: 0.4% (est 0.4%; prev 0.4%) – Spanish CPI (Y/Y) Mar F: 3.3% (est 3.3%; prev 3.3%) – Spanish CPI EU Harmonised (M/M) Mar F: 1.1% (est 1.1%; prev 1.1%) – Spanish CPI EU Harmonised (Y/Y) Mar F: 3.1% (est 3.1%; prev 3.1%)

- Italian General Government Debt Feb: €2772.0B (prevR €2750.4B)

- China’s Megabanks Plan Funding Spree To Plug Capital Shortfall – BBG

- BoJ Gov Ueda: Told G20 BoJ Will Maintain Current Monetary Easing

- Top Charles Schwab Investor Sold Entire Stake Amid Banking Turmoil – FT

- ECB’s Wunsch: ECB Needs More Rate Hikes And Faster Balance Sheet Cuts – RTRS

- China’s First-Quarter GDP Growth Seen Rebounding To 4.0%, 2023 Rate Seen At 5.4% – RTRS Poll

- Tesla Cuts Price For Model 3 In Germany To EUR41,990 From EUR43,990

- Singapore unexpectedly leaves rates unchanged as risks grow … RTRS

- Credit Suisse Sees 80% Chance Of US Recession Over Next 12 Months Vs Earlier Projection Of 60% By Q1 2024

- Fed’s Bostic: After One More Interest Rate Hike, Us Central Bank Can Pause And Assess

Bank earnings so far this morning:

BlackRock Q1 23 Earnings: – Revenue: $4.24B (est $4.24B) – Adj EPS: $7.93 (est $7.67) – AUM $9.09T (est $8.86T)

PNC Financial Q1 23 Earnings: – Revenue $5.60B (est $5.61B) – EPS $3.98 (est $3.66) – Provision For Credit Losses $235M (est $317.4M) – Loans $326.48B (est $327.81B) – Share Buyback Activity Is Expected To Be Reduced In Q2

Wells Fargo Q1 23 Earnings: – Revenue $20.73B (est $20.03B) – EPS $1.23 (est $1.13) – Net Interest Income $13.34B (est $13.09B) – Total Average Loans $948.7B (est $953.22B) – Efficiency Ratio 66% (est 66.8%) – Had $643M Increase In Allowance For Credit Losses

JPMorgan Q1 23 Earnings: – Adj Rev $39.34B (est $36.83B) – EPS $4.10 (est $3.38) – Provision For Credit Losses $2.28B (est $2.31B) – Total Deposits $2.38T (est $2.33T) – Loans $1.13T (est $1.13T) – Investment Banking Rev $1.56B (est $1.54B)

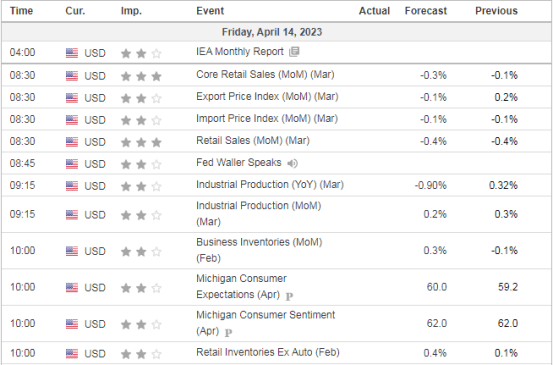

US DATA TODAY