Mostly Green

- Hong Kong: Hang Seng closed up +0.33%

- China CSI 300 +0.02%

- Taiwan KOSPI +1.43%

- India Nifty 50 +0.91%

- Australia ASX +1.55%

- Japan Nikkei -0.87%

- European bourses broadly in positive territory so far this morning with the exception of Germany

- USD -0.27%

TOP 5 STORIES OVERNIGHT

- Investors pile into stocks, bonds as ‘mission accomplished’ on inflation-BofA -Reuters

Investors piled into bonds and stocks while shedding cash in the week to Wednesday, according to a report on Friday from Bank of America (BofA) Global Research.

The report said this reflected the “end of inflation, end of war, end of U.S. dollar bull” following data this week that showed the U.S. economy is shifting into disinflation mode.

Weekly inflows to bonds totalled $12.1 billion, while stocks saw inflows of $11.6 billion and investors pulled $17.6 billion out of cash funds. Investors also shed $500 million worth of gold, BofA said, citing figures from funds data provider EPFR.

U.S. data on Wednesday showed the world’s largest economy shifting to disinflation mode as consumer prices registered their smallest annual increase in more than two years.

“Mission Accomplished” June CPI (headline 2% to 9% to 3% roundtrip is now complete),” the BofA analysts wrote.

Notable Q2 Earnings Overnight

JPMorgan Chase posted a 67% jump in profit for the second quarter on Friday as it earned more in interest from borrowers.

The largest U.S. lender’s profit climbed to $14.47 billion, or $4.75 per share, for the quarter ended June 30. That compares with $8.65 billion, or $2.76 per share a year earlier. Shares of the bank rose 2.4% to $152.49 in premarket trading.

Wells Fargo’s profit rose in the second quarter as it earned more in interest payments from customers.

Net income rose to $4.94 billion, or $1.25 per share, for the three months ended June 30, compared with $3.14 billion, or $0.75 per share, a year earlier, the lender said on Friday.

BlackRock Inc, the world’s largest asset manager, posted a 25% rise in its second-quarter adjusted profit on Friday, benefiting from investors pouring money into its various market funds.

-BlackRock Inc, the world’s largest asset manager, posted a 25% rise in its second-quarter adjusted profit on Friday, benefiting from investors pouring money into its various market funds.

On an adjusted basis, BlackRock earned $1.4 billion, or $9.28 per share, for the three months ended June 30, compared with $1.1 billion, or $7.36 per share, a year earlier.

The New York-based firm ended the second quarter with $9.4 trillion in assets under management (AUM), up from $8.5 trillion a year earlier and higher than $9.1 trillion in the first quarter this year.

- Libya’s Major Oil Field Fully Halted as Tensions Resurface -BBG

The latest disruption at Sharara means a swath of African oil supply has been curbed over the past 24 hours. A nearby — but smaller — Libyan field, El Feel, was halted earlier on Thursday as part of the same protest.

In Nigeria, the continent’s top producer, the Forcados terminal had to halt while the cause of a possible leak gets inspected. Together, the Libyan and Nigerian disruptions represent well over 500,000 barrels a day of oil flow — about 0.5% of global supply. In all three cases, a timeline for a full restart isn’t clear.

Protests started Thursday shutting down El-Feel 60K bpd, and spread to Sharara 300K bpd, there is also a problem in Nigeria

China’s most-traded IronOre futures contract in Dalian gained 2.5% to 849 yuan/tonne, highest since Mar this year, on hopes of govt stimulus to support economy and stabilize real estate, falling iron ore stockpiles at Chinese ports -Yuantalks

This is good news for commodities (at least for today) Ironore is a proxy for the property/building sector in China as it is what steel is made from

Also notable is the Yuan strengthening today as well. Yellen must have made some deal on her trip.

- JPMorgan Asset’s Michele Says Global Bond Rally Is Just Starting-BBG

The bond rally that erupted after this week’s US inflation report was the moment Wall Street veteran Bob Michele has been waiting for.

The J.P. Morgan Asset Management chief investment officer for fixed income has been gearing up for a bond rally since late last year, buying high-quality government bonds, credit and emerging-market debt as they fell to multi-year lows. He has long believed the US economy will enter a recession as the Federal Reserve went too far in raising interest rates.

So when he saw inflation in the world’s biggest economy cooled more than economists had forecast, he was convinced this was the start of a prolonged rally. Michele, who has been in the market for more than four decades, says the deeply inverted US yield curve spells trouble and the Fed will be forced to cut rates by the end of this year.

“More and more indicators are at levels you only see in recession. We are buying every backup in yields,” said Michele. “The considerable central bank tightening is starting to bite hard in the real economy.”

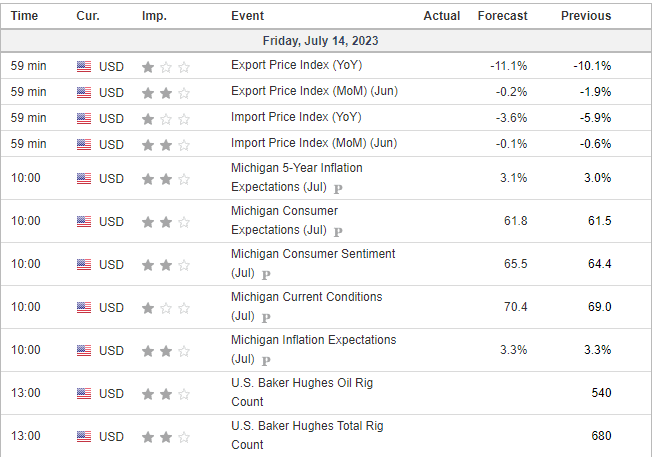

US DATA TODAY