HAPPY FOMC DAY!! Rate decision at 2:00PM ET! Presser 2:30PM ET

Mixed Markets in Asia

- Hong Kong: Hang Seng closed down -0.58%

- China CSI 300 -0.02%

- Taiwan KOSPI -0.72%

- India Nifty 50 +0.17%

- Australia ASX +0.23%

- Japan Nikkei +0.78%

- European bourses in positive territory so far this morning

- USD down -0.20%

TOP 5 STORIES OVERNIGHT

- IEA 5-year report out today

IEA raises 2023 demand growth forecast by 200,000 b/d

India to overtake China as world’s second-largest oil consumer by 2027: IEA

Global oil demand rises 6% to 105.7 million b/d through 2022-28 under the five-year forecast. However, annual increases shrink to 400,000 b/d in in 2028. Aviation underpins growth early in the period, with Asia’s petrochemical demand dominating later. And gasoline demand starts to decline on an annual basis in 2024. India supersedes China as the driver of demand growth in 2027. -Platts

Oil is responding positively to this report this morning

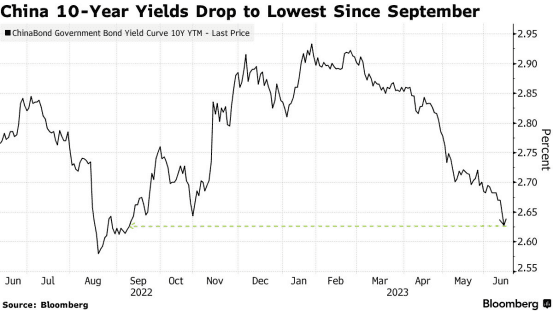

- China Rate Cut Gives Investors Reason to Buy Yuan Bonds Again -BBG

China’s unexpected decision to cut one of its key short-term policy rates is giving fund managers a reason to return to the nation’s bonds after trimming holdings every month this year.

Everyone is still looking at China for clues on the global economy.

- Shanghai‘s Jan-May international trade volume increased by 15.8% y/y to 1.74 trillion yuan.

Exports +19.8% y/y to 702.37 billion yuan

Imports +13.2% to 1.04 trillion yuan.

The exports of electric vehicles are +152.9% y/y,

lithium battery +240.7% y/y

solar cell +80.4% y/y

Commodities are liking this in China with coking coal and nickel futures soaring. Key your eye on battery metals and miners!

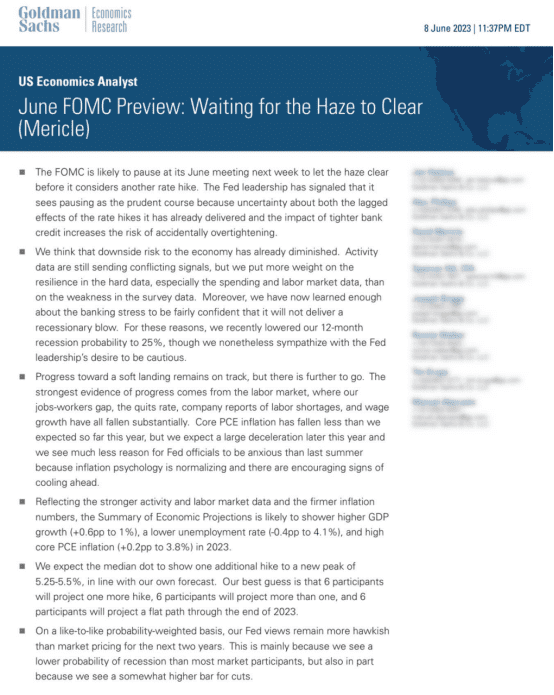

Goldman Sachs || June FOMC Preview: Waiting for the Haze to Clear-Via PiQ

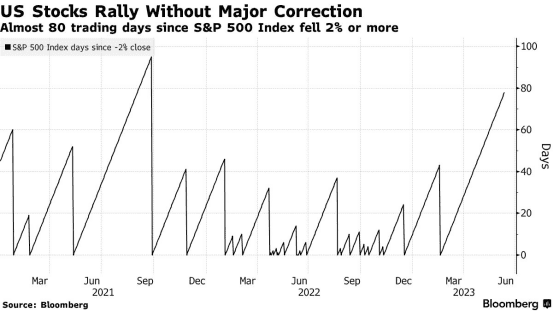

- S&P 500 ahead of FOMC -BBG

Wall Street’s “fear gauge” — the Cboe Volatility Index — has dropped back below 15, against an average of 23 for the past year, underscoring support for risk assets. In another sign of the calm prevailing in equity markets, it’s now almost 80 trading days since the S&P 500 declined by 2% or more.

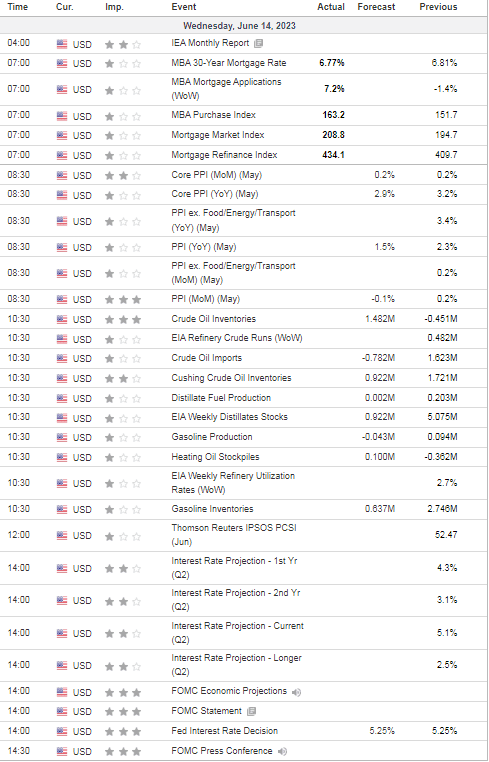

US DATA TODAY