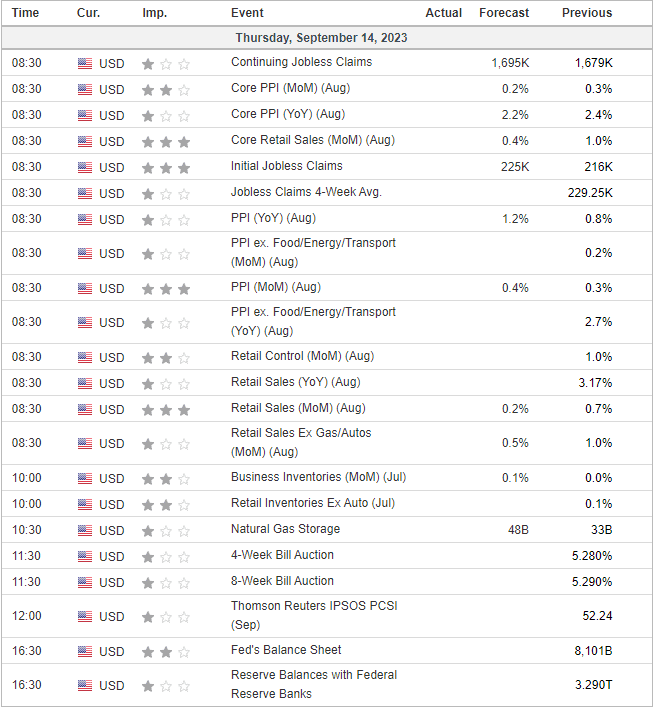

Jobless claims and PPI at 8:30AM ET

Mostly GREEN!

- Hong Kong: Hang Seng closed up +0.21%

- China CSI 300 -0.08%

- Taiwan KOSPI +1.51%

- India Nifty 50 +0.16%

- Australia ASX -0.77%

- Japan Nikkei +1.37%

- European bourses all in positive territory so far this morning

- USD -0.03%

TOP STORIES OVERNIGHT

China Cuts Reserve Requirement Ratio for Second Time This Year-BBG

China’s central bank cut the amount of cash lenders must hold in reserve for the second time this year to bolster an economic recovery that’s struggling to rebound.

The People’s Bank of China lowered the reserve requirement ratio for most banks by 25 basis points, according to a statement Thursday. The weighted average RRR for banks will be 7.4% after the cut, the statement says.

The reduction, which takes place from Friday, is to help maintain reasonably ample liquidity, the PBOC said in the statement.

OPEC Statement on peak fossil fuel demand

On the International Energy Agency’s recent Op-Ed published on 12 September 2023, asserting that fossil fuel demand would peak before 2030, OPEC notes that consistent and data-based forecasts do not support this assertion.

It is an extremely risky and impractical narrative to dismiss fossil fuels, or to suggest that they are at the beginning of their end. In past decades, there were often calls of peak supply, and in more recent ones, peak demand, but evidently neither has materialized. The difference today, and what makes such predictions so dangerous, is that they are often accompanied by calls to stop investing in new oil and gas projects.

“Such narratives only set the global energy system up to fail spectacularly. It would lead to energy chaos on a potentially unprecedented scale, with dire consequences for economies and billions of people across the world,” says OPEC Secretary General, HE Haitham Al Ghais.

This thinking on fossil fuels is ideologically driven, rather than fact-based. It also does not take into account the technological progress the industry continues to make on solutions to help reduce emissions. Neither does it acknowledge that fossil fuels continue to make up over 80% of the global energy mix, the same as 30 years ago, or that the energy security they provide is vital.

COMMENTS: Shots Fired!! This was in response to the IEA report this week. We actually talked about this just yesterday on the Wednesday spaces. If you missed it you can catch it in the OnDemand tab on the PYT website

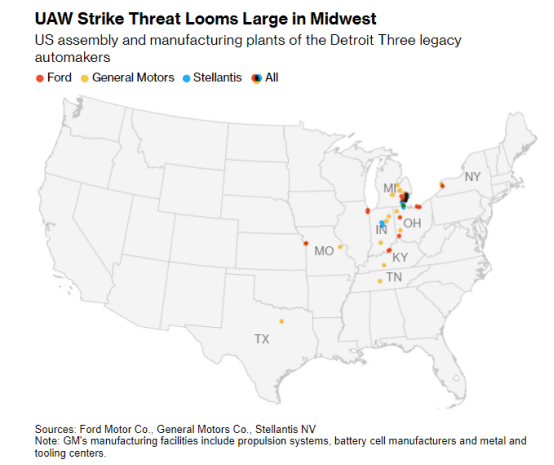

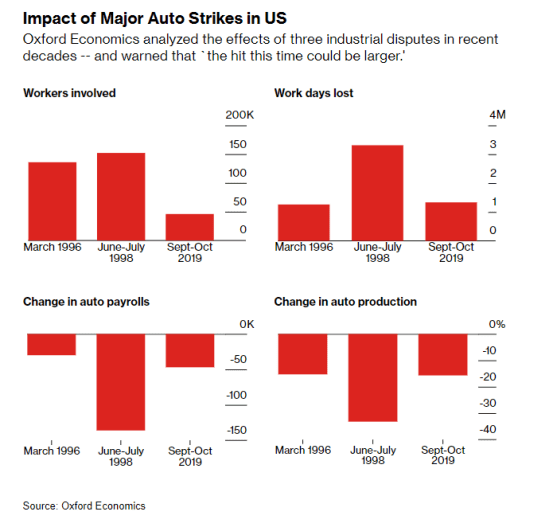

Biden Has Few Options to Prevent a Strike Against Big 3 Carmakers-BBG

The looming strike at America’s Big Three automakers leaves President Joe Biden caught between two of his top policy goals – a greener car industry and a labor revival – with little sway over the outcome.

The United Auto Workers union says it’s ready to call stoppages if there’s no wage deal by Thursday night. Union demands and company offers remain far apart. All Biden can do is cajole both sides to avert a strike that could cost him politically. The president has “encouraged the parties to stay at the table,” his chief economist Jared Bernstein said Wednesday.

An extended shutdown at Ford Motor Co., General Motors Co. and Stellantis NV risks triggering a recession in swing states like Michigan, and rekindling inflation for car prices. More broadly, the dispute pits two of the president’s key constituencies against each other.

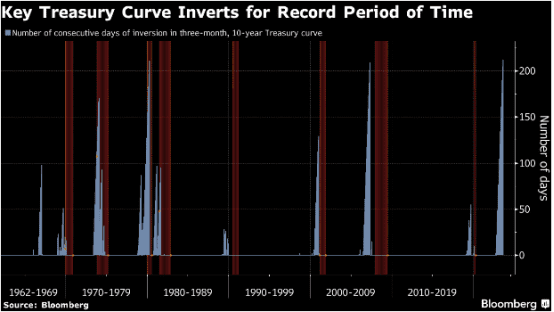

The Bond Market Has Never Sounded Recession Alarms for This Long-BBG

The US bond market hasn’t flashed recession warnings so consistently for so long in at least six decades.

On Wall Street and in Washington, optimism may be building that the Federal Reserve is poised to steer the economy toward a soft landing.

But for 212 straight trading days, no matter what the indicators have said, the Treasury market has delivered what is widely understood as a starkly different message: The economy is veering toward a contraction, since 10-year yields have held below 3-month ones.

Such an inversion telegraphed the last eight recessions. And on Thursday, the market surpassed the 1980 record to hold that way for the longest consecutive daily stretch since Bloomberg’s records begin in 1962.

COMMENTS: We also never had the Fed print as much money before…perhaps that altered the signal and maybe this time it really is different?

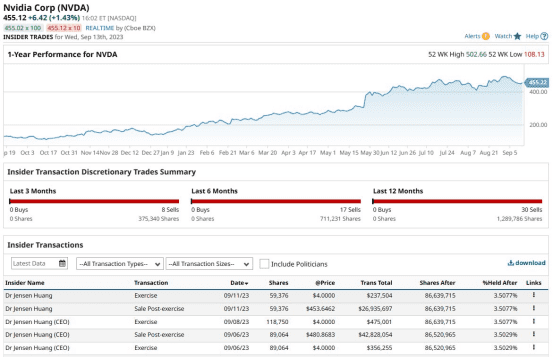

Nvidia Insider Trading Alert -Barchart

Nvidia CEO Jensen Huang Dumps another $27 million worth of $NVDA shares. He has now sold $70 million worth of shares over the last week.

COMMENTS: I am sure this is fine …..

US DATA TODAY