Mixed Markets Overnight

- Hong Kong: Hang Seng closes down -1.43%

- China CSI 300 -0.52%

- Taiwan KOSPI -1.53%

- India Nifty 50 +0.48%

- Australia ASX +0.19%

- Japan Nikkei -0.79%

- European bourses broadly up this morning with the exception of UK, Switzerland, Spain, and Italy (down very slightly)

- US indices slightly down this morning in pre-market, USD up +0.33%

Overnight News/Data

- Eurozone Trade Balance SA Dec: -€18.1B (est -€16.0B; prevR -€14.4B)

Trade Balance NSA Dec: -€8.8B (prev -€11.7B)

Industrial Production SA (M/M) Dec: -1.1% (est -0.8%; prevR 1.4%)

Eurozone Industrial Production WDA (Y/Y) Dec: -1.7% (est -0.7%; prev 2.8%)

- Spanish CPI (Y/Y) Jan F: 5.9% (est 5.8%; prev 5.8%) – Spanish CPI (M/M) Jan F: -0.2% (est -0.3%; prev -0.3%) – Spanish CPI EU Harmonised (Y/Y) Jan F: 5.9% (est 5.8%; prev 5.8%) – Spanish CPI EU Harmonised (M/M) Jan F: -0.4% (est -0.5%; prev -0.5%)

- UK PPI Output NSA (M/M) Jan: 0.5% (est 0.1; prevR -0.9%) – UK PPI Output NSA (Y/Y) Jan: 13.5% (est 13.3; prev 14.7%) – UK PPI Input NSA (M/M) Jan: -0.1% (est 0.2; prevR -1.2%) – UK PPI Input NSA (Y/Y) Jan: 14.1% (est 14.7; prev 16.5%)

UK CPI (Y/Y) Jan: 10.1% (est 10.3%; prev 10.5%) – UK CPI (M/M) Jan: -0.6% (est -0.4%; prev 0.4%) UK CPI Core (Y/Y) Jan: 5.8% (est 6.2%; prev 6.3%)

- China PBoC Injects Net 199 Bln Yuan Via MLF

PBoC Inject 203 Bln Yuan Of 7 Day Reverse Repo At 2%

China PBoC Sets Yuan Mid-Point At 6.8183 / Dollar VS Last Close 6.8309

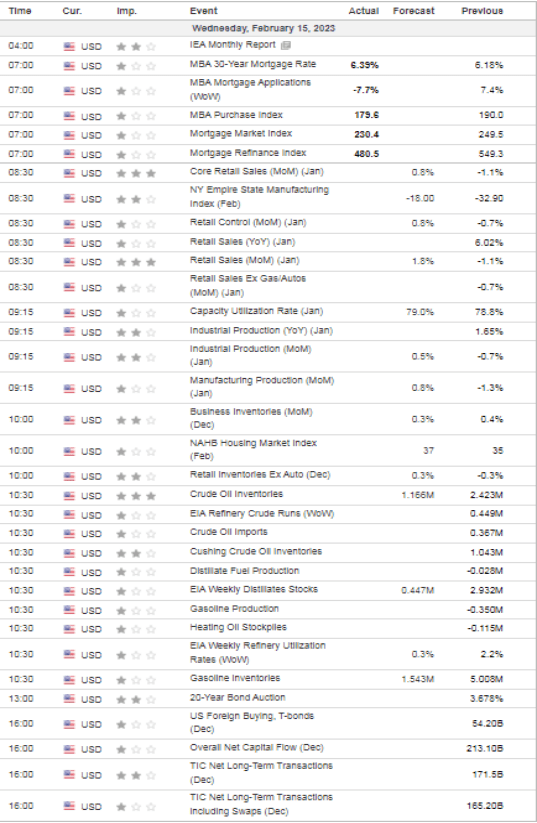

US DATA TODAY

Another packed day!

COMMODITIES HEADLINES OVERNIGHT

Metals

Glencore hands $7.1 bln to shareholders after record profit

Barrick Gold reports US$735M Q4 loss compared with $726M profit a year earlier

Gold Plunges As Markets Weigh Inflation Trajectory

Energy

Whisper it, but offshore oil and gas investment is making a comeback

Iran Deputy Oil Minister: Iran Seeks Upto $40Bln In Energy Investment From China

China’s state-owned refiners resume Russian Urals crude imports

IEA advises countries to reduce oil and gas reliance despite $4 trillion industry profit in 2022

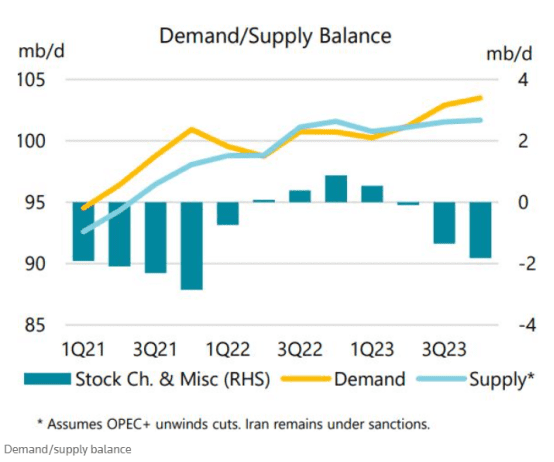

IEA sees oil demand rising by 2 million barrels per day (bpd) in 2023, with China making up 900,000 bpd

Japanese oil refiners may buy Russian crude from the Sakhalin-2 oil and gas project, if needed

Resurgent China will drive 2023 oil demand but deficit could loom -IEA