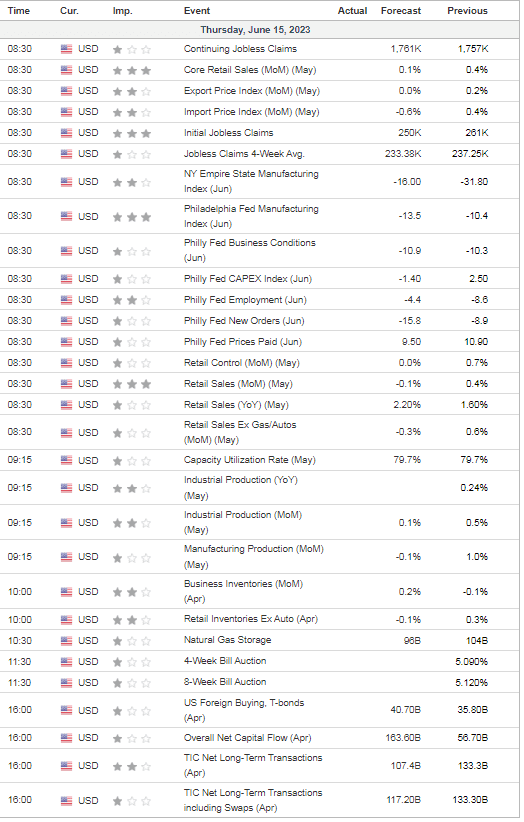

Jobless Claims 8:30AM ET

Mixed Markets Asia, China ripping …Europe a sea of RED

- Hong Kong: Hang Seng closed up +2.17%!!!

- China CSI 300 +1.59%

- Taiwan KOSPI -0.40%

- India Nifty 50 -0.40%

- Australia ASX +0.34%

- Japan Nikkei -1.06%

- European bourses in negative territory so far this morning

- USD +0.12%

TOP 5 STORIES OVERNIGHT

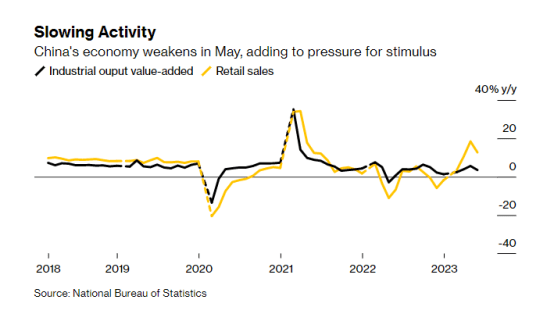

- China juices the economy markets rip

China’s Weakening Economy Puts Focus on Stimulus After Rate Cut-BBG

China’s weakening economy prompted the central bank to cut interest rates for the first time since August, and expectations are growing for more stimulus targeted at ailing industries including the property sector.

The People’s Bank of China reduced the rate on its one-year loans on Thursday after lowering short-term rates earlier this week

China Retail Sales Y/Y May: 12.7% (est 13.7%, prev 18.4%) –

China Retail Sales YTD Y/Y May: 9.3% (est 9.6%, prev 8.5%)

China Industrial Production Y/Y May: 3.5% (est 3.7%, prev 5.6%)

China Industrial Production YTD Y/Y May: 3.6% (est 3.9%, prev 3.6%)

- Yen Falls To 7-Month Low As Traders Shift Focus From Fed To BoJ – BBG

Japan will stop yen decline beyond 145 to the dollar, most economists say in Reuters poll

Japan’s government and central bank will act to stop the yen’s decline if it depreciates to the 145 per U.S. dollar level, more than half of economists polled by Reuters said.

Market participants closely watch how the government and the Bank of Japan (BOJ) respond to currency moves, following their meeting last month when the yen neared a six-month low and ahead of the central bank’s rate review concluding on Friday.

- Tentative agreement ends worker slowdowns and stoppages that crippled West Coast ports

A tentative deal between the Pacific Maritime Association and the International Longshore and Warehouse Union was announced Wednesday night, ending 14 days of worker slowdowns and stoppages that crippled port productivity.

The new contract is for six years and will cover workers at all 29 West Coast ports. No details of the deal’s terms were released.

Great news for supply-chains and shippers

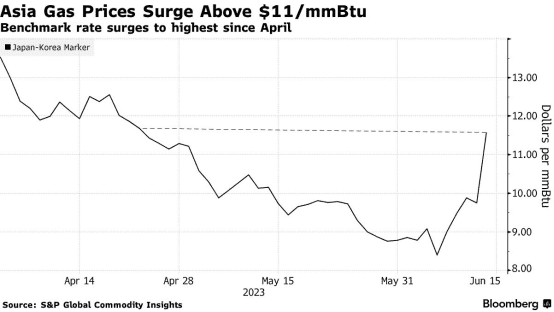

- Natural gas prices are ripping in Asia

China Natural Gas Traders Pause Spot Purchases as Prices Surge-BBG

The biggest spike in Asian natural gas prices in more than six months has made buyers in China pause spot purchases.

Benchmark prices rose 19% to $11.58 per million British thermal units on Wednesday, the biggest one-day gain since last November, according to data from S&P Global Commodity Insights. That surge is dealing a blow to renewed demand for the fuel from price-sensitive emerging economies, said traders.

Asian gas prices have rallied amid hot weather and supply outages in Europe including disruptions in Norway that are expected to last through the middle of next month. That’s pushed up European prices and intensified global competition for cargoes.

- Netherlands Set to Close Europe’s Biggest Gas Field in 2023

The Dutch government is set to permanently shut down the Groningen gas field in October, a move that may limit Europe’s supply buffer as it heads into the next winter.

The closure will take effect from Oct. 1, people familiar with the matter said, asking not to be identified as the plans are still private. The official decision to shut the field will be taken during a cabinet meeting later this month, said a spokesperson for the Dutch State Secretary for Mining.

Keep an eye on US nat gas in the coming months

US DATA OVERNIGHT