**$CS Credit Suisse CDS ripping, stock is tanking stoking fears of another bank crisis

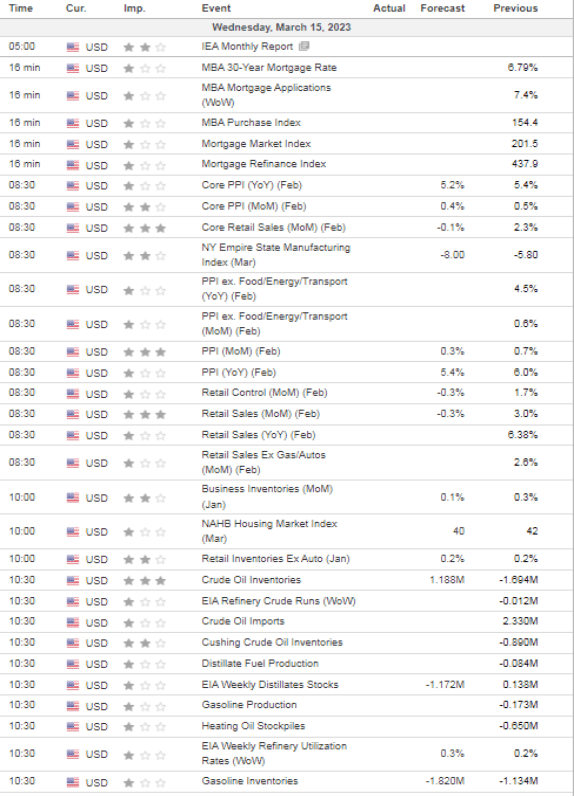

Packed US data today

Asian Markets MIXED – Europe RED

- Hong Kong: Hang Seng closes UP +1.52%

- China CSI 300 +0.06%

- Taiwan KOSPI +1.31%

- India Nifty 50 -0.40%

- Australia ASX -1.50%

- Japan Nikkei -2.21% !

- All European bourses all in negative territory with the exception Spain and Greece

- US indices in negative territory this morning in pre-market, USD up 0.52% (US treasuries ripping)

Overnight Data/News

- China PBoC Sets Yuan Mid-Point At 6.8680 / Dollar VS Last Close 6.8795

- China Industrial Production YTD (Y/Y) Feb: 2.4% (est 2.6%) – Retail Sales YTD (Y/Y) Feb: 3.5% (est 3.5%) – Fixed Assets Ex Rural YTD (Y/Y) Feb: 5.5% (est 4.5%) – Property Investment YTD (Y/Y) Feb: -5.7% (est -8.5%) – Surveyed Jobless Rate Feb: 5.6% (est 5.3%)

- German Wholesale Price Index (M/M) Feb: 0.1% (prev 0.2%) – Wholesale Price Index (Y/Y) Feb: 8.9% (prev 10.6%)

- Swedish CPI (Y/Y) Feb: 12.0% (exp 11.7%; prev 11.7%) – CPI (M/M) Feb: 1.1% (exp 0.9%; prev -1.1%)

- French CPI EU Harmonised (Y/Y) Feb F: 7.3% (exp 7.2%; prev 7.2%) – CPI EU Harmonised (M/M) Feb F: 1.1% (exp 1.0%; prev 1.0%) – CPI (Y/Y) Feb F: 6.3% (exp 6.2%; prev 6.2%) – CPI (M/M) Feb F: 1.0% (exp 0.9%; prev 0.9%)

- Italian Unemployment Rate Q4: 7.8% (prevR 8.0%)

- Eurozone Industrial Production SA (M/M) Jan: 0.7% (exp 0.3%; prevR -1.3%) – Industrial Production SA (Y/Y) Jan: 0.9% (exp 0.3%; prevR -2.0%)

- ECB Likely To Stick To Big Rate Hike Despite Banking Turmoil – RTRS Sources

- US Construction Shows No Signs Of Slowdown, Caterpillar CEO Says – BBG

- China Reopening, Air Travel Rebound To Supercharge Oil Demand, IEA Says – RTRS

- Russia’s Energy Min: Russian Oil Production To Decrease In 2023 – TASS

- Credit Suisse Default Swaps Are 18 Times UBS, 9 Times Deutsche Bank – BBG

Credit Suisse Credit Default Swaps

US DATA TODAY

OVERNIGHT COMMODITY HEADLINES

Metals

Copper flat as investors gauge demand uncertainty

Energy

Russian oil exports fell by 500 kb/d to 7.5 mb/d in February as the EU embargo on refined oil products came into force. Shipments to the EU fell by 800 kb/d to 600 kb/d, compared with more than 4 mb/d at the start of 2022. IEA

Following an 80 kb/d contraction in 4Q22, world oil demand growth is set to accelerate sharply over the course of 2023, from 710 kb/d in 1Q23 to 2.6 mb/d in 4Q23. -EIA

Elengy’s French LNG terminals to remain on strike until March 21 -company

Willow project helps ensure energy independence, fossil fuels to be in mix for years to come – US energy secretary Granholm

Spain Boosts Russia LNG Imports 84% While EU Urges Less Reliance Country’s shipments from Algeria fall amid diplomatic feud Spain is the EU’s top buyer of Russian LNG so far this year

OPEC+ to stick to production cut, Saudi minister tells Energy Intelligence

China Jan-Feb refinery output up 3.3% on fuel policy, demand recovery

Fire broke out in small CDU at Pemex Deer Park, Texas refinery -sources