Sea of GREEN

- Hong Kong: Hang Seng closed UP +3.92%!!

- China CSI 300 +0.70%

- Taiwan KOSPI +2.20%

- India Nifty 50 +1.19%

- Australia ASX +0.83%

- Japan Nikkei +0.99%

- European bourses in POSITIVE territory so far this morning

- USD +0.07%

TOP STORIES OVERNIGHT

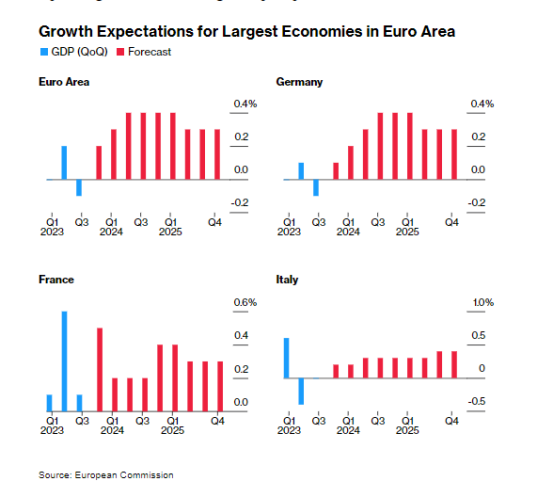

Euro Area to Avoid Recession as Inflation Retreats, EU Says-BBG

The euro area and its biggest economies will avoid a recession as growth returns at the end of the year, helped by slowing inflation and a robust jobs market, according to new European Union forecasts.

Output in the 20-nation bloc will increase by 0.2% in the fourth quarter after shrinking 0.1% in the three months through September, the European Commission said in a report on Wednesday. Even Germany, which has fared worse than peers amid a prolonged manufacturing slump, is predicted to avoid a recession.

COMMENTS: European markets liking this

BofA joins ‘Fed done hiking rates’ view; Barclays sees one more-Reuters

BofA Global Research no longer expects the U.S. Federal Reserve to raise interest rates, joining other Wall Street banks, following softer-than-expected October inflation data in the world’s largest economy.

Data on Tuesday showed U.S. consumer prices were unchanged in October month-on-month, representing a significant cooling from September’s rise.

This bolstered views among investors that the Fed was probably done raising interest rates, and prompted bets that the central bank could start cutting rates in May.

BofA had previously forecast a final 25 basis points (bps) hike in December.

The drop in owners’ equivalent rent inflation – a gauge of the real estate market – and the cooldown in core services excluding housing, should encourage the Fed to stay on hold, BofA said in a note dated Tuesday.

“We now think that the hiking cycle is over… The Fed will probably try to leave the door open for more hikes next year at its December meeting, but there are diminishing returns to hawkish rhetoric when its policy choices lean dovish,” BofA economists led by Stephen Juneau said.

The brokerage expects the Fed to start cutting rates in June 2024, and deliver a cut every quarter.

While most other Wall Street majors view the Fed as likely done with raising rates, Barclays still expects another 25 bps hike in January.

“A closer look… reveals that the easing in core inflation pressures appears somewhat exaggerated,” said Barclays economists led by Pooja Sriram.

“With data on economic activity and labor markets still carrying a fair bit of momentum, we think there remains a case for an additional rate hike early next year.

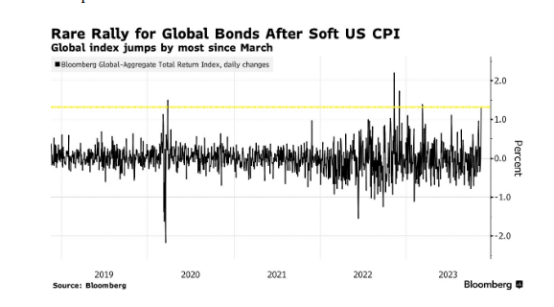

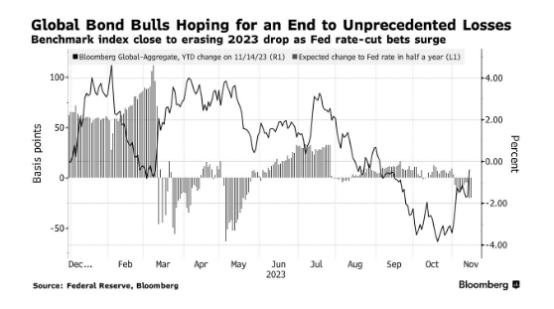

Rate-Cut Euphoria Puts Global Bonds on Course to Erase 2023 Loss-BBG

Global bonds have been such a kicking post in recent months that it may come as something of a surprise they are just a fraction away from erasing this year’s loss.

The Bloomberg Global Aggregate Bond Index jumped 1.3% Tuesday, the biggest one-day gain since March, following weaker-than-expected US inflation data. The gauge, which was down by as much as 3.8% for the year less than a month ago amid the higher-for-longer narrative, is now just 0.3% lower for 2023.

The global index, which tracks more than $61 trillion, powered ahead as the US inflation numbers spurred traders to erase bets on any further Federal Reserve interest-rate hikes and to boost wagers on lower borrowing costs. The soft data added to signs the steepest tightening cycle in a generation is set to slow economies worldwide and push central banks toward rate cuts in 2024.

“It doesn’t matter now what the Fed says about holding rates higher for longer, it’s likely to start a gradual easing cycle in the first half of 2024,” said Kellie Wood, deputy head of fixed income at Schroders Plc in Sydney. Schroders is long two-year Treasuries and is also favoring Australian and European rates on a bet that global bond yields have peaked, she said.

Markets are now pricing in more than half a percentage point of rate cuts by July, about double the amount they anticipated at the end of October. The US core consumer price index, which excludes food and energy costs, increased 0.2% in October from September, less than the median forecast of 0.3% in a Bloomberg survey.

COMMENTS: This is helping to lift global equities yesterday and continuing today

Vitol Says Refiners Face ‘Soft Patch’ in 2024 on New Plants-BBG

Global oil refiners will suffer a “soft patch” next year as new capacity in Mexico, Africa and the Middle East boosts fuel supply, according to Vitol Group’s Head of Research Giovanni Serio.

However, given the global energy transition, it’s hard to build a strong case for more investment in the sector, Serio said at the Financial Times Commodities Asia Summit in Singapore. Refining supply-balances are set to tighten by 2030 unless there is another round of investments in the industry, he added.

“The pace of the energy transition in oil and in transportation has fallen short of expectations, and at the same time, the lack of investment in the industry has not translated into a shortage of supply as expected,” said Serio.

Vitol expects net additions of gasoline-fueled cars in China to rise by 12 million units this year and by 11 million in 2024, Serio said. He added that demand for liquefied petroleum gas will keep growing due to requirements from the petrochemical sector, which produce a wide array of plastic products.

The pace of oil demand in most nations has returned to pre-pandemic levels, with the exception of the US, Serio said. Russian crude output remains high and production in the US, Brazil and Guyana is growing, he said.

There are some concerns about China’s construction sector but there are “green shoots of hope” for the nation’s oil demand, Mike Muller, Vitol’s head of Asia, said at the event. Gasoline and jet fuel consumption is still growing, although the use of coal has weighed on liquefied natural gas demand, he added.

Meanwhile, India is seeing large growth in commodity demand as its level of industrialization and urbanization gathers pace, said Muller.

COMMENTS: Oil a bit soft this morning

Biden and Xi Jinping: what to expect from meeting in San Francisco-Reuters

U.S. President Joe Biden and Chinese President Xi Jinping will meet on Wednesday before a summit of the Asia Pacific Economic Cooperation (APEC) forum in San Francisco, seeking to reduce friction in what many see as the world’s most dangerous rivalry.

The leaders of the world’s two largest economies have known each other for over a decade and have shared hours of conversation in six interactions since Biden’s January 2021 inauguration. But they have met only once in person since then, and Xi, who arrived in San Francisco on Tuesday evening, had not visited the United States since 2017 when Donald Trump was president.

WHAT ISSUES ARE THEY LIKELY TO DISCUSS?

The White House says the aim of the summit, to be held at an unannounced location in the San Francisco Bay Area, is to boost communication to prevent an intense rivalry from veering into conflict. The meeting is expected to cover global issues from the conflict in the Middle East to Russia’s invasion of Ukraine, North Korea’s ties with Russia, Taiwan, human rights, artificial intelligence, as well as “fair” trade and economic relations.

Biden is expected to tell Xi that the U.S. remains committed to standing with its allies and partners in the Indo-Pacific, in the face of Chinese pressure against democratically governed Taiwan, which China claims as its own, and in the South and East China Seas. He will also express a specific commitment to the security of the Philippines, U.S. officials said.

COMMENTS: San Francisco welcome Xi…looking rather communist

WHAT DEALS CAN WE EXPECT?

The White House says Washington is looking for specific outcomes and hopes to see progress in reestablishing military-to military ties with China and in combating trade in the potent synthetic opioid drug fentanyl, which has become a scourge in the United States. Any deal on fentanyl would likely mean Washington’s having to lift human rights sanctions on China’s police forensic institute in return.

Biden said on Tuesday his goal would be to resume normal communications with China, including military-to-military contacts.

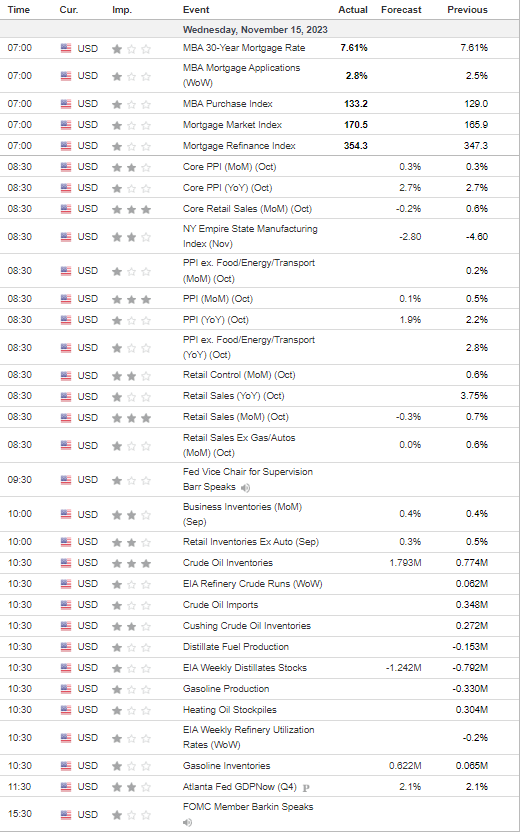

US DATA TODAY