Mixed Markets

- Hong Kong: Hang Seng closed down -1.36%

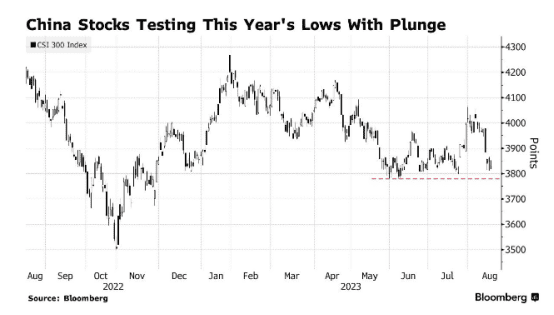

- China CSI 300 -0.37%

- Taiwan KOSPI -1.76%

- India Nifty 50 +0.06%

- Australia ASX +0.36%

- Japan Nikkei -0.42%

- European bourses in mixed territory so far this morning; DAX, CAC, IBEX, FTSE in negative territory

- USD -0.15%

TOP STORIES OVERNIGHT

China Asks Some Funds to Avoid Net Equity Sales as Markets Sink-BBG

Chinese authorities asked some investment funds this week to avoid being net sellers of equities, as a rout in the nation’s financial markets deepened, people familiar with the matter said.

Stock exchanges issued the so-called window guidance to several large mutual fund houses, telling them to refrain for a day from selling more onshore shares than they purchased, according to the people who asked not to be identified discussing private information. The instructions were relayed to fund managers through investment executives at the firms, they added.

Not the best sign

China Shadow Bank Misses Dozens of Payments as Risks Grow-BBG

Zhongrong International Trust Co. missed payments on dozens of products and has no immediate plan to make clients whole, indicating troubles at the embattled Chinese shadow bank are deeper than previously known.

Wang Qiang, board secretary of the firm partly owned by financial giant Zhongzhi Enterprise Group Co., told investors in a meeting earlier this week that the firm missed payments on a batch of products on Aug. 8, adding to delays on at least 10 others since late July, according to people familiar with the matter. At least 30 products are now overdue and Zhongrong also halted redemptions on some short-term instruments, one of the people said.

The company doesn’t have an immediate plan to cover the payments since its short-term liquidity has suddenly dried up, Wang said. He added that the number of products with missed payments has risen and the company is facing a “tsunami” of questions from investors and their own wealth managers, according to the people familiar, who asked not to be identified because the meeting was private. Wang asked for patience as the firm seeks to recoup the value of its investments.

More bad news from China

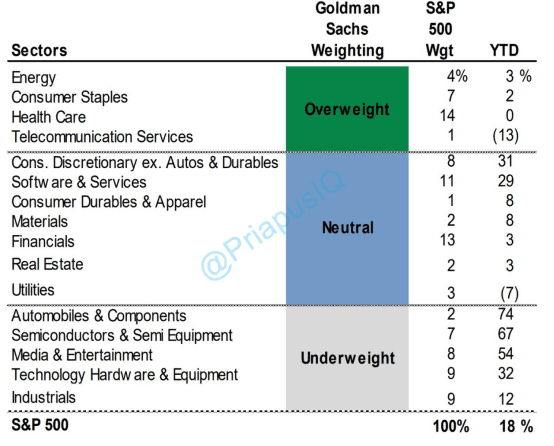

Goldman Sachs Recommended Sector Positioning

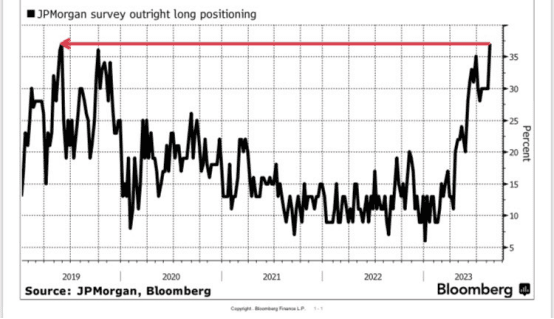

JPMorgan’s latest survey of Treasury clients shows jump in outright LONG positions to most since 2019

This could get ugly if yields keep rising

Industrial output jump gives euro zone growth small boost-Reuters

The euro zone’s vast industrial sector rebounded in June, giving overall growth a small boost to end an otherwise weak quarter on a positive note, data from Eurostat showed on Wednesday.

Industrial production in the 20 nations sharing the euro expanded by 0.5% on the month, beating expectations for a 0.2% rise, while gross domestic product was up 0.3% in the second quarter, unchanged on preliminary data, the EU’s statistics agency said.

Underlying growth was probably weaker, however, as data is distorted by a 3.3% jump in Irish GDP, which is driven by the oversized impact of big foreign companies based there for tax reasons.

In fact, the euro zone economy has broadly stagnated for the past three quarters, weighed down by a manufacturing recession and high costs for food and energy, with services and employment providing the few bright spots.

Recovery is also not yet in sight, with leading indicators suggesting stagnation for the quarters ahead, partly due to decades-high interest rates, which will make the European Central Bank extra careful in pushing up borrowing costs any further.

But a deeper downturn is also unlikely, especially as unemployment is pinned at an all-time-low and employment expanded by 0.2% in the quarter, suggesting that the labour market continues to run hot.

Employment is so tight that 43% of German firms are reporting a shortage of qualified workers, according to the Ifo institute, an apparent anomaly as weak growth should typically drive up unemployment.

But firms, enjoying some of their best margins in years, are hoarding labour, fearing that re-hiring workers would be too difficult once the upturn starts, economists say.

For now, economists’ main scenario is for the euro zone to post small growth in the quarters ahead, helped by what is set to be a strong tourism season and a continued demand for workers, particularly in services.

Interest rates are also not likely to go much further with the debate focusing on whether one last small rate hike is needed to contain inflation.

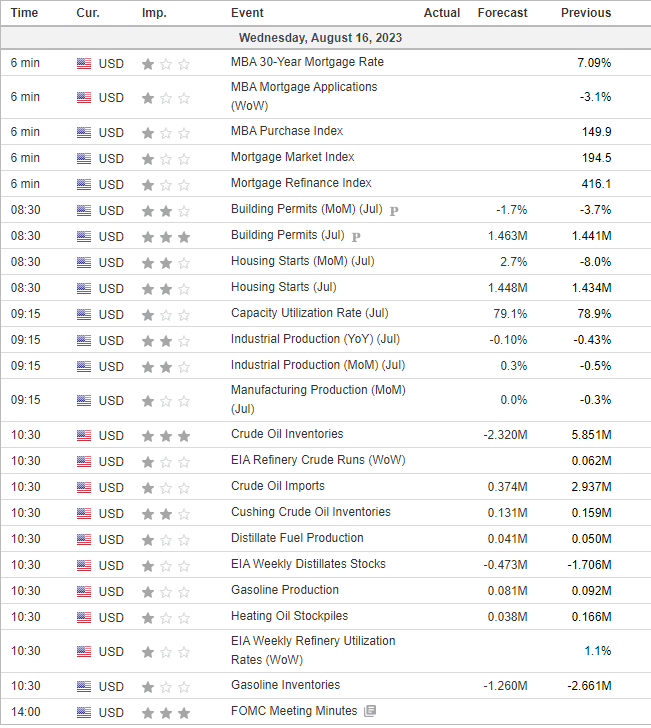

US DATA TODAY