HAPPY TRIPLE WITCHING!

SEA OF GREEN

- Hong Kong: Hang Seng closed UP +1.07%

- China CSI 300 +0.96%

- Taiwan KOSPI +0.66%

- India Nifty 50 +0.71%

- Australia ASX +0.22%

- Japan Nikkei +1.74%

- European bourses in positive territory so far this morning

- USD FLAT

TOP 5 STORIES OVERNIGHT

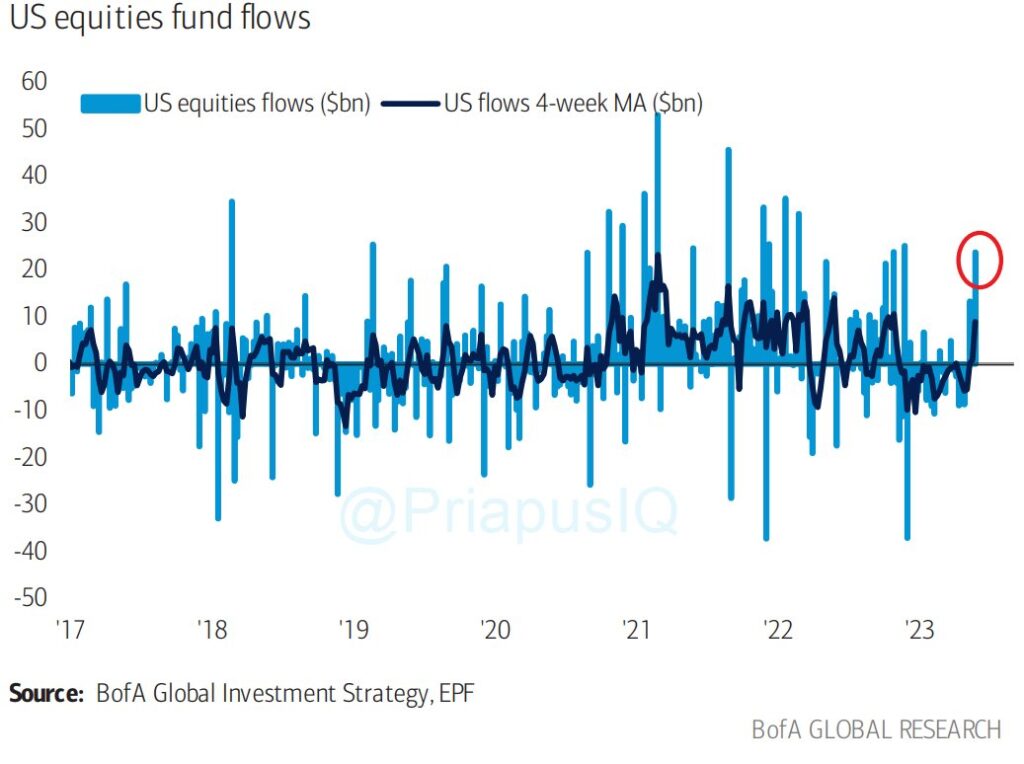

- Global equity funds attract biggest inflow in 12 weeks-Reuters

In the week ended June 14, investors added a net $16.18 billion to global equity funds, nearly offsetting the $17.69 billion in net selling observed just a week earlier, according to data from Refinitiv Lipper.

Investors allocated $18.85 billion to U.S. equity funds and $723 million to Asian equity funds. Conversely, European funds experienced a third consecutive weekly outflow, amounting to approximately $3.43 billion.

The technology sector attracted approximately $1.7 billion, marking the largest weekly inflow since March 2022. Consumer discretionary and financial sectors also saw inflows, amounting to $584 million and $386 million, respectively.

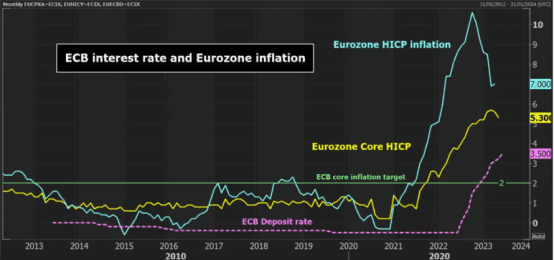

- Eurozone CPI unchanged (ECB hiked rates yesterday 25bps)

Eurozone CPI (Y/Y) May F: 6.1% (exp 6.1%; prev 6.1%)

CPI (M/M) May F: 0.0% (exp 0.0%; prev 0.0%)

CPI Core (Y/Y) May F: 5.3% (exp 5.3%; prev 5.3%)

- China takes next step in currency globalization, with some HK stocks priced in yuan-Reuters

Hong Kong stocks such as Alibaba and Tencent are among the 24 stocks which will be priced and traded in both yuan and the Hong Kong dollar under the Dual Counter Model on the Hong Kong stock exchange (HKEX) from Monday.

Under the dual counter arrangement, investors can choose to trade a stock either using Hong Kong dollars via the HKD counter, or yuan via the RMB counter, with market makers providing liquidity and minimizing price discrepancies.

The U.S. dollar remains the dominant global currency, accounting for 42% of global payments. The yuan’s share is just 2.29%, but is up from 1.95% two years ago.

- The Bank of Japan (BOJ) maintained ultra-easy monetary policy on Friday despite stronger-than-expected inflation, signalling it will remain a dovish outlier among global central banks and focus on supporting a fragile economic recovery-Reuters

“We expect trend inflation to heighten as economic activity heightens and the labour market tightens. But there’s very high uncertainty on next year’s wage negotiations and the sustainability of wage growth.”

“We expect Japan’s consumer inflation to slow as cost-push factors dissipate. But we also see notable changes in corporate price-setting behaviour. I would add that there’s very high uncertainty on the economic and price outlook.”

“We expect inflation to moderate, but it’s true the pace of decline is somewhat slow. But we’re still in the early stages of the moderation. There’s uncertainty on whether the future slowdown will be a gradual one, or a quite sharp one.”

- Nikkei clinches fresh three-decade high as BOJ stands pat

– Japan’s Nikkei notched a fresh three-decade high and its 10th consecutive weekly gain on Friday, as investors cheered the central bank leaving its ultra-easy policy settings unchanged.

The Bank of Japan (BOJ) kept intact its pledge to “patiently” maintain massive stimulus. The Nikkei closed 0.7% higher at 33,706, having touched a 33-year high in late trade.

Its weekly gain was 4.5% and the 10-week winning streak that propelled the index 22% higher and was the longest in 11 years.

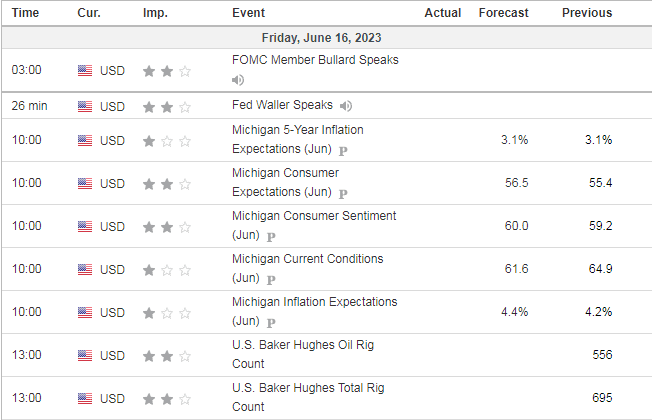

US DATA TODAY