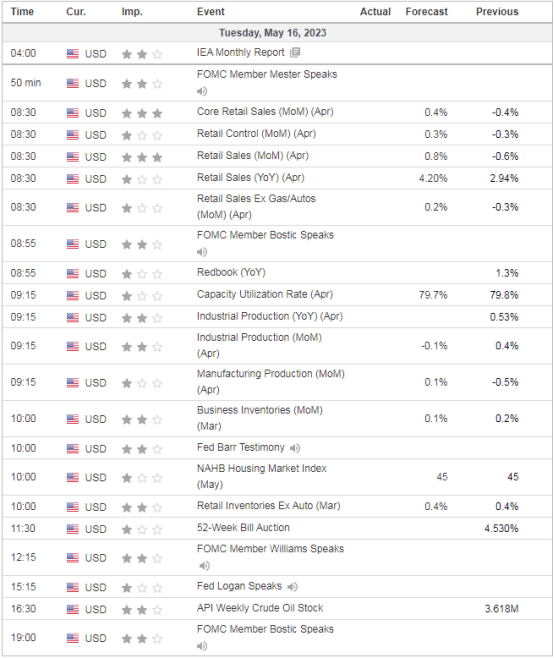

US RETAIL SALES 8:30 AM ET

Mixed Markets

- Hong Kong: Hang Seng closed up +0.04%

- China CSI 300 -0.52%

- Taiwan KOSPI +0.04%

- India Nifty 50 -0.68%

- Australia ASX +0.10%

- Japan Nikkei +0.10%

- All European bourses all in positive territory so far this morning with the exception of Austria, Spain, Greece, and Switzerland

- US indices in broadly flat so far in pre-market, USD -0.13%

Overnight Data/News

- China PBoC Sets Yuan Mid-Point At 6.9506 / Dollar VS Last Close 6.9520

- China Industrial Production (Y/Y) Apr: 5.6% (est 10.9%; prev 3.9%) – Industrial Production YTD (Y/Y) Apr: 3.6% (est 4.9%; prev 3.0%)

- China Retail Sales (Y/Y) Apr: 18.4% (est 21.9%; prev 10.6%) – Retail Sales YTD (Y/Y) Apr: 8.5% (est 8.2%; prev 5.8%)

- China Fixed Assets Ex Rural YTD (Y/Y) Apr: 4.7% (est 5.7%; prev 5.1%) – Property Investment YTD (Y/Y) Apr: -6.2% (est -5.7%; prev -5.8%) – Residential Property Sales YTD (Y/Y) Apr: 11.8% (prev 7.1%)

- China Surveyed Jobless Rate Apr: 5.2% (est 5.3%; prev 5.3%)

- UK ILO Unemployment Rate 3M Mar: 3.9% (est 3.8%; prev 3.8%) – UK Employment Change (3M/3M) Mar: 182K (est 160K; prev 169K) – UK Average Weekly Earnings 3M (Y/Y) Mar: 5.8% (est 5.8%; prev 5.9%) – UK Weekly Earnings Ex Bonus 3M (Y/Y) Mar: 6.7% (est 6.8%; prev 6.6%)

- UK Jobless Claims Change Apr: 46.7K (prev 28.2K) – UK Claimant Count Rate Apr: 4.0% (prev 3.9%)

- Eurozone GDP SA (Q/Q) Q1 P: 0.1% (est 0.1%; prev 0.1%) – Eurozone GDP SA (Y/Y) Q1 P: 1.3% (est 1.3%; prev 1.3%)

- Eurozone Employment (Q/Q) Q1 P: 0.6% (prev 0.3%) – Eurozone Employment (Y/Y) Q1 P: 1.7% (prev 1.5%)

- Eurozone Trade Balance SA Mar: €17.0B (prevR -€0.2B) – Eurozone Trade Balance NSA Mar: €25.6B (prev €4.6B)

- German ZEW Survey Expectations May: -10.7 (est -5.0; prev 4.1) – German ZEW Survey Current Situation May: -34.8 (est -37.0; prev -32.5)

- RBA Says More Rate Increases May Be Required, Dependent On Economy – AFR

- Michael Burry Doubles Alibaba Stake In Big Bet On China Tech – BBG

- China’s Economic Recovery Worries Mount As Data Disappoints – BBG

- Wells Fargo Agrees To Pay Shareholders $1 Billion To Settle Class-Action Suit – WSJ

- The Japanese government will allow seven of nation’s major power companies to raise household electricity prices from June, a move likely to add to inflation

- Ford To Scale Back China Investments Amid EV Competition From Local Rivals – FT

- EU Urged To Crack Down On Imports Of Indian Fuels Made With Russian Oil – FT

- UK Wage Growth Accelerates As Labour Tightness Persists – BBG

- Investors Most Pessimistic So Far This Year, BofA Survey Shows – BBG

- Japan Stock Index Hits 33-Year High As Investors Warm To Tokyo Story – FT

- India’s April Gold Imports Fall 45% Y/Y To 16 Tonnes, Lowest In 3 Months – RTRS Citing Govt Source

- IEA: Despite Russia’s Announced 500,000 Bpd Supply Cut, It May Be Boosting Volumes To Make Up For Lost Revenue – OPEC+ Oil Supply Will Fall By 850,000 Bpd While Non-OPEC+ Supply Will Rise By 710,000 BPD From April Through Dec

- IEA: China’s Demand Recovery Surpasses Expectations, Hit Record In March Of 16 Mln BPD – Demand Is Expected To Eclipse Supply By Almost 2 Mln BPD In Second Half Of Year – China Will Account For Nearly 60% Of Global Oil Demand Growth In 2023

- German Chemicals Sales Decline Further As High Costs Persist, Industry Body Says – RTRS

- Russian Oil Exports Hit Post-Invasion High – FT

- Worrying ZEW numbers out of Germany. Its economy is going to remain subdued at best, and the flirtation with stagnation will continue

- Central Banks Use Record Amount Of Yuan Via PBoC Swaps – BBG

US DATA TODAY