Mixed Markets

- Hong Kong: Hang Seng closed down 0.01%

- China CSI 300 +0.33%

- Taiwan KOSPI -0.23%

- India Nifty 50 -0.61%

- Australia ASX -1.44%

- Japan Nikkei +0.17%

- European bourses in mixed territory so far this morning

- USD -0.08%

TOP STORIES OVERNIGHT

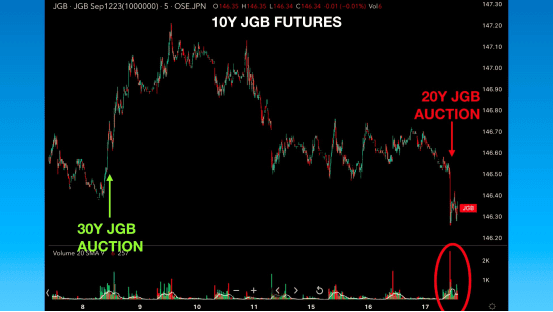

JGB 20Y auction results at 12:35PM crashes JGBs at long end, taking USTs down alongside Via @acrossthespread

~$200mn notional in 10Y JGB futures sold immediately- far more volume vs Aug 8th’s very strong 30Y auction, & erasing gains since

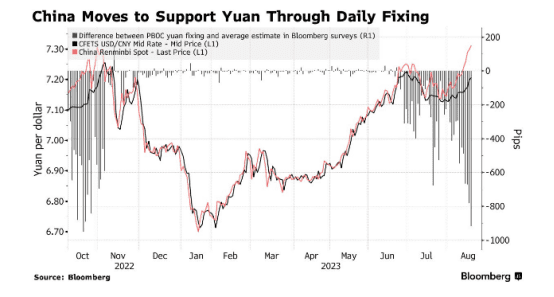

China Told State Banks to Escalate Yuan Intervention This Week-BBG

Chinese authorities told state-owned banks to step up intervention in the currency market this week, in a push to prevent a surge in yuan volatility, according to people familiar with the matter.

Senior officials are also considering the use of tools such as cutting banks’ foreign-exchange reserve requirements to prevent a rapid depreciation in the currency, said the people. The request came as the yuan fell toward 7.35 per dollar, a level that top leadership has been paying close attention to, they added.

Authorities were also checking whether domestic companies helped accelerate yuan declines by conducting speculative trades against it, said the people, who requested not to be named as they are not authorized to discuss the matter.

A sense of gloom has descended on China’s markets this week, even though Beijing sought to bolster sentiment with a surprise interest-rate cut, a string of stronger-than-expected daily reference rates for the yuan and large injections of short-term cash to the financial system. Despite these measures, the onshore yuan is tumbling toward the weakest level since 2007 and a key index of shares in Hong Kong is close to a bear market.

We literally just talked about this on the PYT spaces yesterday!!

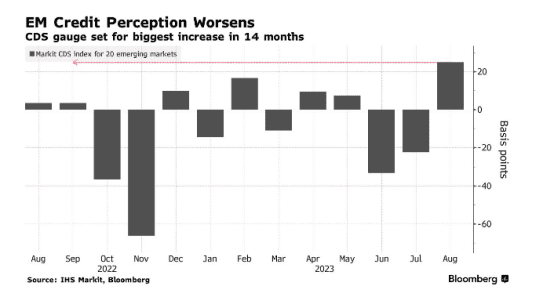

Emerging-Market Credit Risk Jumps as Hawkish Tilt Batters Bonds-BBG

The emerging-market selloff that started in equities and spread to currencies this month has now gripped bonds, as traders rush to unwind bets they made on expectations for interest-rate cuts.

The average cost to hedge against a default among 20 emerging economies rose Thursday, heading for the biggest monthly increase since June 2022. Asia led a selloff in the dollar-debt and currency markets as China’s economic, financial and property crises weigh on the continent’s growth outlook. Local-currency bond yields spiked the most in Hungary, Romania and Pakistan.

Traders took two messages from the Federal Reserve minutes released late Wednesday: first, that most US policymakers favor staying on the rate-hike path, and second, that quantitative tightening in the world’s largest economy will continue irrespective of the direction of interest rates. That proved the final straw for a popular trade that was already losing a bit of traction — taking long-bond and rate-receiver positions predicated on the start of an easing cycle.

A gauge of credit default swaps covering developing nations rose to 216 basis points today, taking this month’s increase to 25 basis points.

Goldman Sachs Blames Zero-Day Options for Fueling S&P 500 Selloff-BBG

Look closely at the contours of Tuesday’s tumble in the S&P 500 and fingerprints of a new market force come into focus.

They’re options tied to S&P 500 with a maturity less than 24 hours. A flurry of trading in the contracts known as zero days to expiration, or 0DTE, was the backdrop to a jarring acceleration of the day’s decline, one in which the equity benchmark slid roughly 0.4% in 20 minutes, according to Goldman Sachs Group Inc.’s managing director Scott Rubner.

According to Rubner, market makers, whose need to keep books balanced often means they must buy or sell stock en masse when options orders cascade in, were forced into action by furious trading in bearish puts with a strike price at 4,440. Those options saw almost 100,000 contracts change hands during the session, or $45 billion in notional value.

As their cost spiked to $9 from 70 cents in a short span near the session’s end, it sent market makers on the other side of transactions in a dash for hedges to stay market neutral. In this case, that meant an exodus from equities.

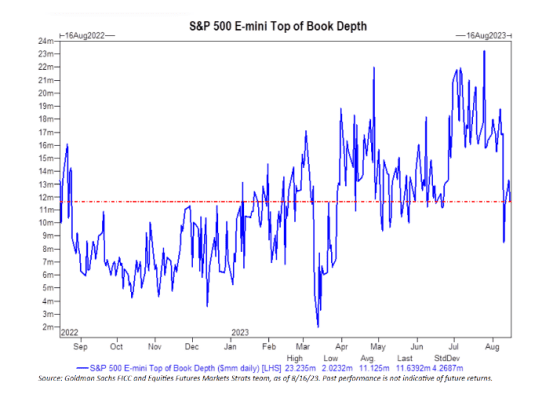

“There is not enough liquidity on the screens to handle market makers delta hedging such a dramatic move over a short 20 minute period,” Rubner, who has studied flow of funds for two decades, wrote in a note Wednesday.

His analysis is the latest to venture views on the impact of zero-day options on the underlying stock market. Earlier this week, research from Nomura Securities International and Citigroup Inc. showed that trading in 0DTE contracts has exploded to record highs this month, with traders pivoting toward puts. The mushrooming popularity, while likely a consequence of a break in the 10-month equity rally, may have been contributing to intensified intraday swings, according to Nomura.

Amplifying the influence of zero-day options is a market where it’s getting harder to trade stocks without moving their prices, according to Goldman’s Rubner. By his estimate, the liquidity condition has worsen over the past two weeks, with a measure plunging 56%.

The pickup in volatility, along with receding momentum, threatens to turn rules-based investors into sellers, Rubner warned. Those strategies making asset allocations based on trend and price signals have been among this year’s largest equity buyers.

“There has been a clear shift in sentiment over the past few weeks across my persistent IB, zooms, trading calls,” Rubner wrote. “This is no longer a buy the dip market.”

Bankruptcies in the EU highest since 2015, Eurostat says-Reuters

Bankruptcy declarations in the European Union reached the highest level since 2015 in the second quarter of this year, driven by increases in the accommodation and food services sectors, the bloc’s statistics agency Eurostat said on Thursday.

The number of wound up companies in the April-June period was 8% higher than the previous quarter, marking a sixth consecutive increase, Eurostat said.

Registrations of new businesses edged down in the same period, but remained higher than in 2015-2022, the agency added.

While all sectors of the economy recorded an increasing trend in bankruptcies, accommodation and food services were the most affected, with a 24% increase from the previous reading.

Companies going out of business in the transportation and storage sectors were up 15% on the quarter, while in education, health and social activities the increase was 10%.

The number of bankruptcy declarations was also higher than pre-pandemic levels, with the exception of the industry and construction sectors, which recorded 12% and 3% declines, respectively, from the fourth quarter of 2019, Eurostat said.

Obviously ungood

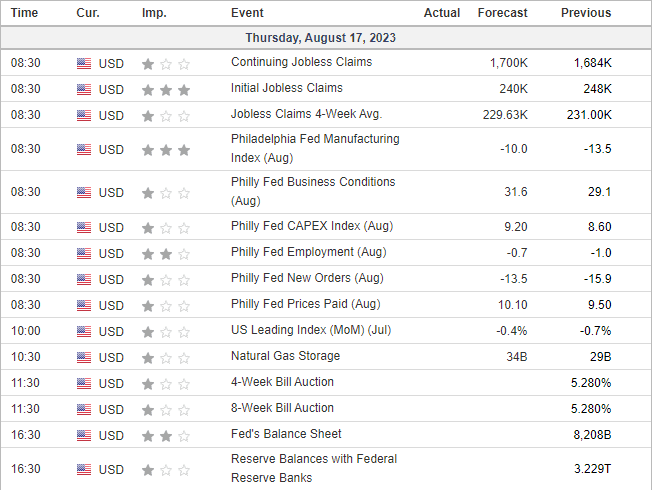

US DATA TODAY