Asia RED ..Europe GREEN

- Hong Kong: Hang Seng closed down -2.12%

- China CSI 300 -0.12%

- Taiwan KOSPI -0.74%

- India Nifty 50 -0.24%

- Australia ASX -0.65%

- Japan Nikkei +0.16%

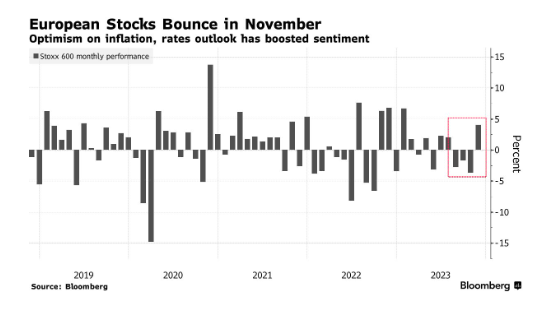

- European bourses in POSITIVE territory so far this morning

- USD -0.24%

TOP STORIES OVERNIGHT

Biden Signs Bill Averting Shutdown, Teeing Up 2024 Budget Battle-BBG

President Joe Biden signed a stopgap bill to extend government funding into early 2024, averting a government shutdown for now but kicking a politically-divisive debate over federal spending into a presidential election year.

The White House confirmed the move in a statement early Friday morning in Washington, less than a day before existing funding would have expired. Biden — in California for a summit of APEC leaders — signed the legislation on Thursday, according to the statement.

Facing that Friday night deadline and with the House under new leadership, Congress passed an interim measure with broad bipartisan majorities earlier this week.

COMMENTS: Not really a shocker

Stocks, Bonds Rally as Rate-Cut Conviction Builds-BBG

Stocks advanced and bond yields dropped as fresh signs of an economic slowdown prompted investors to ramp up bets on interest-rate cuts next year.

Europe’s Stoxx 600 index jumped 1.1%, on track for an almost 3% rally this week. US futures climbed, with Gap Inc. soaring 17% in premarket trading after reporting third-quarter profit that exceeded forecasts. Bonds added to Thursday’s gains, with markets now pricing a full percentage point of rate reductions next year from the European Central Bank. Gilt yields fell as much as 12 basis points as data showed a surprise drop in UK retail sales last month.

This week’s soft inflation and jobs data in the US has fueled the conviction that aggressive policy-tightening cycles from the Federal Reserve and other central banks are finally at an end. That view helped drive $23.5 billion into stock funds in the week through Nov. 15, the second-biggest inflows of the year, Bank of America Corp. said, citing EPFR Global data.

Russian Figures Suggest Western Oil Sanctions Not Working-BBG

The west’s sanctions on Russian oil exports are failing to deprive the Kremlin of revenue to fund its war in Ukraine, meaning the measures are not succeeding in one of their principal objectives.

Whether in dollars or rubles, net or gross, Russian Finance Ministry data show that the money flooding into government coffers has been grinding higher for months now.

The figures beg the question as to whether Group of Seven nations, especially the US and Europe, will need to take more aggressive action if they really want to deprive Moscow of petrodollars.

Their key tool for curbing that funding was a price cap that prevented western firms from helping in the transport of Russian oil if it cost more than $60 a barrel. But one study this week showed that almost every seaborne cargo breached the threshold last month.

Gross revenues from three main tax sources of petrodollars nearly doubled between April and October, coming to more than $13 billion last month, Bloomberg calculations based on the Finance Ministry’s data show. The October earnings exceeded those for any single month in 2021, before the invasion of Ukraine caused unprecedented volatility to the nation’s exports.

COMMENTS: I have been saying this since summer…sanctions just do not work, look at Iran and Venezuela for the most recent examples. There is always a way around sanctions.

US equity funds draw heavy inflows on expectations for Fed pause-Reuters

U.S. investors were big buyers of equity funds in the seven days through Nov. 15, spurred by expectations that the Federal Reserve may pause its interest rate hikes in light of recent subdued U.S. inflation data.

LSEG data shows that U.S. equity funds attracted about $9.33 billion in net inflows during the week, marking the largest weekly net purchase since Sept. 13.

Large-cap U.S. funds led the charge, securing $8.54 billion in net inflows, the highest in two months. Small- and multi-cap funds also saw substantial inflows, garnering $1.23 billion and $1.01 billion, respectively. However, mid-cap funds experienced net outflows totalling $1.13 billion.

Technology sector funds were a prime target for investors, who injected a net $1.73 billion, the largest inflow since mid-December 2021. Gold & precious metals, and consumer discretionary sectors also attracted significant inflows, amounting to $596 million and $212 million, respectively.

U.S. bond funds reported $2.67 billion in net purchases, continuing a trend of inflows for the second consecutive week. High-yield funds, riding on improved risk sentiment, garnered $4.5 billion, following a robust $6.3 billion net purchase in the prior week.

Conversely, U.S. short/intermediate government and treasury funds, along with general domestic taxable fixed income funds, saw withdrawals of $1.13 billion and $897 million, respectively.

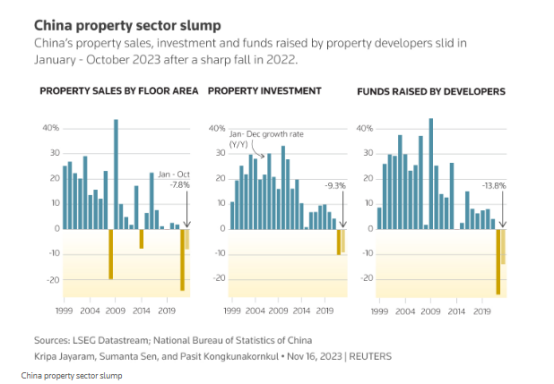

China needs to pull ‘multiple levers’ for property turnaround, say analysts-Reuters

China’s direct interventions to ease a cash crunch for crisis-hit property developers are a step in the right direction, but analysts say these actions must be complemented by stronger fiscal and monetary policies to shore up demand in the sector.

The extended slump in property sales, investment, and home prices last month has piled more pressure on authorities to step up efforts to prevent contagion across the broader financial sector.

Beijing needs to pull “multiple levers” at the same time to address the “vulnerabilities” in the financial system, local government financing, as well as consumer sentiment, said Edward Al-Hussainy, head of emerging market fixed income research at Columbia Threadneedle, which owns Country Garden bonds.

“When confidence is low, the only entity that can solve it is the government and I think the government has to solve it by being very aggressive, very visibly aggressive, with language like ‘whatever it takes'”, he said.

COMMENTS: I almost think this a controlled demolition, China could do more if they wanted.

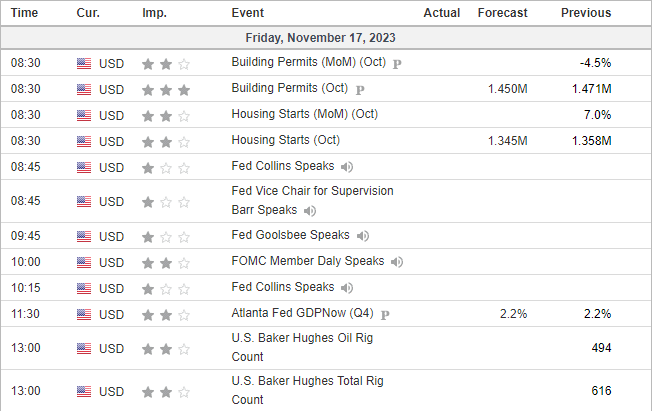

US DATA TODAY