Mixed Markets

- Hong Kong: Hang Seng closed up +0.75%

- China CSI 300 +0.35%

- Taiwan KOSPI +0.98%

- India Nifty 50 -0.44%

- Australia ASX -0.35%

- Japan Nikkei +0.40%

- European bourses mostly in negative territory so far this morning

- USD +0.05%

TOP STORIES OVERNIGHT

German Investor Confidence Improves as Interest Rates Hit Peak-BBG

German investor confidence improved for a third month — signaling hope that an end to more than a year of interest-rate increases can help Europe’s biggest economy overcome its current weakness.

The ZEW institute’s gauge of expectations rose to -1.1 in October from -11.4 in September — better than economists had predicted in a Bloomberg survey. An index of current conditions worsened a little.

“It seems that we have passed the lowest point,” ZEW President Achim Wambach said Tuesday in a statement. “The heightened economic expectations are accompanied by the anticipation that inflation rates will decrease further and the fact that now more than three-quarters of respondents anticipate stable short-term interest rates in the euro zone.”

COMMENTS: European markets liking this today

China Tech Stocks’ Narrowing Losses Signal Market Is On the Mend-BBG

The rout in China’s largest tech stocks is becoming less severe with each passing bout this year, signaling to some investors that confidence is slowly returning with regulatory headwinds seen to have peaked.

The peak-to-trough decline in the first quarter was more than 21%, which has narrowed in subsequent episodes of selling. The latest extended selloff was about 13%. The end of China’s years-long crackdown on the tech industry and earnings beats for some internet bellwethers have helped offset concerns over the sluggish consumption recovery. The Hang Seng Tech Index has outperformed the benchmark Hang Seng Index and the CSI 300 Index, rising over 30% from the trough in October last year.

“This is a sign of a bottom forming in the market,” said Kerry Goh, chief investment officer at Kamet Capital Partners Pte. China’s “policy direction is correct,” he added.

COMMENTS: China markets stabilizing today

Pemex shuts large CDU at Deer Park, Texas, refinery -sources-Reuters

Pemex (PEMX.UL) shut down the 270,000 barrel-per-day crude distillation unit (CDU) at its Deer Park, Texas, refinery on Monday because a process line ruptured, said people familiar with plant operations.

The DU-2 CDU, the larger of two at the 312,500 bpd refinery, provides 80% of feedstocks from crude oil to production units at the refinery. If it remains shut, other units will have to shut down, the sources said.

COMMENTS: Watch those crack spreads today

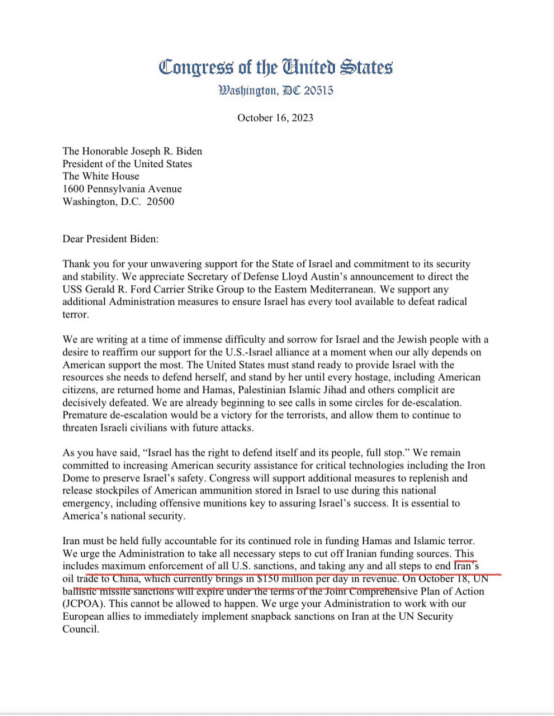

White House must punish Iran over Hamas attacks, lawmakers say-WAPO

“Iran must be held fully accountable for its continued role in funding Hamas and Islamic terror,” states the congressional letter, which praises Biden for his assistance to Israel thus far in the crisis. “We urge the Administration to take all necessary steps to cut off Iranian funding sources. This includes maximum enforcement of all U.S. sanctions, and taking any and all steps to end Iran’s oil trade to China.”

COMMENTS: Bipartisan pressure is growing on the Biden administration to focus on Iranian growing oil production. Something to watch as this would obviously affect oil prices

Bank of America tops profit estimates on better-than-expected interest income-CNBC

Bank of America topped estimates for third-quarter profit on Tuesday on stronger-than-expected interest income.

Here’s what the company reported:

Earnings per share: 90 cents vs. expected 82 cent estimate from LSEG, formerly known as Refinitiv

Revenue: $25.32 billion, vs. expected $25.14 billion

US DATA TODAY