Pretty RED out there ….Bloodbath in China

- Hong Kong: Hang Seng closed down 2.05%!!!!!!

- China CSI 300 -1.23%!!!

- India Nifty 50 -0.43%

- Australia ASX -0.64%

- Japan Nikkei +0.089%

- European bourses in negative territory so far this morning

- USD -0.11%

TOP STORIES OVERNIGHT -CHINA EDITION

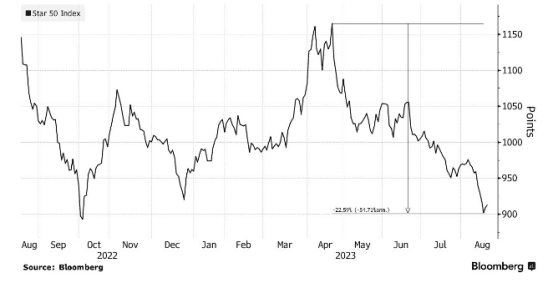

China Urged Buybacks at Star Board Companies as Market Tumbled -BBG

Chinese authorities encouraged companies listed on the Shanghai science and technology board to buy back their shares this week, people familiar with the matter said, another sign that China is taking steps to shore up market confidence.

The Shanghai Stock Exchange communicated with the Star-board listed firms after receiving guidance from the China Securities Regulatory Commission, according to the people, who asked not to be identified discussing private information. Companies that have applied for equity refinancing were also encouraged to do buybacks, the people added.

Companies answered the call. Major shareholders at around 30 firms on the tech-heavy Star Board in Shanghai proposed buybacks late Thursday. That compares with a total of around 230 Chinese companies across all exchanges that have executed share purchases this year, according to data compiled by Bloomberg.

“While the amounts are not huge and mostly symbolic in nature, the fact that they are willing to do buybacks under these hard times shows their strong intention to boost confidence,” said You Lanqiang, fund manager at Pingtan Strategic Asset Management Co.

It wasn’t immediately clear why the Star board would be a particular focus, though it’s down 5.1% year-to-date compared with a drop of 1.8% for the CSI 300.

An initial boost to sentiment didn’t last, with the Star 50 Index flipping to a loss of 0.3%. Other gauges in China also weakened in afternoon trading, with the CSI 300 Index 1% lower.

China is getting desperate, but it might be too late …

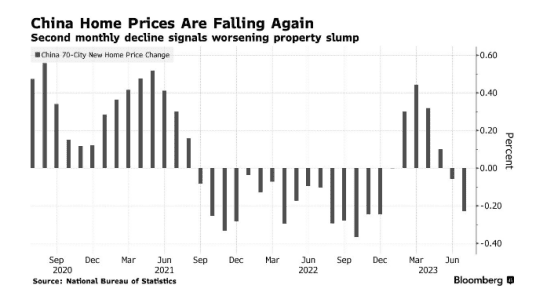

China’s State Developers Warn of Losses as Crisis Spreads-BBG

China’s state-owned property developers are warning of widespread losses, fueling concerns that the housing crisis is expanding from the private sector to companies with government backing.

Eighteen out of 38 state-owned enterprise builders listed in Hong Kong and the mainland reported preliminary losses in the six months ended June 30, up from 11 that warned of full-year losses in 2022, according to a Bloomberg tally based on corporate filings. Two years ago, only four firms with controlling or major state shareholdings posted losses.

The warnings signal state builders are no longer immune from the two-year housing slump that has weakened the economy and triggered dozens of defaults by private peers, with speculation that Country Garden Holdings Co. may be next. Authorities have in recent weeks stepped up pledges to support the property sector, though analysts are skeptical that the measures will be enough to revive the market anytime soon.

“China’s property slowdown is already hurting all developers, including the large government-linked ones,” said Zerlina Zeng, senior credit analyst at CreditSights Singapore. “We do not expect the situation to materially improve in the second half.”

Nomura Cuts China’s Growth Forecast to 4.6% on ‘Downward Spiral’-BBG

Nomura Holdings Inc. lowered this year’s growth forecast for China to 4.6% after weaker-than-expected data in July and an ongoing “downward spiral” in the economy.

The bank cut its estimate from 5.1% previously, it said in a report on Friday. The growth forecast for next year was maintained at 3.9%.

“In coming months, growth will face further pressure as the post-pandemic pent-up demand for travel runs its course,” Nomura’s economists led by Ting Lu wrote in the note. It’s more likely Beijing will miss this year’s growth target of around 5%, rather than meet it, they said.

Morgan Stanley earlier this week slashed its 2023 growth forecast to 4.7%, while JPMorgan Chase & Co. lowered its projection to 4.8%

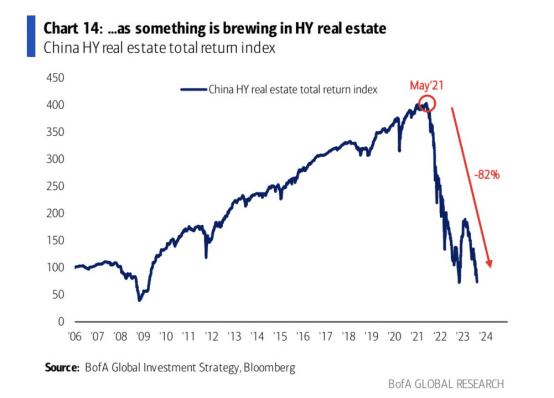

BofA Global on China Data:

“Shocking. Positively shocking”: “Wildcard for ‘soft landing’. .. Risk of China ‘credit event’ already spooking global markets but we would expect China event quickly elicits big (international) policy response ..” [Hartnett]

Obviously all of these contributed to the large losses in China markets overnight and are spooking global markets in general.

I know Fridays are generally bullish in US markets, but be careful out there today…

Europe Gas Set for Third Weekly Gain on Australia Strike Jitters-BBG

European natural gas futures headed for a third weekly gain as concerns over potential strikes in Australia inject renewed volatility into the market.

The possibility of walkouts at three liquefied natural gas facilities operated by Chevron Corp. and Woodside Energy Group Ltd. has taken center stage in recent days, as traders monitor negotiations. Strikes — if they go ahead — could disrupt global supplies and increase competition for the super-chilled fuel.

Workers at key Chevron LNG facilities are scheduled to begin voting Friday on industrial action, according to the Offshore Alliance, a group representing two major labor unions.

Traders are weighing supply risks against rising stockpiles in Europe, which are now 90% full — well ahead of the European Union’s Nov. 1 target date for that level. Still, robust inventories may not be sufficient to see the region through the winter. Meanwhile, heavy maintenance is expected at facilities in Norway.

US DATA TODAY (VERY QUIET DAY)