China mostly Red…Europe Mixed

- Hong Kong: Hang Seng closed down -2.05% !!!!

- China CSI 300 -0.32%

- Taiwan KOSPI -0.43%

- India Nifty 50 +0.20%

- Australia ASX -0.07%

- Japan Nikkei +0.33%

- European bourses mixed so far this morning

- USD -0.05%

TOP 5 STORIES OVERNIGHT

- China’s existing-home prices back in free fall as sellers rush in -Nikkei

Prices for existing homes in China are tumbling even in major cities as an influx of sellers and a dearth of buyers undermine the once-unquestioned assumption that the market would only keep growing.

Weak demand for housing is bogging down China’s economic recovery. Seasonally adjusted gross domestic product grew just 0.8% on the quarter in April through June, down from 2.2% in the first quarter when the end of the country’s zero-COVID policy gave the economy a brief boost.

- China Developer Bonds on Cusp of Distress After Wanda Surprise -BBG

Mounting signs of financial stress at Chinese developers are again roiling the nation’s dollar-bond market and adding to concerns about the health of the world’s second-largest economy.

Shui On Land Ltd. became the market’s latest worry on Tuesday, with its notes plunging by record amounts of more than 10 cents as the firm seeks to identify bondholders — a step that sometimes foreshadows payment delays. State-backed peer Sino-Ocean Group Holding Ltd. halted trading in a local note that matures in two weeks, flagging “significant” uncertainty in repaying that security.

The moves came just a day after a key unit of Dalian Wanda Group Co. warned creditors of a funding shortfall for a bond that comes due July 23.

All three firms had until recently been viewed by investors as among the few developers capable of weathering an industrywide debt crisis that has weighed on China’s economy for more than two years. The bond-price volatility in recent days underscores the broader challenges facing the property sector, which often rallies briefly on supportive policy steps but then falls back when more repayment woes emerge.

The maturing Wanda note plunged a record 22 cents after creditors were told there’s a funding gap of at least $200 million for repaying it. The bond swung Tuesday, initially rebounding 11 cents before falling as much as 13 cents from Monday’s closing level. It was down less than 3 cents at 69 cents as of 5:30 p.m. in Hong Kong, according to prices compiled by Bloomberg.

This is why Hang Seng is down so much today

l BlackRock Appoints CEO of Oil Giant Aramco to Its Board-BBG

Nasser has led the world’s biggest oil producer since 2015, including overseeing its public listing, and provides BlackRock with “a unique perspective” on key issues facing the company and its clients, CEO Larry Fink said Monday in an emailed statement.

It’s “a very cunning move,” said Sasja Beslik, chief investment officer at NextGen ESG in Japan.

Bringing Nasser onto BlackRock’s board “partly signals that we need oil and gas at the table if we are to make this transition work,” he said. But the move also “protects BlackRock from vultures questioning its public ESG stance, which in practice was never hard core.”

Nasser has taken issue with the ESG movement, warning in February that an increased focus on environmental, social and governance metrics was undermining investment in oil and gas to the point of posing a threat to global energy security. He serves on several boards, including the Massachusetts Institute of Technology Presidential CEO Advisory Board and the JP Morgan International Council.

THIS IS HUGE! This may actually get investors back interested in O&G equities with out fear of backlash

l US funds hit limits on holdings of high-flying tech stocks-FT

Many of the largest US investment funds are being blocked from buying more shares in popular stocks due to diversification rules, as they struggle to keep up with indices that are increasingly dominated by a few massive tech groups.

Major asset managers and mutual fund specialists such as Fidelity, BlackRock, JPMorgan Asset Management, American Century and Morgan Stanley Investment Management have run into strict regulatory limits that determine whether a fund can be categorised as “diversified”.

The trend is a further sign of how a lopsided rally powered by just a handful of big companies is creating unexpected issues for investors and index providers, and follows news that even the Nasdaq 100 — the index most closely associated with high-flying tech groups — will be rebalanced to reduce the dominance of the largest groups such as Apple, Microsoft and Nvidia.

The S&P 500 has added 18 per cent so far this year, but seven large tech stocks have accounted for the majority of the gains.

Mutual funds that register with the Securities and Exchange Commission as “diversified” cannot put more than 25 per cent of their assets into large holdings — with a large holding defined as a stock that represented more than 5 per cent of the fund’s portfolio at the time of investment.

This is important! Trading volumes likely to decrease, you may see more volatility as these stocks will now be more governed by options. It also may subdue this rally a bit without huge funds piling in.

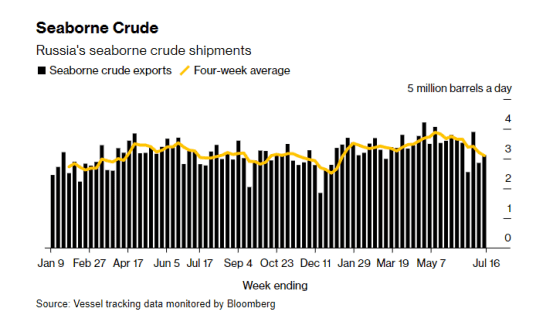

l Russia’s Overseas Crude Shipments Slump to a Six-Month Low-BBG

Russia’s seaborne crude flows sank to a six-month low in the latest four-week period as Moscow finally appears to be making good on its pledge to cut supply to international markets.

Crude shipments in the four weeks to July 16 dropped to 3.1 million barrels a day, according to vessel-tracking data monitored by Bloomberg and corroborated by other data sources. That’s down by 780,000 barrels a day from their peak in the 28 days to May 14. Shipments were 270,000 barrels a day below the level in February, the baseline month cited when the Russian government announced an output cut to come into effect in March.

This is what everyone has been waiting for, consistent data that Russia is abiding by their word in February to cut production and exports.

I think there are two reasons we are seeing this

- I think OPEC (see: KSA) had a strong word with them in the June meeting

- The discount to Brent window is closing in fast, meaning Russian crude is not as heavily discounted anymore, thus less appealing to buy in bulk

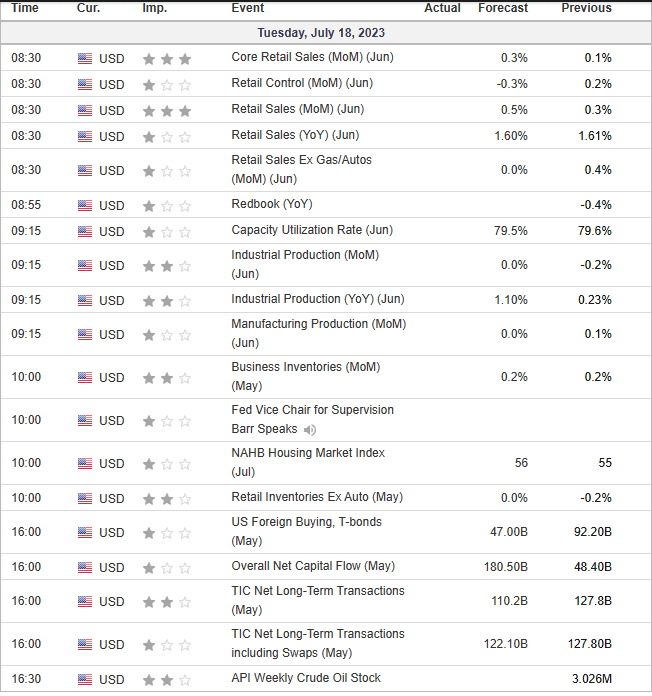

US DATA TODAY