Sea of RED

- Hong Kong: Hang Seng closed down -1.37%

- China CSI 300 -0.90%%

- Taiwan KOSPI +0.16%

- India Nifty 50 -0.27%

- Australia ASX -0.27%

- Japan Nikkei -0.60%

- All European bourses all in negative territory so far this morning

- US indices in negative territory so far this morning in pre-market, USD +0.27%

Overnight Data/News

- PBoC Fixes USDCNY Reference Rate At 6.8731 (prev fix 6.8814 prev close 6.8766)

- Japanese Industrial Production (M/M) Feb F: 4.6% (prev 4.5%) – Industrial Production (Y/Y) Feb F: -0.5% (prev -0.6%) – Capacity Utilisation (M/M) Feb: 3.9% (prev -5.5%)

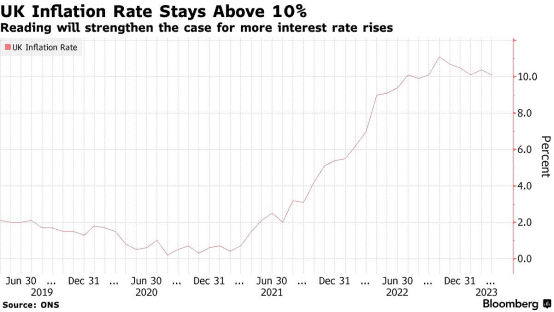

- UK CPI (M/M) Mar: 0.8% (est 0.5%; prev 1.1%) – UK CPI (Y/Y) Mar: 10.1% (est 9.8%; prev 10.4%) – UK CPI Core (M/M) Mar: 0.9% (est 0.6%; prev 1.2%) – UK CPI Core (Y/Y) Mar: 6.2% (est 6.0%; prev 6.2%) – UK CPIH (Y/Y) Mar: 8.9% (est 8.7%; prev 9.2%

- UK PPI Output NSA (Y/Y) Mar: 8.7% (est 8.5%; prev 12.1%) – UK PPI Output NSA (M/M) Mar: 0.1% (est -0.2%; prev -0.3%) – UK PPI Input NSA (Y/Y) Mar: 7.6% (est 7.0%; prev 12.7%) – UK PPI Input NSA (M/M) Mar: 0.2% (est -0.03%; prev -0.1%)

- UK House Price Index (Y/Y) Feb: 5.5% (est 5.1%; prevR 6.5%)

- EU27 New Car Registrations Mar: 28.8% (prev 11.5%)

- Eurozone CPI (Y/Y) Mar F: 6.9% (est 6.9%; prev 6.9%) – Eurozone CPI (M/M) Mar F: 0.9% (est 0.9%; prev 0.9%) – Eurozone CPI Core (Y/Y) Mar F: 5.7% (est 5.7%; prev 5.7%) – Eurozone CPI Core (M/M) Mar F: 1.3% (est 1.2%; prev 1.2%)

- Eurozone Construction Output (M/M) Feb: 2.3% (prevR 3.8%) – Eurozone Construction Output (Y/Y) Feb: 2.3% (prevR 0.5%)

- ECB’s Lane: Investment In Commercial Real Estate Is Expected To Be Hit Particularly Hard By The Tighter Lending Conditions

- US Bancorp Q1 23 Earnings: – Adj EPS $1.16 (est $1.13) – Net Interest Income $4.67B (est $4.61B) – Total Avg Deposits $510.32B (est $521.54B) – Total Avg Loans $386.75B (est $390.01B) – Cash & Due From Banks $67.23B (est $51.08B)

- US MBA Mortgage Applications Apr 14: -8.8% (prev 5.3%) – US 30-Yr MBA Mortgage Rate Apr 14: 6.43% (prev 6.30%)

- More US Consumers Are Falling Behind On Payments – RTRS

- UK Inflation Sticks Above 10%, Lifting Prospect of Rate Hike – Boomberg

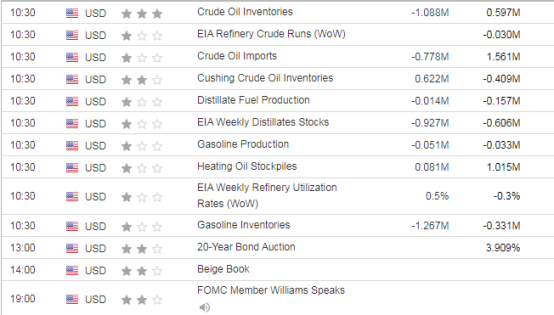

US DATA TODAY -light day again