Asia Mixed—Europe Green

- Hong Kong: Hang Seng closed down-0.33%

- China CSI 300 -0.11%

- Taiwan KOSPI +0.02%

- India Nifty 50 +0.50%

- Australia ASX -0.20%

- Japan Nikkei +0.79%

- European bourses all in positive territory so far this morning

- USD +0.31%

TOP 5 STORIES OVERNIGHT

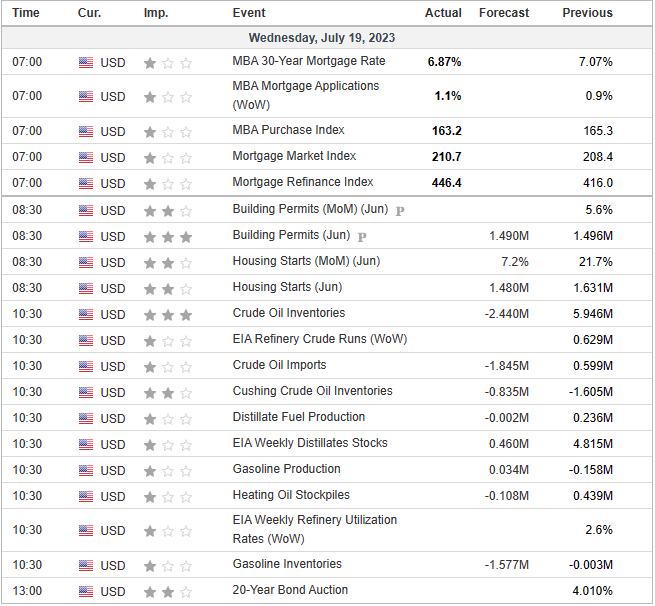

- Eurozone CPI

Eurozone Jun. Core CPI (MoM): 0.4%, [Est. 0.3%, Prev. 0.2%]

Eurozone Jun. Core CPI (YoY): 5.5%, [Est. 5.4%, Prev. 5.3%]

Eurozone Jun. CPI (MoM): 0.3%, [Est. 0.3%, Prev. 0.0%]

Eurozone Jun. CPI (YoY): 5.5%, [Est. 5.5%, Prev. 6.1%]

Eurozone Core CPI surprises slightly to the upside, with headline inflation coming in right on expectations.

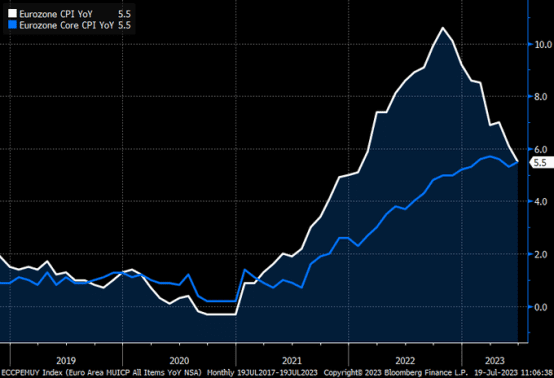

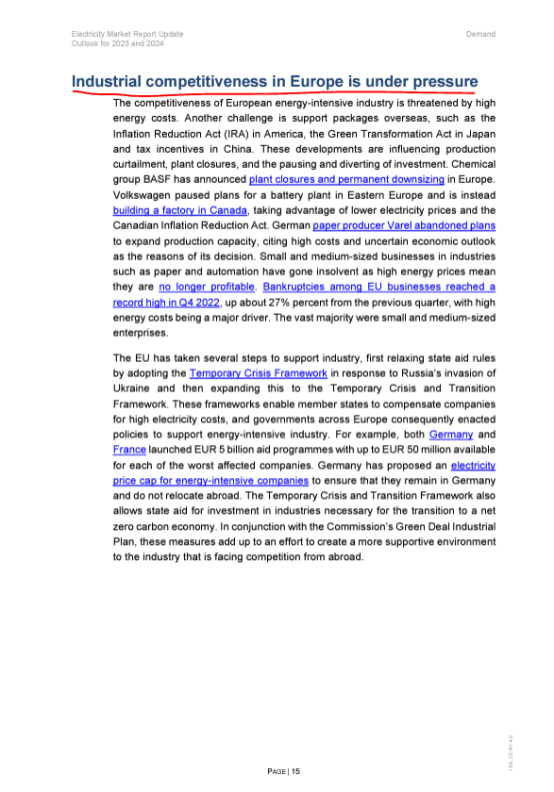

- IEA Electricity Report

Deindustrialization continues in Europe

“… nearly 2/3 of the net decline [in 2022 European electricity demand is] estimated to be due to the reduction in demand from energy-intensive industries amid high energy price…” “…

No rebound […] in sight …”

Europe is screwed for lack of a better word

China’s gold futures hit new high as uncertainties in rate hikes in US, Europe boost gold prices -YuanTalks

- European Stocks Advance as UK Shares Jump on Slowing Inflation -BBG

UK and European shares gained as British inflation fell below 8% for the first time in more than a year, boosting sentiment.

The Consumer Prices Index in the UK was 7.9% higher than a year ago in June, a sharp drop from the 8.7% reading in May, the Office for National Statistics said Wednesday. Economists had expected a decline to 8.2%.

The FTSE 100 Index advanced 1.4% as of 10:55 am in London following the inflation data, which revived speculation about how many more rate hikes the Bank of England will deliver to contain prices. The more domestically-focused FTSE 250 Index rose 3.1%, the most in almost six months. Across Europe, the Stoxx 600 Index was 0.5% higher, with real estate and consumer stocks outperforming, while basic resources and media declined.

As rates traders pared bets on further interest rate hikes by the Bank of England, UK homebuilders rallied. The FTSE 350 household goods and construction index jumped as much as 7.2%, the most since 2008. Leading gainers included builders Redrow up 9.3%, Crest Nicholson up 8.4% and Persimmon up 8.0%.

“The strength in the pound was due to higher inflation pushing rates expectations up and growth expectations down,” said Barclays strategist Emmanuel Cau. “So today’s weaker than expected inflation print is arguably a relief, which should lift sentiment on the depressed domestic plays and rates plays. Investors are very bearish on UK and under exposed, so short covering may be powerful.”

- China Junk Bonds Suffer Worst Slide of 2023 as Defaults Mount-BBG

China’s high-yield dollar bonds suffered their sharpest three-day selloff this year, with a fresh default from a state-backed developer underscoring how a liquidity crisis is worsening even for those with funding access.

Greenland Holding Group Co., which is partially owned by local government entities, has defaulted on a 6.75% dollar bond it guaranteed, according to a notice sent to bondholders and seen by Bloomberg News. That comes as state-backed Sino-Ocean Group Holding Ltd. proposed repaying a local note over one year.

The slide in the junk bonds on Wednesday leaves an index tracking the notes set for its worst three-day decline since November, according to prices compiled by Bloomberg. The gauge has lost 10% since the start of the year.

Investors are once again on the tenterhooks as a series of events and a contraction in the nation’s real estate sector highlight deep-rooted debt repayment problems. The renewed turmoil cut short a market rebound seen last week, when the gauge advanced as authorities took further steps to support the ailing sector, including an extension of outstanding loans.

US DATA TODAY