Mixed Markets

- Hong Kong: Hang Seng closed up +0.37%

- China CSI 300 -0.19%

- Taiwan KOSPI -0.60%

- India Nifty 50 -0.29%

- Australia ASX -0.73%

- Japan Nikkei +0.27%

- European bourses in positive territory except Germany

- USD -0.19%

TOP STORIES OVERNIGHT

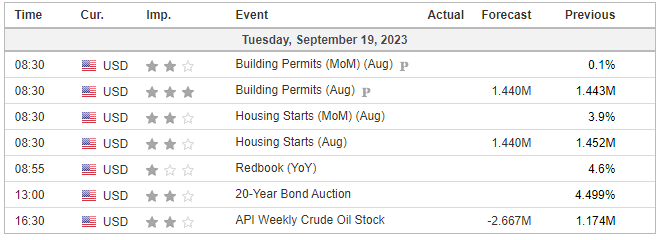

Euro-Zone Inflation Eased Last Month, Revised Data Show-BBG

Euro-area inflation slowed last month after all, according to revised data that will support European Central Bank officials saying no more interest-rate hikes are needed.

Consumer prices increased 5.2% in August, down from an initial reading of 5.3%, which had matched July’s number. Core inflation, which excludes volatile elements like food and energy and is a key gauge for policymakers, was confirmed at 5.3%.

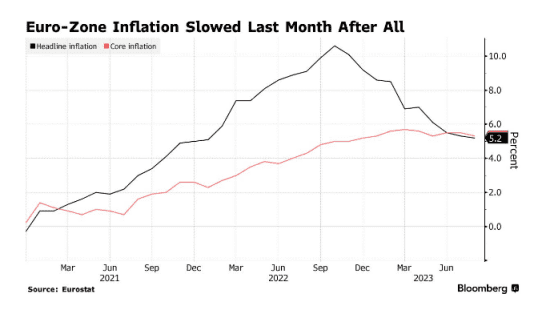

Oil’s Rally Gathers Momentum as Brent Pops Above $95 a Barrel-BBG

Oil surged to a 10-month high — extending a powerful rally that may rekindle inflation — as supply cuts from OPEC+ tightened the market, with Saudi Arabia’s energy minister shying away from any change in course.

Global benchmark Brent topped $95 a barrel for the first time since November before paring gains. The tighter market has ignited a flurry of predictions that $100 oil could soon return in a roster than runs from industry heavyweights such as Chevron Corp. Chief Executive Officer Mike Wirth to traditional bears at Citigroup Inc.

The latest upswing has been marked by significant moves in timespreads, one of the market’s most-keenly tracked metrics. Brent’s three-month spread earlier ballooned to more than $4 a barrel in backwardation, a bullish pattern. That compares with a differential of $1.26 a barrel about a month ago.

COMMENTS: This is what I was talking about yesterday on discord, except about WTI. Contract roll to November for retail is today. There is a contract gap to 92.10.

UAE’s $1.5 billion dollar bond issue oversubscribed five times-Khaleej Times

The Federal Government of the UAE, represented by the Ministry of Finance, successfully closed its offering of a US dollar-denominated 10-years $1.5 billion bond maturing on September 2033, issued with a yield of 4.917 per cent representing a spread of 60 bps over US Treasuries. The bond will be listed on the London Stock Exchange (LSE) and Nasdaq Dubai.

The order book attracted high quality investors and exceeded $7.4 billion with the transaction being firmly oversubscribed by 5 times by the time the final guidance was disclosed, attracting strong demand from domestic, regional and international investors.

COMMENTS: So much for dedollarization and no one wanting US debt.

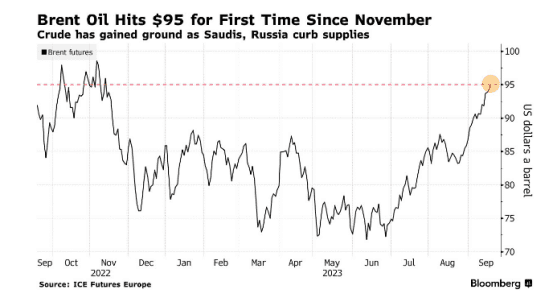

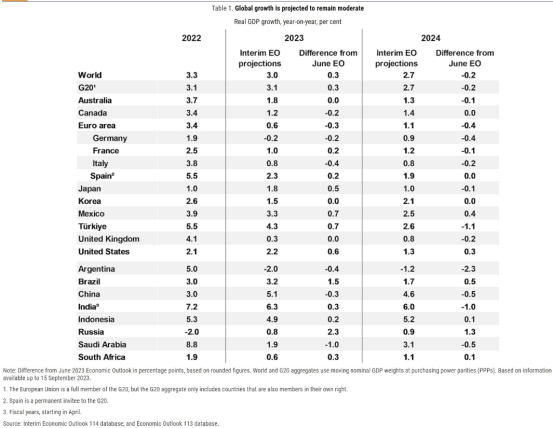

Global Economy Poised to Slow as Rate Hikes Bite, OECD Says-BBG

The world economy is set for a slowdown as interest-rate increases weigh on activity and China’s pandemic rebound disappoints.

Growth will ease to 2.7% in 2024 after an already “sub-par” expansion of 3% this year, according to the latest OECD forecasts. With the exception of 2020, when Covid struck, that would mark the weakest annual expansion since the global financial crisis.

“While high inflation continues to unwind the world economy remains in a difficult place,” OECD Chief Economist Clare Lombardelli told a news conference on Tuesday. “We’re confronting the double challenges of inflation and low growth.”

The Paris-based the organization warned that risks to its prediction are tilted to the downside as past rate hikes could yet have a stronger impact than expected and inflation may prove persistent, requiring further monetary tightening. It called China’s struggles a “key risk” for output around the world.

Comments: OECD report out today. Link to full report here. Germany GDP forecast to be negative is weighing on the German stock market this morning.

UAW Warns It Will Expand Strikes If No Serious Progress Is Made by Friday-BBG

The United Auto Workers said more of its members will go on strike at General Motors Co., Ford Motor Co. and Stellantis NV facilities starting at noon Friday unless substantial headway is made toward new labor contracts.

“Either the Big Three get down to business and work with us to make progress in negotiations, or more locals will be called on to stand up and go out on strike,” UAW President Shawn Fain said in a video released late Monday.

The deadline raises the stakes for talks between three of the biggest automakers in the US and the union representing 146,000 of their workers. Friday will mark one week since the UAW called its first-ever walkout across all three of the legacy Detroit manufacturers, which is costing the companies output of about 3,200 vehicles a day, according to S&P Global Mobility.

COMMENTS: The longer this goes on, the bigger risk to inflation as it is affecting 24K cars a day. If this creates vehicle scarcity, we could have a run up in prices similar to 2020,

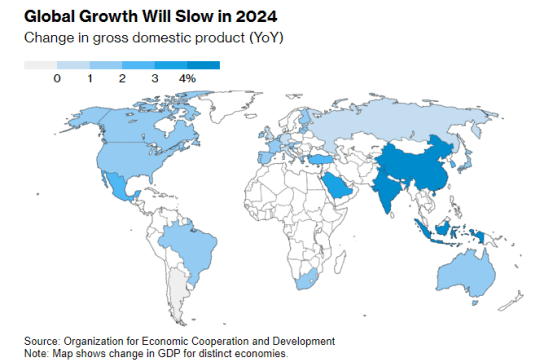

US DATA TODAY