US GETS DOWNGRADED BY FITCH (SEE BELOW)

SEA OF RED

- Hong Kong: Hang Seng closed DOWN -2.47%

- China CSI 300 -0.70%

- Taiwan KOSPI -1.90%

- India Nifty 50 -1.11%

- Australia ASX +0.54%

- Japan Nikkei +0.38%

- European bourses all in negative territory so far this morning

- USD flat after a huge sell of on the US Fitch downgrade

TOP STORIES OVERNIGHT

Fitch downgrades US credit to AA+ from AAA

Fitch’s US Credit Downgrade Sparks Criticism Along With Unease-BBG

Fitch Ratings’ downgrade of US government debt sparked criticism from Washington and Wall Street even amid unease that swollen fiscal deficits risk eventual turbulence in markets, the economy and next year’s presidential election.

Fitch cut the US’s sovereign credit grade one level from AAA to AA+. The move comes just two months after it warned the rating was under threat as lawmakers flirted with default by battling over raising the nation’s debt limit.

The credit grader justified the shift by arguing the country’s finances will likely deteriorate over the next three years given tax cuts, new spending initiatives, economic shocks and repeated political gridlock.

Pushing back hours before her department is set to ramp up its borrowing to plug a ballooning budget deficit, Treasury Secretary Janet Yellen called the downgrade “arbitrary” and “outdated.” The economy has recently shown signs of resilience and the debt limit was ultimately lifted, she noted.

Some highlights from the report via Ayesha Tariq:

Governance is an issue – the US has a complicated budgeting process and there’s been a deterioration in standards of governance over the last 20 years.

Postponing the Debt Ceiling has become an issue of constant worry because of the political standoff’s

Tax cut and Fiscal Stimulus has let to excessive debt with limited progress on rising social security and Medicare costs with an aging population. The CBO projects that the Social Security fund will be depleted by 2033 and the Hospital Insurance Trust Fund (used to pay for benefits under Medicare Part A) will be depleted by 2035 under current laws, posing additional challenges for the fiscal trajectory unless timely corrective measures are implemented.

This will cause the government deficit to rise to 6.3% of GDP in 2023, from 3.7% in 2022. Fitch forecasts a deficit of 6.6% of GDP in 2024 and a further widening to 6.9% of GDP in 2025

The interest-to-revenue ratio is expected to reach 10% by 2025 (compared to 2.8% for the ‘AA’ median and 1% for the ‘AAA’ median) – Interest costs are bound to increase because of the increase in debt levels and the higher rates.

Fitch projects a mild recession in Q4, 2023 and Q1, 2024

MY COMMENTARY: I would like to note that the US was on a negative watch since May, so this is not really a HUGE shocker. Fitch also notes that:

Exceptional Strengths Support Ratings: Several structural strengths underpin the United States’ ratings. These include its large, advanced, well-diversified and high-income economy, supported by a dynamic business environment. Critically, the U.S. dollar is the world’s preeminent reserve currency, which gives the government extraordinary financing flexibility.

At the end of the day, the US still maintains a rating far above that of most other developed economies. As well, the US has generally done better than others in GDP growth terms. Aside from an initial sell off in risk assets, I do not think this hampers markets long term and US markets provide deep liquidity and still holds the reserve currency. (USD bouncing back immediately is a good tell).

SIDE NOTE: Also notable under ESG Considerations, US got dinged for Political Stability and Rights:

The U.S. has an ESG Relevance Score of ‘5’ for Political Stability and Rights as World Bank Governance Indicators have the highest weight in Fitch’s SRM and are therefore highly relevant to the rating and a key rating driver with a high weight. As the U.S. has a percentile rank below 50 for the respective Governance Indicator, this has a negative impact on the credit profile.

Wheat and Corn Surge as Russia Hits Danube River Port in Ukraine-BBG

Wheat and corn jumped after Russian drones damaged a Ukrainian port facility on the Danube river, adding to a spate of attacks aimed at crippling the country’s exports from ports on the Danube and the Black Sea.

Now that Black Sea is closed to grain exports the Danube ports are most important ..keep an eye on this area. We spoke about this are on the PYT spaces last week. If you missed it you can catch the replay HERE.

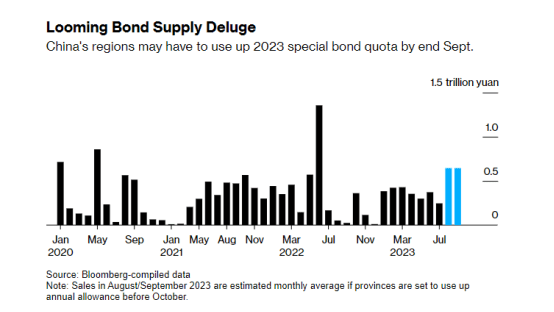

China Puts Pressure on Local Governments in Pro-Growth Push-BBG

China is stepping up its policy support for the economy, pressuring local governments to speed up the sale of bonds to fund infrastructure spending.

Regulators have told local authorities to use up this year’s quota of special purpose bonds by the end of next month, according to people familiar with the matter, and for the proceeds to be put to use by the end of October.

More stimulus coming

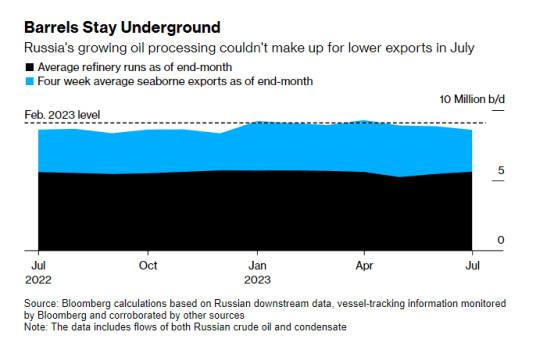

Russia’s Main Oil Flows Signal Output May Finally Be in Sync with OPEC+ Pledge-BBG

Russia’s two most-watched oil indicators — seaborne exports and domestic crude processing — are finally signaling that the nation may be in full compliance with its OPEC+ pledge to cut output.

Last month, a greater amount of crude was delivered to Russia’s refineries, but exports by sea fell even more. The net result was a combined daily volume for those two crucial flows of just under 8.6 million barrels.

That’s almost 490,000 barrels below February levels — closely matching Russia’s pledged production cut.

Average daily oil flows by from Russian ports in the four weeks to July 30 dropped to 2.98 million barrels a day, the lowest level since winter, according to ship-tracking information monitored by Bloomberg and other sources.

Nice to see Bloomberg finally catching up what I have been noting since May via alternate sources. Watch inventories today as API came in with -15M barrels for inventories last night

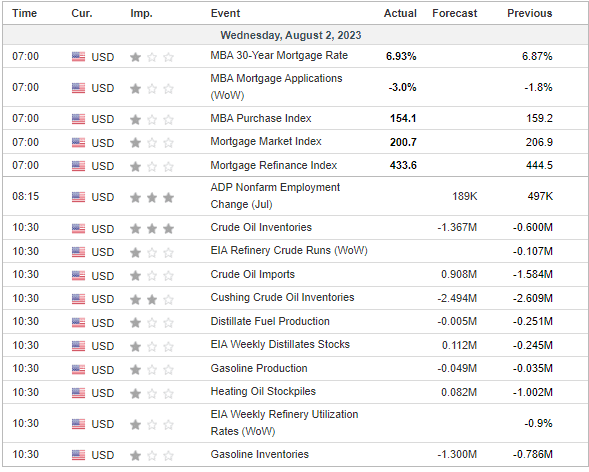

US DATA TODAY