Mixed Markets

- Hong Kong: Hang Seng closed down -0.13%

- China CSI 300 -0.71%

- Taiwan KOSPI -0.31%

- India Nifty 50 +0.69%

- Australia ASX +0.55%

- Japan Nikkei -1.54%

- European bourses mixed so far this morning

- USD -0.09%

TOP 5 STORIES OVERNIGHT

- China’s Xi Rebuffs Kerry’s Call for Faster Climate Action -WSJ

John Kerry, President Biden’s climate envoy, emerges from talks in Beijing without a new agreement.

Mr. Xi, who did not meet with Mr. Kerry during the envoy’s visit this week, said that China will follow its own timetable regarding emissions reductions. “The pathway and means for reaching this goal, and the tempo and intensity, should be and must be determined by ourselves, and never under the sway of others,” he said in a speech Wednesday according to the official People’s Daily.

So there is that.

- China Mulls Mortgage Easing to Spur Homebuying in Big Cities -BBG

Chinese authorities are considering easing home buying restrictions in the nation’s biggest cities, potentially removing a hurdle that has curbed demand in Beijing and Shanghai for years, according to people familiar with the matter.

Regulators are weighing scrapping rules that disqualify people who’ve ever had a mortgage – even if fully repaid – from being considered a first-time homebuyer in major cities, said the people, asking not to be identified discussing a private matter. Currently homebuyers with a mortgage record who don’t own a property are still subject to the higher down-payment and more restrictive borrowing limits applied to those buying a second home.

China’s existing policies have failed to sustain a rebound in the property market as price slumps extend across the nation, putting the government’s 5% economic growth target at risk. Gross domestic product figures released Monday showed the recovery lost momentum in the second quarter, intensifying calls for more stimulus.

For years, China has sought to suppress real estate demand in the biggest cities by treating buyers with previous mortgages as second-time purchasers, substantially raising down payment thresholds and increasing borrowing costs. In the capital of Beijing, a second-time buyer needs to come up with a down payment of as much as 80% of the property’s value. The down payment is just 40% for first-time buyers.

The change, if approved, will enable buyers who have sold their properties to enjoy the lower down payment despite their mortgage records. However, whether it can spur a quick transaction rebound depends on the scope of implementation, according to CGS-CIMB’s Cheng.

Not sure if this moves the needle much.

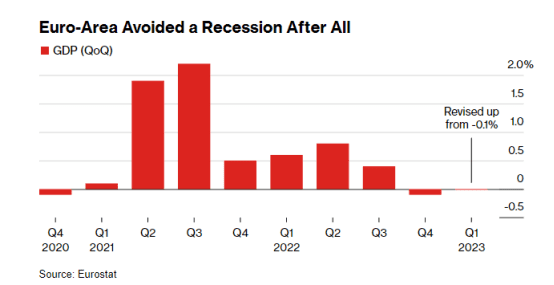

- Euro Area Stagnated in 1st Quarter, Dodging Winter Recession -BBG

The euro-area economy avoided a winter recession after all, with revised data showing it stagnated at the start of this year instead of shrinking as previously thought.

Output in the 20-nation currency bloc was flat in the first quarter, according to updated figures on Eurostat’s website on Thursday. That’s up from a prior reading of -0.1%, which — combined with a decline of the same magnitude at the end of 2022 — had suggested the first six-month contraction since the Covid-19 pandemic.

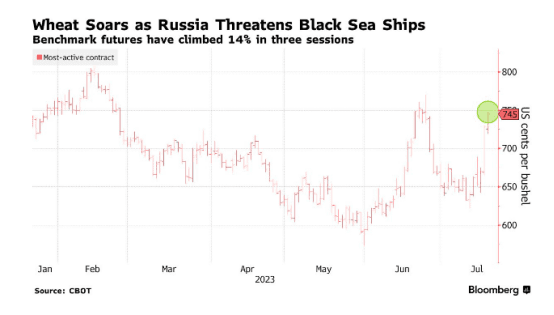

- Wheat Soars After US Warns of Explosives at Ukrainian Sea Ports -BBG

Wheat prices jumped again, bringing their three-day gain to 13%, after the US warned that Russia has laid mines at Ukrainian grain ports.

The US alert, based on intelligence, came after Russia on Wednesday said that all ships sailing to those ports would be considered military vessels. The threats have dashed hopes that Ukraine will be able to keep exporting grains via the Black Sea — historically its most important shipping route — forcing supplies to world markets through narrower and more cumbersome avenues.

- TSMC flags 10% fall in 2023 sales as weak global outlook weighs -Reuters

Taiwanese chipmaker TSMC forecast a drop of around 10% in 2023 sales on Thursday and flagged investment spending at the low end of estimates as global economic woes dent demand for chips used in everything from cars to cellphones.

The world’s largest contract chipmaker said that high demand for artificial intelligence (AI) and its position as the largest manufacturer of AI chips has not offset broader end market weakness as the global economy recovers more slowly than it had expected.

“The short-term frenzy about the AI demand definitely cannot extrapolate for the long term. Neither can we predict the near future – meaning next year – how the sudden demand will continue or flatten out,” TSMC chairman Mark Liu said after the company reported a 23% fall in second-quarter profit.

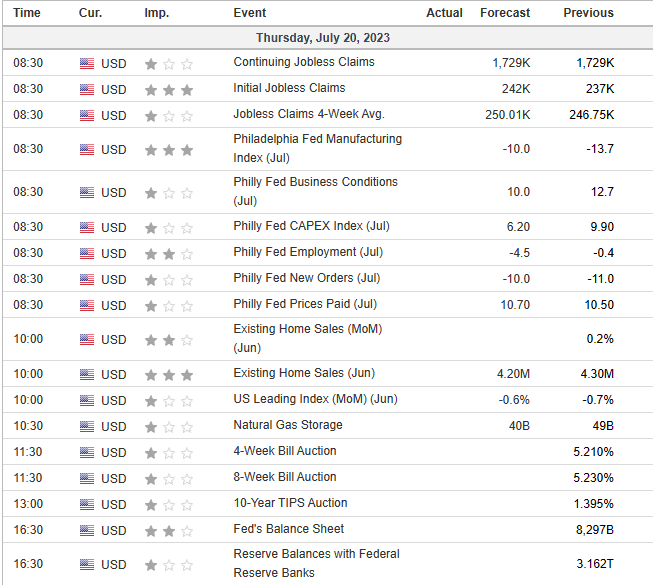

US DATA TODAY