Happy FOMC Day!

Asia RED, Europe Green

- Hong Kong: Hang Seng closed down -0.62%

- China CSI 300 -0.40%

- Taiwan KOSPI +0.02%

- India Nifty 50 -1.11%

- Australia ASX -0.45%

- Japan Nikkei -0.25%

- European bourses in positive territory

- USD -0.14%

TOP STORIES OVERNIGHT

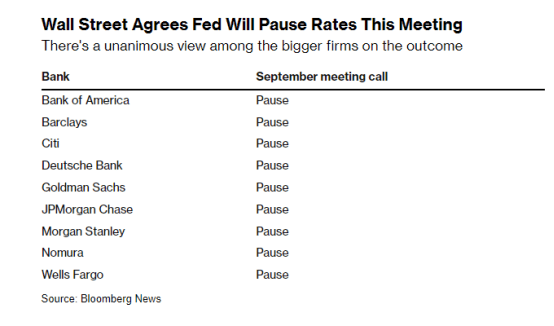

Fed Set to Pause Rate Hikes, But Don’t Count Out Another Increase-BBG

The Federal Reserve is expected to pause its interest-rate hikes Wednesday for the second time this year following a slowing in inflation while leaving the door open for another increase as early as November.

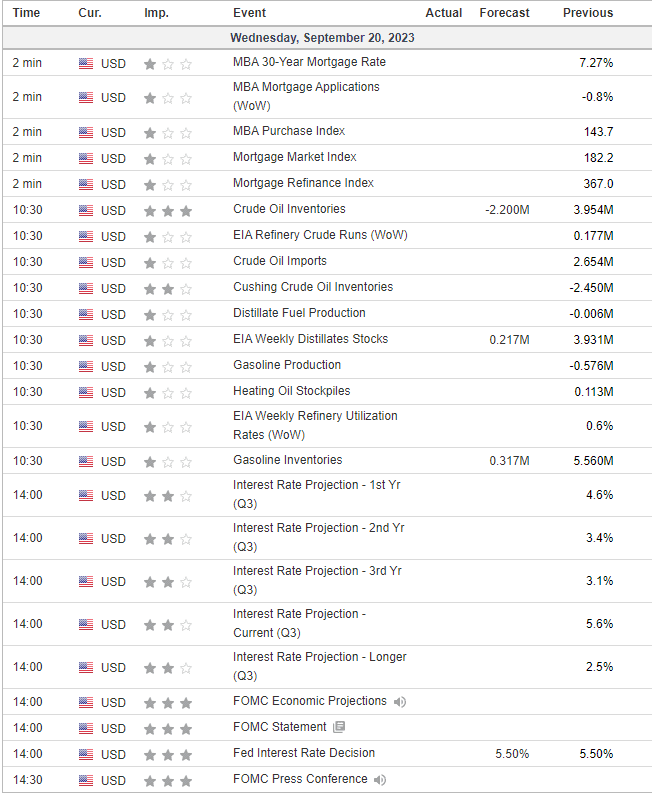

The Federal Open Market Committee will keep rates steady at its Sept. 19-20 meeting in a range of 5.25% to 5.5%, a 22-year high. The rate decision and committee forecasts will be released at 2 p.m. in Washington. Chair Jerome Powell will hold a press conference 30 minutes later.

Powell has signaled that Fed leaders would prefer to wait to evaluate the impact of past increases on the economy as they near the end of their rate-hiking campaign. With inflation still well above the committee’s 2% target and the US economy resilient, officials may pencil in one more hike in their quarterly projections.

COMMENTS: This will be all about Powells presser today (hawkish/dovish)

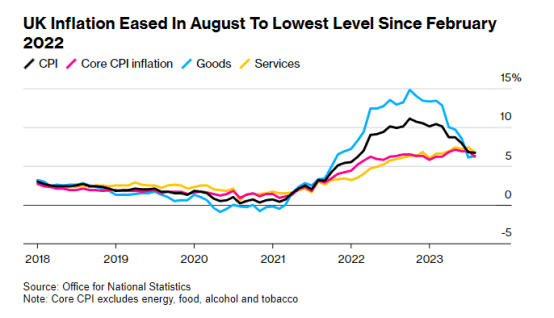

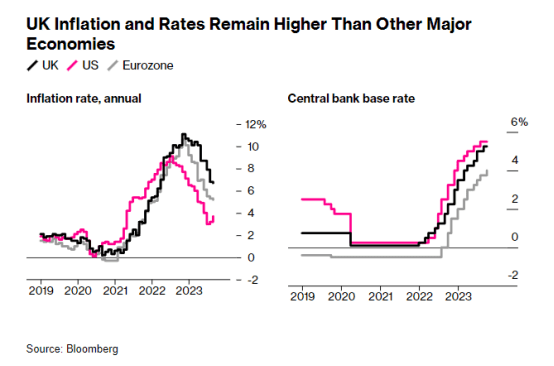

UK’s Unexpected Inflation Drop Opens Prospect of Rates Pause-BBG

Britain’s inflation rate fell unexpectedly to the lowest level in 18 months, opening the prospect that the Bank of England could pause or even end its quickest series of interest rate hikes in three decades.

The Consumer Prices Index rose 6.7% from a year ago in August, less than the 6.8% gain the month before, the Office for National Statistics said Wednesday. Economists had expected a rise to 7%.

Investors reined in bets for further tightening from the BOE after the release, driving the pound to the weakest level since May. Traders are fully pricing only one more increase this cycle to 5.5%. The odds of quarter-point hike on Thursday — which was almost guaranteed earlier this week — dropped to 50%.

COMMENTS: European markets green on this

Oil Nearing $100 Is Red Flag for Central Banks’ Inflation Fight-BBG

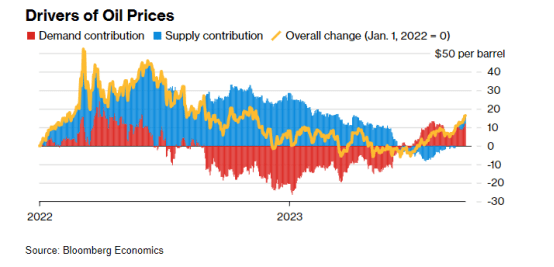

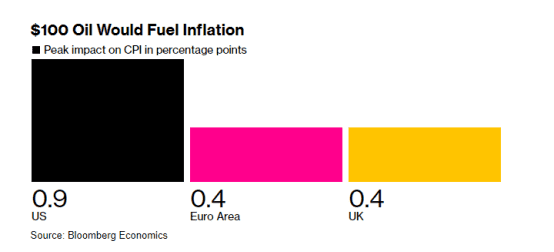

Just as global monetary policy switches toward high-altitude cruise control, another bout of turbulence is bearing down on the world economy with surging oil prices.

The approach of crude toward $100 a barrel is presenting central bankers with a reminder that the era of volatility heralded by the pandemic and war in Ukraine isn’t going away.

It showcases how the “higher-for-longer” stance that Federal Reserve Chair Jerome Powell signaled for interest rates at Jackson Hole last month is being framed more than ever by the “age of shifts and breaks” that his euro-zone colleague, Christine Lagarde, described at the same event.

Whether the crude spike is just a temporary blip or more enduring is a question confronting central bankers meeting this week from London to Washington — not least as oil can act both as a spur to consumer prices and a brake on economic growth. That trade-off will test the emerging consensus among officials that inflation risks are contained enough for them to pause tightening for now.

“The latest spike in oil prices is massively unhelpful,” Dario Perkins, an economist at GlobalData TS Lombard, said in a report. “That said, it is important to keep these recent inflationary developments in context. We are not yet in danger of undoing 12 months of solid disinflationary progress – not even close.”

Years of limited gas supply spell price spikes, Equinor says-Reuters

A protracted lack of supply in the gas market means even minimal disruption will cause prices to spike, a senior executive at Equinor (EQNR.OL), Europe’s largest supplier of natural gas, said on Wednesday.

“This market is still very tight and very nervous,” Irene Rummelhoff, Equinor’s head of marketing, midstream and processing, said.

“There is no longer such a thing as the European gas market in my mind, as Europe is totally dependent on LNG imports and you really need to look at global energy balances,” she said.

The market will remain tight, as demand in Europe and especially Asia will grow in the next two years, while new supply will not enter the market until the end of 2026 and in 2027, Rummelhoff said.

COMMENTS: Europe is not out of the woods ..this winter will be interesting if it gets cold

Russia Becomes UAE’s Top Gold Source After Being Shut Out of West-BBG

Russia became the United Arab Emirates’ top source of gold last year after Western countries imposed sanctions on supplies following the Kremlin’s invasion of Ukraine.

The UAE last year imported 96.4 tons of gold from Russia, more than any other country, according to the United Nations’ Comtrade database. That’s roughly a third of Russia’s annual mine production, and a more than 15-fold increase year-on-year in the UAE’s gold imports from the country.

US DATA TODAY