Mixed Markets

- Hong Kong: Hang Seng closes down -1.71%

- China CSI 300 +0.26%

- Taiwan KOSPI +0.16%

- India Nifty 50 -0.01%

- Australia ASX FLAT

- Japan Nikkei -0.16%

- European bourses broadly down so far this morning with the exception of Greece and Austria

- US indices all down this morning in pre-market, USD up +0.12%

Overnight News/Data

Europe stages a surprise recovery in manufacturing

- UK S&P Global/CIPS Manufacturing PMI Feb P: 49.2 (est 47.5; prev 47.0) – UK S&P Global/CIPS Services PMI Feb P: 53.3 (est 49.2; prev 48.7) – UK S&P Global/CIPS Composite PMI Feb P: 53.0 (est 49.0; prev 48.5)

- Eurozone S&P Global Manufacturing PMI Feb P: 48.5 (est 49.3; prev 48.8) – Eurozone S&P Global Services PMI Feb P: 53.0 (est 51.0; prev 50.8) – Eurozone S&P Global Composite PMI Feb P: 52.3 (est 50.7; prev 50.3)

- German S&P Global/BME Manufacturing PMI Feb P: 46.5 (est 48.1; prev 47.3) – German S&P Global Services PMI Feb P: 51.3 (est 51.0; prev 50.7) – German S&P Global Composite PMI Feb P: 51.1 (est 50.3; prev 49.9)

- French S&P Global Services PMI Feb P: 52.8 (est 49.8; prev 49.4) – French S&P Global Manufacturing PMI Feb P: 47.9 (est 51.0; prev 50.5) – French S&P Global Composite PMI Feb P: 51.6 (est 49.8; prev 49.1)

- Japan – Factory activity shrinks at fastest pace in 2-1/2 years – PMI

– Feb prov. Manufacturing PMI 47.4 vs. Jan final 48.9

– Japan Services activity at 8 mth high

– Feb prov. Services PMI 53.6 vs. Jan final 52.3

– Jan final Machine Tool Orders vs. prov. -9.7% - Australia – BHP upbeat on demand outlook as China reopens, first-half profit misses

– H1 profit misses estimate; Interim dividend beats estimate

– Positive on demand outlook from China

– Starts process to sell two Queensland met coal mines

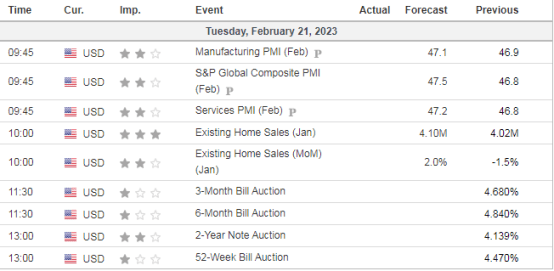

USD DATA TODAY

COMMODITY HEADLINES OVERNIGHT

Metals

Gold listless as traders look to U.S. data for Fed clues

Copper prices in London dip as weak China demand persists

Energy

- Asia/Gas – Gas shortage exposes fragile South Asian economies to more pain

– Drop in LNG imports hits power supply

– Electricity supply woes to worsen in 2023

China doubles Urals oil purchases during first half of Feb- sources, Refinitiv

Poll shows Scots want to halt rush away from oil and gas