**NASDAQ reshuffle today** (see top 5 stories)

Mixed Markets

- Hong Kong: Hang Seng closed up +0.78%%

- China CSI 300 -0.05%

- Taiwan KOSPI +0.37%

- India Nifty 50 -1.00%

- Australia ASX +0.05%

- Japan Nikkei +1.04%

- European bourses in positive territory so far this morning with the exception of Germany

- USD +0.16%

TOP 5 STORIES OVERNIGHT

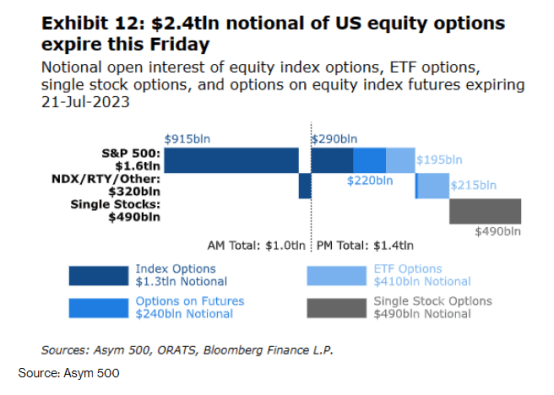

- Nasdaq 100 Reshuffle Adds Twist to $2.4 Trillion Options Event -BBG

An out-of-cycle rebalance in the Nasdaq 100 is adding another layer of wrinkles to stock trading with a flood of options expiring Friday.

The special index rebalance, intended to reduce the dominance of technology megacaps, may see passive investors use the last window to bring their portfolios in line with the benchmark before the changes take effect Monday. The revamp is set to boost the presence of smaller members, with two-way transactions likely reaching $60 billion, according to an estimate by Min Moon, a strategist at JPMorgan Chase & Co.

The tech-heavy index’s rejig coincides with a monthly options event at a time when traders are anxiously waiting for corporate earnings and next week’s Federal Reserve policy meeting for clues on the market’s outlook. Stocks have defied all gloom warnings this year, charging into a bull run and forcing traders to flock to bullish options to play catch-up.

With equities mired in a summer lull — July is on course to be the second-slowest month of trading in two years, Friday’s duo events are expected to spur trading volume and violent price swings. That’d also provide an opportunity of liquidity for money managers needing to adjust big holdings.

“I would look into the illiquid stocks that are getting money added to them as opposed to the very liquid stocks that are probably going to be sold for,” said Dennis Davitt, a fund manager at Millbank Dartmoor Portsmouth. “There may be fireworks.”

Could be a wild day…be careful out there

Wild Ride in the Yen overnight

- Japan’s inflation may have peaked, no imminent change seen to BOJ policy -Reuters

– Japan’s core inflation stayed above the central bank’s 2% target in June for the 15th straight month but an index stripping away the effect of energy costs slowed, data showed, suggesting the prolonged commodity-driven price pressures may have peaked.

Yet, with services price growth also slowing last month, policymakers will feel that wage pressures have yet to build up enough to warrant an imminent tweak to the ultra-loose monetary stance.

The data comes ahead of the BOJ’s closely-watched policy meeting on July 27-28, when the board will release fresh quarterly projections and discuss how much progress Japan is making towards sustainably achieving its 2% inflation target.

Core inflation in Japan’s capital, set for release hours before the BOJ’s policy announcement on July 28, also likely slowed sharply in July, according to a Reuters poll.

With inflation having exceeded the BOJ’s target for more than a year, markets are simmering with speculation the BOJ could soon phase out its controversial yield curve control (YCC) policy as early as next week.

This caused markets to believe that BOJ would tweak its policy next week, but then BOJ came out and said:

BoJ Is Said To See Little Need To Act On Yield Control For Now

Is Said Still Not Confident About Hitting Price Goal Stably

Is Said To View Keeping Easing As Important Amid Progress

and with that…...the YEN took a dive, prompting the currency chief to make a statement

- Japan Currency Chief Kanda: Watching Forex Market With Sense Of Urgency – Jiji

Japan’s top currency diplomat Masato Kanda came out with a verbal intervention to rescue the Japanese Yen after it plunged on reports that the Bank of Japan (BoJ) could leave its policy settings unchanged next week.

USD/JPY trimmed gains on the above comments, trading at 141.65. The spot is still up 1.18% on the day

- China Launches Measures to Boost Car, Electronics Consumption -WSJ

China on Friday unveiled a host of measures to boost auto and electronics consumption, the latest move by Beijing officials to shore up the world’s second largest economy.

The country’s top economic planner, the National Development and Reform Commission, called for local governments to bolster and support auto purchases through measures that include raising annual car purchase quotas, optimizing secondhand car transactions and enhancing consumer credit support. The commission also said it would support more new-energy vehicle purchases by the public sector.

For electronics, Beijing offered similar stimulus measures, such as calling for companies to accelerate technological innovation in order to encourage consumers to replace and upgrade their devices more frequently. The officials also said they would support local government subsidies for electronics, home appliances purchases in rural areas.

The slew of measures comes amid rising investor hopes that Beijing would step up policy stimulus to help economic growth. Analysts are broadly expecting officials to take a more proactive approach to boosting economic growth in the second half of the year after China’s second-quarter GDP data missed expectations.

- China FX regulator says will use policy measures to stabilise yuan expectations -Reuters

China’s foreign exchange regulator said it will comprehensively use policy measures to stabilise market expectations, at a time when the yuan currency faces renewed downside pressure.

The remarks were made by Wang Chunying, spokeswoman at the State Administration of Foreign Exchange (SAFE).

China’s yuan has lost about 4% to the dollar so far this year, one of the worst performing Asian currencies, pressured by widening yield differentials with the United States and signs of a faltering economic recovery.

Energy markets reacted positively to this China news

US DATA TODAY

No data today except rig counts…its all OPEX and Nasdaq reshuffle today