Mixed Markets -China markets hit hardest

- Hong Kong: Hang Seng closed down -1.98%

- China CSI 300 -1.53%

- Taiwan KOSPI -0.86%

- India Nifty 50 +0.22%

- Australia ASX +0.30%

- Japan Nikkei +1.70%

- European bourses mixed so far this morning

- USD +0.08%

TOP 5 STORIES OVERNIGHT

- German recession will be sharper than expected: Ifo

The German economy will contract more than previously expected this year as sticky inflation takes its toll on private consumption, the Ifo Institute said on Wednesday while presenting its forecasts.

German gross domestic product is expected to fall by 0.4% this year, more than the 0.1% forecast by the Ifo Institute in March. -Reuters

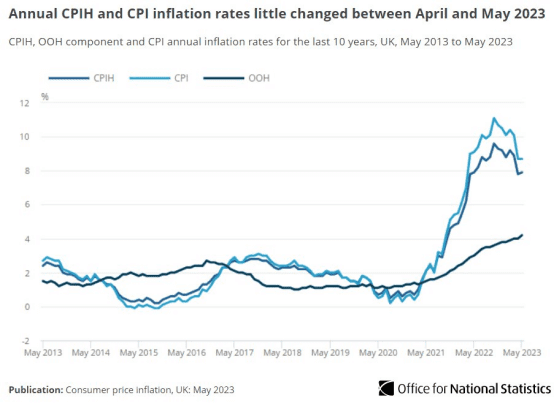

- UK CPI and PPI out

Annual inflation was little changed in May 2023.

UK CPI (Y/Y) May: 8.7% (est 8.4%; prev 8.7%) –

UK CPI (M/M): 0.7% (est 0.5%; prev 1.2%)

UK CPI Core (Y/Y): 7.1% (est 6.8%; prev 6.8%)

UK CPIH (Y/Y): 7.9% (est 7.6%; prev 7.8%)

UK still struggling with inflation

UK still struggling with inflation

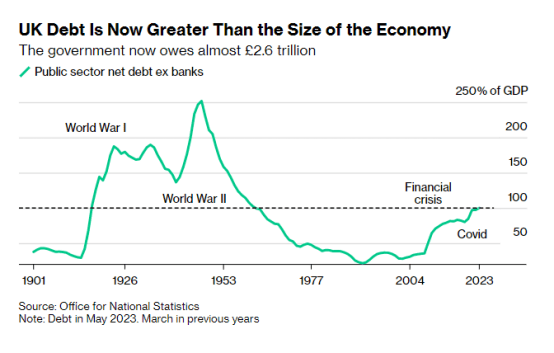

- UK National Debt Breaches 100% of GDP for First Time Since 1961 -BBG

Rocketing interest rates and inflation drove UK government debt above 100% of GDP for the first time since 1961, dealing a blow to Prime Minister Rishi Sunak’s pledge to get it falling and denting hopes for tax cuts in the build up to an expected general election next year.

The bleak milestone was passed as spending exceeded revenue by £20 billion ($25.5 billion) in May, more than private-sector economists and the independent Office for Budget Responsibility had forecast.

UK FTSE (stock market) down slightly

- Bank of Japan statements

BoJ’s Adachi: If Goods Prices Do Not Fall Around Summer, May Have To Revise BoJ Baseline Scenario That Consumer Inflation Will Slow Back Below 2% Around Middle Of Current FY

BoJ’s Adachi: Hard To Make A Strong Call On Infl. Outlook At Next Policy Meeting – If Overseas Growth Rebounds And Pushes Up Domestic Prices, BoJ Will Move To A Phase Of Gauging Timing Of Policy Shift – What We Most Fear Is A Premature Policy Shift That Puts Us Back To Deflation

Everyone is watching Japan and its response to inflation via a rate policy change, that would ripple through globally and affect the Yen.

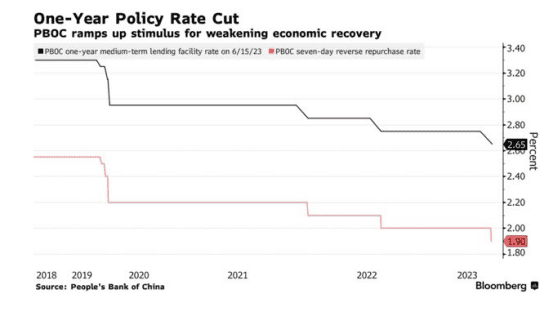

- China markets down sharply again

China Stimulus Calls Mount From State Media, Top Advisers -BBG

Chinese policymakers are facing growing calls for economic stimulus, this time from several prominent state media and top government advisers.

The country’s three main state-run securities newspapers ran front-page articles Wednesday saying the central bank is likely to ease monetary policy further, citing well-known economists.

Expectations for more monetary and fiscal stimulus have risen following the People’s Bank of China’s surprise rate cut last week, which economists said signaled a shift to more looser policy. So far, officials have been slow to follow up with any holistic package of support measures, with the State Council, China’s cabinet, saying late last week it was discussing proposals.

Again, all eyes on China, it is notable that China state media would be speaking out, rarity.

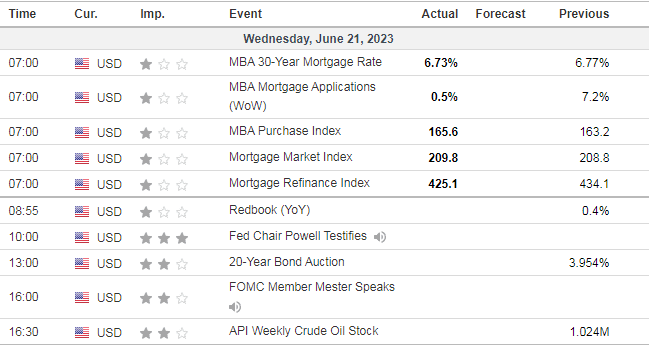

US DATA TODAY