SEA OF GREEN

- Hong Kong: Hang Seng closes UP +1.36%

- China CSI 300 +1.10%

- Taiwan KOSPI +0.38%

- India Nifty 50 +0.75%

- Australia ASX -1.43%

- Japan Nikkei +O.66%

- All European bourses all in positive territory this morning (including banks)

- US indices in positive territory this morning in pre-market, USD FLAT

Overnight Data/News

- PBoC Sets Yuan Mid-Point At 6.8763 / Dlr VS Last Close 6.8785

- China Overnight Funding Rate Soars Ahead Of PBoC Easing Measure – BBG

- Tens Of Thousands Of Jobs At Risk After UBS Takeover Of Credit Suisse – FT

- Eurozone EU27 New Car Registrations Feb: 11.5% (prev 11.3%)

- Swiss Exports Real (M/M) Feb: -2.7% (prevR 2.6%) – Swiss Imports Real (M/M) Feb: -0.5% (prevR 0.1%)

- Swiss Money Supply M3 (Y/Y) Feb: 0.1% (prevR -0.1%)

- Goldman Sachs Expects Commodities Supercycle – RTRS

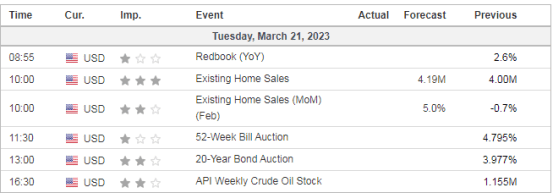

US DATA TODAY

COMMODITIES HEADLINES OVERNIGHT

Metals

Brent crude oil and copper stabilize while gold loses upside momentum

Energy

TRAFIGURE CEO: NOT MUCH DOWNSIDE ON OIL FROM HERE

TRAFIGURA: CURRENT OIL PRICES NOT ENCOURAGING PRODUCTION

US Rearranges Unfinished Oil Flows After Russian Ban

Moldova resumes gas purchases from Russia’s Gazprom -Moldovagaz head

Iran counts on ‘huge volumes’ of oil and gas swaps from Russia – RIA

Venezuela Maduro accepts resignation of oil minister El Aissami

US Energy Secretary Granholm backs reforms to speed permitting process, touts industrial policy shift

China january crude imports were at 10.25mbpd, February at 10.76mbpd vs 11.01mbpd in December – China custom office

Vitol sees global oil demand growing 2 mil b/d in 2023, flags economic risks

Bank turmoil hits oil markets but fears of 2008 repeating itself look overdone