SEA OF RED

- Hong Kong: Hang Seng closed down -1.29%

- China CSI 300 -0.90%

- Taiwan KOSPI -1.75%

- India Nifty 50 -0.77%

- Australia ASX -0.45%

- Japan Nikkei -1.79%

- European bourses all in negative territory so far this morning

- USD +0.33%

TOP STORIES OVERNIGHT

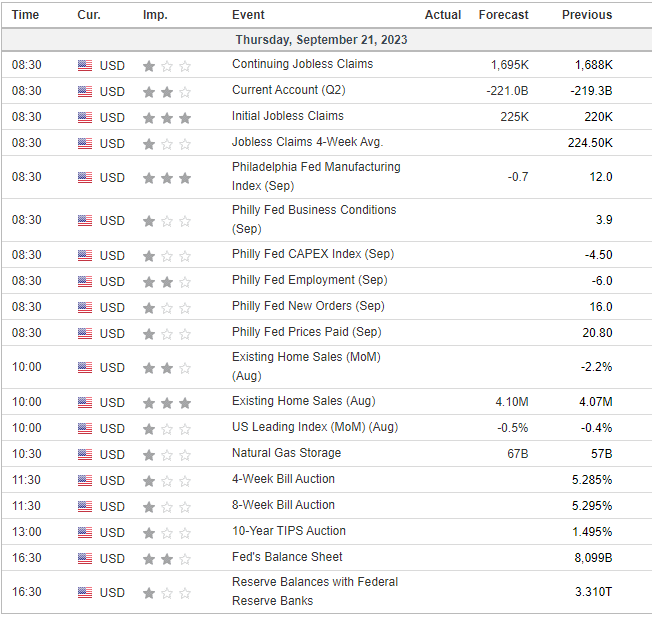

China Stocks Slide to 10-Month Low as Growth Pessimism Persists-BBG

Chinese stocks extended their poor run on Thursday, pushing a key gauge to its lowest since November, as an exodus of foreign funds continued amid persistent concerns about the economy.

The MSCI China Index dropped as much as 1.6%, on track for a third consecutive week of losses. The Hang Seng Index and a gauge of major Chinese firms listed in Hong Kong also fell more than 1%. The onshore yuan weakened as much as 0.2%.

The selloff is yet another indication that Beijing’s efforts to restore market confidence are falling flat with investors. Just Wednesday, China’s central bank vowed to use various tools to keep liquidity reasonably ample, adding to a series of steps from policymakers in recent weeks — including a reduction in transaction costs for stock trading and some restrictions on stake sales by top shareholders.

Hedge funds have boosted their bearish bets on Chinese and Hong Kong stocks, with short interest rising this month pretty much across sectors, according to data compiled by Morgan Stanley. Thursday’s declines came amid a broader risk-off mood in global equity markets after the Federal Reserve signaled interest rates will be higher for longer.

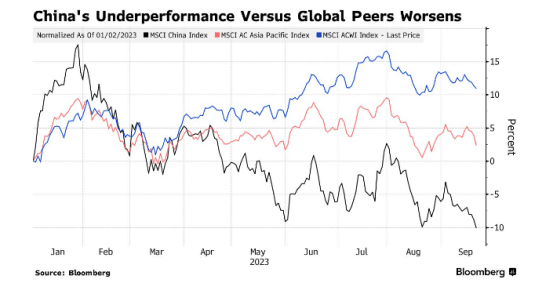

A Popular Quant Trade Misfiring on Wall Street Rallies Overseas-BBG

One of last year’s hottest quant trades is getting a reboot, even as it misfires in the world’s largest stock market.

So-called value shares — which trade at lower multiples relative to fundamentals — are all the rage again but this time in Asia and, more recently, Europe.

Investors are essentially betting that global interest rates will stay higher for longer without torpedoing economic growth. In Japan, cheap-looking shares have outperformed so-called growth equities by a beefy 17 percentage points on a total return basis, MSCI indexes show.

COMMENTS: Let us see if this value finally gets some love in the US market. The problem is that everyone in the US is so used to buying every dip in tech from the last 15 years of low/no interest rates. Like Pavlov’s dogs.

Stocks Retreat as BOE Cliffhanger Follows the Fed-BBG

Stocks dropped after the Federal Reserve signaled interest rates will be higher for longer and as traders awaited a Bank of England policy decision that hangs in the balance.

Europe’s Stoxx 600 Index fell more than 1%, with all industry groups in the red. Futures contracts for US benchmarks declined and Asian stocks slumped the most in nearly a month. Treasuries were broadly lower, while the dollar strengthened.

The BOE announcement will cap a frenetic day for European central bankers. The Swiss franc fell after the Swiss National Bank delivered a surprise hold. Sweden’s Riksbank increased its key rate as expected and said more hikes were possible, while Norway’s central bank said more tightening may come in December after raising rates as economists predicted.

The Fed on Wednesday held its target range, while updated quarterly projections showed most officials favored another rate hike in 2023. Policymakers also see less easing next year, with the median forecast for the federal funds rate at 5.1% by year-end, up from 4.6% when projections were last updated in June.

“People did expect a hawkish hold from the Fed, but it’s the extent of the hawkishness that surprised,” said Lee Hardman, a strategist at MUFG Bank Ltd. “We thought they may take one cut out of next year’s forecasts — instead they took two out. So it was much more hawkish than markets were pricing in.”

Traders on Intervention Watch as Yen Hovers Near 150 to Dollar-BBG

Traders are on guard for any sharp move in the yen as it hovers near the 150 level to dollar that some analysts consider to be a trigger for intervention by Japan.

The market is on tenterhooks ahead of the Bank of Japan’s policy decision on Friday, awaiting more detail from Governor Kazuo Ueda on the outlook for negative interest rates and his view on the yen’s weakness.

The currency appeared to be caught in limbo during Thursday, with the risk of intervention offering support while the yield gap with the US weighed against this. While speculation is rising that the BOJ will lift its negative policy rate early next year, the Federal Reserve this week signaled another rate hike is likely in 2023, which would widen the gap.

The yen touched 148.46 during the morning session in Asia, its weakest against the dollar since November last year. It strengthened slightly after Chief Cabinet Secretary Hirokazu Matsuno said Japan wouldn’t rule out any options to curb excessive moves.

COMMENTS: If Japan intervenes this could cause a sharp reverse in the carry trade and ripple through currency markets

Russia cuts September seaborne diesel exports to meet domestic shortage -Reuters

Russia cut its seaborne diesel and gasoil exports by nearly 30% to about 1.7 million metric tons in the first 20 days of September from the same time in August, as local refineries went into seasonal maintenance and the domestic market faces a fuel shortage and rising prices, traders said and LSEG data showed.

Idle primary oil refining capacity for September is estimated at 4.657 million tons, up 45% from August, according to Reuters calculations.

Due to the domestic fuel shortage, Russia’s government is considering an export duty for oil products of $250 per ton – much higher than current fees – from Oct. 1 until June 2024, sources told Reuters on Tuesday.

In September so far, Turkey remains the top destination for diesel exports from Russian ports, though they almost halved to about 600,000 tons, LSEG data showed.

COMMENTS: Diesel shortages everywhere. Europes largest diesel refinery is currently down as well (I posted on it earlier this week). The situation seems to be getting worse, not better.

That said, good to see oil prices getting a bit of a reprieve. See my blog from Sunday, I noted that we could see a push higher at the beginning of the week, but expected a sell off with Powell and overbought conditions.

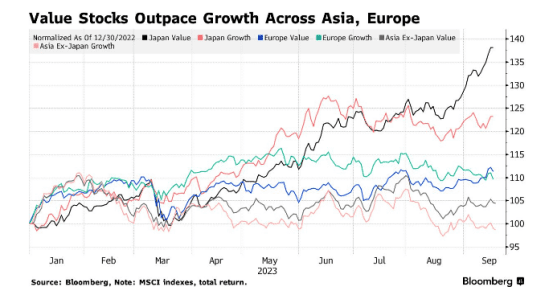

US DATA TODAY