Pretty Green out there

- Hong Kong: Hang Seng closed up +0.95%

- China CSI 300 +0.77%

- Taiwan KOSPI +0.28%

- India Nifty 50 -0.02%

- Australia ASX -0.41%

- Japan Nikkei +0.48%

- European bourses in positive territory so far this morning

- USD FLAT

TOP STORIES OVERNIGHT

Sudden Rally in China Stocks Has Traders Scratching Their Heads-BBG

Chinese stocks staged a sudden rally late on Tuesday, with several traders attributing the rebound to technical reasons in the absence of any fresh triggers.

In Hong Kong, the Hang Seng Index climbed nearly 2% within minutes, after a seven-day losing run that was the longest since late 2021. About half of the stocks in the index were oversold according to one technical indicator as of Monday, the highest ratio since March 2022. The CSI 300 Index, benchmark for mainland shares, finished up 0.8% after erasing a loss of as much as 0.7%. The gauge was the most oversold since early June on Monday.

Speculation was rife as stocks jumped, with many market participants talking about the possibility of buying by state-backed funds. The CSI 300 gauge dropped in each of the last two weeks and previous incidents have shown that purchases by the so-called “national team” help slow losses. Some other traders cited a Caixin report from Saturday, which said China is considering stronger action to address risks from local government financing vehicles.

“Most people I spoke to were quite baffled by the move this afternoon. There were all kinds of speculations but there has been no clear explanation,” said Willer Chen, senior analyst at Forsyth Barr Asia Ltd. But “it is also reasonable to see some technical rebound” given the steep losses recently, he added.

Meanwhile, foreign investors continued to sell onshore Chinese stocks on a net basis. They pulled out 6.4 billion yuan ($875 million) on Tuesday, extending a record selling streak to 12 days. Turnover for Chinese stocks was about 800 billion yuan, largely in line with the average for the month, according to data compiled by Bloomberg.

The skeptic in me says the long arm of the PBOC is somehow involved covertly (also could be due to the yuan battle-see next article)

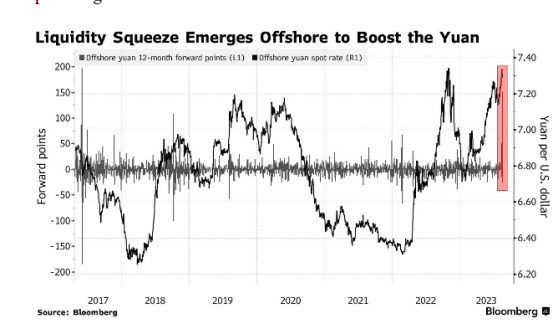

China Ramps Up Fight With Yuan Bears to Stop Selloff Spiraling-BBG

China is escalating its defense of the yuan, pushing up funding costs in the offshore market to squeeze short positions and setting a new record with its stronger-than-expected reference rate for the currency.

Analysts say the steps are designed to slow the pace of yuan depreciation rather than engineer a sustained rally. Forecasters at JPMorgan Chase & Co., Nomura Holdings Inc. and UBS Wealth Management all predict further weakness in the currency this year. The offshore yuan reversed earlier gains to weaken Tuesday, dropping back toward its 2023 low set last week.

The People’s Bank of China set its daily fixing for the currency at 7.1992 per dollar Tuesday

Draining offshore liquidity may squeeze short positions, but it will also undermine the long-term policy intention for yuan internationalization, said Xiaojia Zhi, chief China economist at Credit Agricole CIB in Hong Kong. This latest step shows “the PBOC is intolerant of rapid one-way moves and would consider various pool tools to discourage speculative flows on CNY depreciation and manage expectations,” she said.

This is the most important bit in this whole article: Draining offshore liquidity may squeeze short positions, but it will also undermine the long-term policy intention for yuan internationalization

So, do not expect the yuan to take over global trade with these kinds of currency interventions!

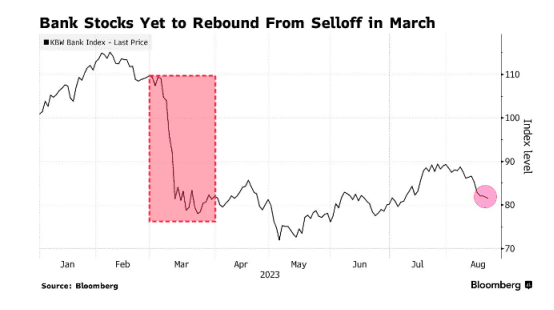

S&P Joins Moody’s in Cutting US Banks Amid ‘Tough’ Climate -BBG

Two weeks after Moody’s Investors Service rattled financial stocks by cutting the ratings for a slew of US banks, S&P Global Ratings is downgrading and dimming its outlook for several more — citing a similar mix of pressures making life “tough” for lenders.

S&P lowered grades one notch for KeyCorp, Comerica Inc., Valley National Bancorp, UMB Financial Corp. and Associated Banc-Corp, it said Monday in a statement, noting the impact of higher interest rates and deposit moves across the industry.

S&P also lowered its outlook for River City Bank and S&T Bank to negative and said its view of Zions Bancorp remains negative after the review.

Many depositors have “shifted their funds into higher-interest-bearing accounts, increasing banks’ funding costs,” S&P wrote in a note summarizing the moves. “The decline in deposits has squeezed liquidity for many banks while the value of their securities — which make up a large part of their liquidity — has fallen.”

The KBW Bank Index of major US banks has since slumped almost 7% — heading for its worst monthly performance since the collapse of three regional banks in March sparked a broad selloff.

Watch banks today..may get ugly in that sector

Rice prices soar, fanning fears of food inflation spike in Asia-BBG

A perfect storm may be brewing in Asia.

Rice prices surged to their highest in almost 12 years, after India’s rice export ban and adverse weather conditions dented production and supplies of Asia’s primary staple food, according to the UN’s food agency.

“The price of global rice prices is particularly worrying,” Qingfeng Zhang, a senior director from the Asian Development Bank, told CNBC. “What seems to be clear is that food price volatility will continue in coming months.”

Other than India, food inflation has been relatively tame in Asia so far this year.

But a confluence of factors is stoking fears that shortage of rice supplies could mark a return to a broad increase in the prices of other food commodities in Asia.

US energy firm payouts to oil investors top exploration spending for first time-Reuters

Top U.S. energy companies last year paid out more of their earnings to shareholders than they invested in new oil and gas fields for the first time, according to a report released on Tuesday.

The outlook for stronger energy prices has not changed the focus on investor returns from the U.S. industry, according to the report’s authors, Ernst & Young LLP. U.S. energy companies have been focused on regaining favor with investors after years of overspending on production growth hurt returns and put them in the doghouse.

The returns focus has lifted the energy sector to about 4.5% of the S&P 500’s market valuation, a doubling of its weighting since 2020, but well below its 8% average.

Spending on dividends and share buybacks by the top 50 U.S. independent oil and gas producers hit $58.8 billion last year, topping the $55.1 billion allocated to exploration and development, according to the EY research.

Combined profits of the group, which includes shale stars such as DiamondBack Energy, Pioneer Natural Resources, and ConocoPhillips, topped $333 billion last year, a third more than the $217 billion in 2014, when U.S. spot oil prices averaged $93 per barrel.

Last year’s investor payouts were up substantially – 214% over 2021 and more than sevenfold over 2020 levels, the report said. Money spent on finding and tapping oil and gas also rose, but as a much slower pace.

“We expect this will continue even in a high interest rate environment or a high oil price environment,” said Bruce On, a principal in EY’s strategy and transactions group. One new outlet for the cash is acquisitions, which have risen this year and could continue next, he said.

Love me those high dividend energy stocks…(been pounding the table on this for two years) expect these dividends to continue

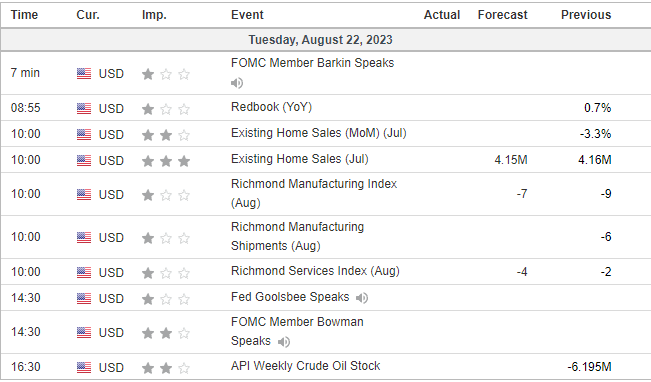

US DATA TODAY