Happy PCE day!! (Feds favorite metric) 8:30 AM ET

Mixed Markets

- Hong Kong: Hang Seng closed DOWN -1.69%

- China CSI 300 +0.19%

- Taiwan KOSPI -0.02%

- India Nifty 50 +0.36%

- Australia ASX -0.47%

- Japan Nikkei -0.41%

- European bourses in MIXED territory so far this morning

- USD -0.29%

TOP STORIES OVERNIGHT

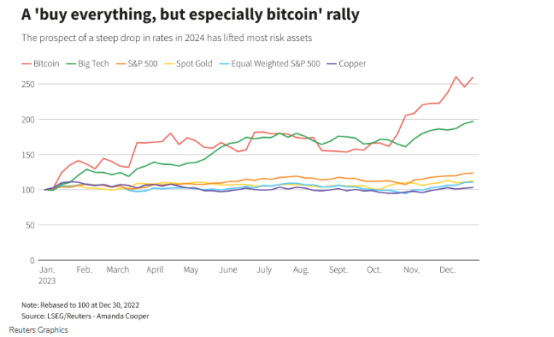

An epic Santa rally-Reuters

It’s the last day in the final full week of trading for the year – not a bad point at which to take stock of what 2023 has brought to equity investors. A recession that never was, a consumer that has proven almost bulletproof in the face of high inflation and interest rates, an unexpected boom in AI-linked stocks and, supercharging the market in the final weeks of the year, the anticipation of a steep drop off in borrowing costs in 2024.

Market watchers have been at pains to point out that much of the S&P 500’s 24% gain this year has been due to the stellar performance of Big Tech – and the AI glitterati. But the equal-weighted S&P 500, which strips out the megacaps, is heading for a near 11% gain this year, most of which has come over November and December.

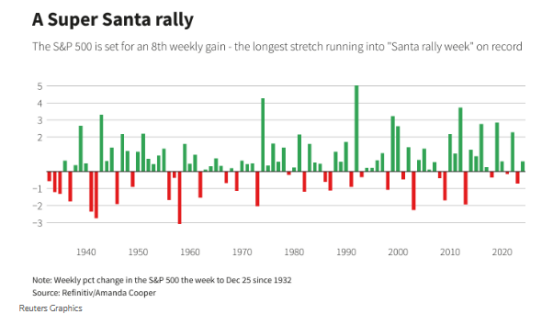

The S&P is heading for a 0.5% gain this week. This might look a bit flimsy as “Santa rallies” go, but it will mark the eighth straight week of gains for the index – the longest such stretch since late 2017. And there has never been this kind of momentum in the run-up to Santa’s stock market boost before.

The longest string of weekly gains ahead of the Santa rally – gains in the week leading into Dec. 25 – was a five-week stretch in 2019.

Greasing the wheels of this rally is the biggest two-month drop in 10-year U.S. Treasury yields since 2008, which has created a theoretical sweet spot for stocks.

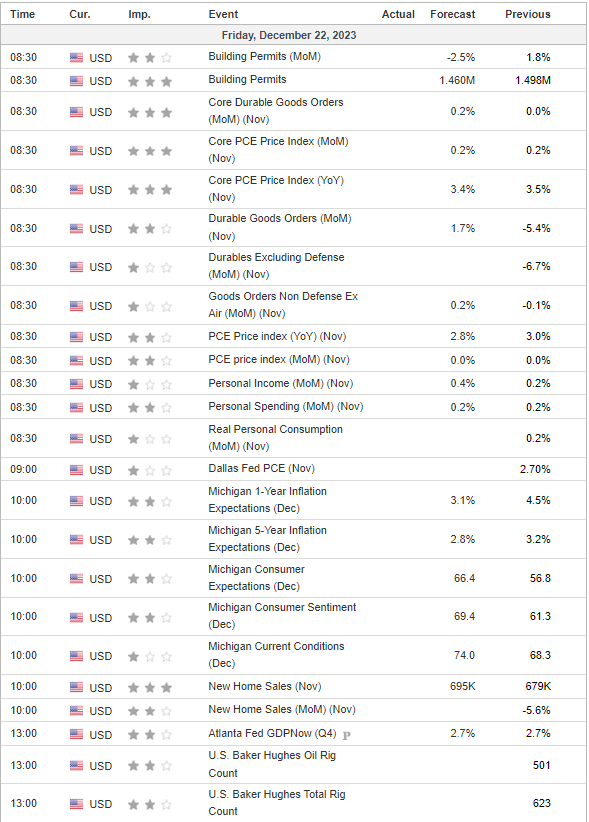

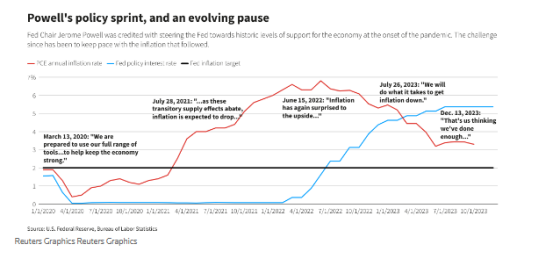

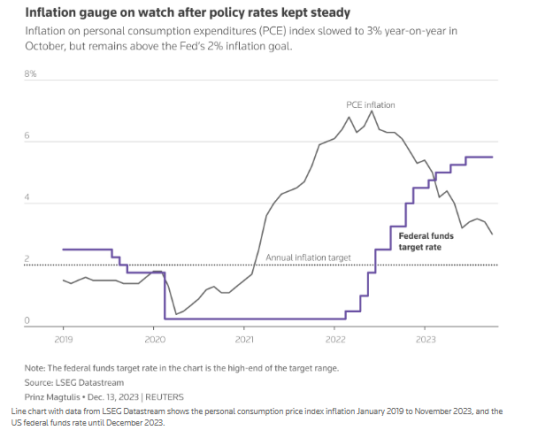

Inflation numbers later on Friday could give this year’s Santa rally some extra sparkle, but they are unlikely to materially change the view that the Federal Reserve could cut interest rates down to 3.50-3.75% by the end of next year, from 5.25-5.50% right now.

The core personal consumption expenditures index, the Fed’s preferred measure of inflation, is expected to have risen at an annual rate of 3.3% in November and to have increased by just 0.2% on a month-on-month basis.

If the index comes in at a yearly 3.3%, this will be the lowest reading since April 2021, but still more than double where it was back in February that year, before core PCE began to skyrocket and above the Fed’s 2% target.

The stock market appears content that inflation is under control. What is more in question is how much more can price pressures cool as a function of falling global energy costs, rather than as a function of burgeoning weakness in the economy. Even Santa can’t hand out any crystal balls to answer that.

COMMENTS: All eyes on PCE this morning

Euro Hits Strongest Since August as Dollar Eases on US Rate Bets-BBG

The euro rose to a four-month high against the dollar, which came under selling pressure on growing expectations that US interest rates may fall in the coming months.

The common currency gained as much as 0.1% to $1.1021, its highest since Aug. 10.

The euro has climbed 1.2% against the dollar this month, with the vast bulk of the gains coming in the wake of the Federal Reserve last week forecasting a pivot to interest-rate cuts that broadly weakened the greenback. That decision contrasted with European Central Bank policymakers cautioning investors against betting on imminent reductions.

Money markets are pricing 162bps of cuts from the ECB by the end of 2024, compared with 100bps just over two weeks ago. In the US, traders now see 158bps of easing.

Global equity funds see significant outflows as investors book year-end profits-Reuters

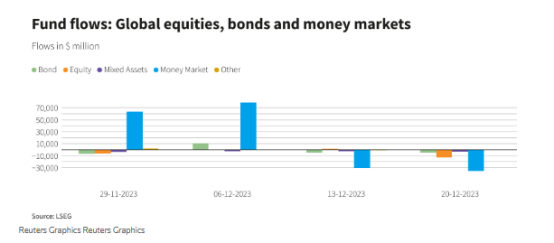

Global equity funds saw significant withdrawals in the week up to Dec. 20 as investor enthusiasm over potential rate cuts waned and profit-taking set in ahead of the year-end holidays.

The markets have experienced a sharp rally since late October. Investors reassessed positions during the week and sold $12.5 billion worth of equity funds, marking their largest weekly net selling since June 21.

COMMENTS: Not unusual for year end. Markets likely get super thin next week as well, stay nimble.

Gold climbs to near three-week high on Fed rate cut bets-Reuters

Gold prices rose to their highest level in nearly three weeks on Friday as the dollar and bond yields fell ahead of key U.S. inflation data that could offer more clarity on the Federal Reserve’s interest rates path next year.

Spot gold was up 0.5% to $2,054.50 per ounce as of 1103 GMT and U.S. gold futures rose 0.8% to $2,067.40.

Gold rose to its highest since Dec. 4 earlier in the session and is set for a 1.8% weekly rise, its second in a row.

“If the markets are pricing in so many rate cuts and the dollar and yields are lower, then gold is going to perform really well,” said Craig Erlam, senior markets analyst at OANDA.

Fed Rate Cuts Pit Economists Versus Markets on Timing, Depth-BBG

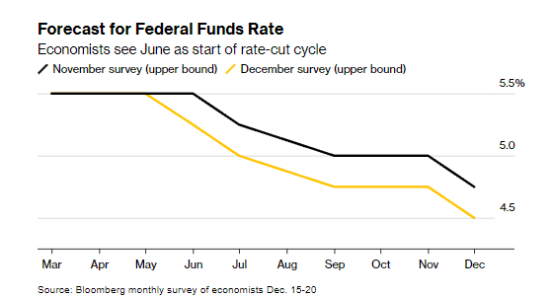

Economists see the Federal Reserve holding off on interest-rate cuts until mid-2024, contrary to market expectations the easing cycle will begin sooner.

Bloomberg’s monthly survey shows the median expectation is for the US central bank to reduce the benchmark rate by 25 basis points at the June 2024 policy meeting, followed by three more cuts in the second half of the year. The benchmark has been in a range of 5.25% to 5.5% since July.

A month ago, economists expected an initial rate cut in July. But a separate Bloomberg survey conducted before the Fed meeting that ended Dec. 13 already showed a first cut in June, indicating the Fed’s pivot had little impact on forecasts.

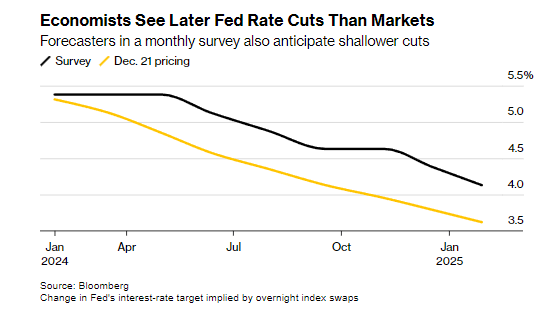

In contrast, investors are placing more than a 90% probability on the central bank lowering rates at or before its March meeting, with the main rate finishing the year at around 3.77%.

Several Fed officials over the past week have pushed back on speculation that the central bank would lower rates in March.

COMMENTS: For now euphoria is following markets expectations, end of Q1 could get dicey if the Fed does not cut in March.

US DATA TODAY