Sea of Red

- Hong Kong: Hang Seng closes down -0.51%

- China CSI 300 -0.90%

- Taiwan KOSPI -1.68%

- India Nifty 50 -1.54%

- Australia ASX -0.10%

- Japan Nikkei -0.71%

- European bourses broadly down so far this morning with the exception of Germany tech stocks which are only slightly positive

- US indices slightly positive/flat this morning in pre-market, USD up +0.05%

Overnight News/Data

- US MBA Mortgage Applications Feb 17: -13.3% (prev -7.7%) – US MBA 30-Yr Mortgage Rate Feb 17: 6.62% (prev 6.39%)

- German IFO Business Climate Feb: 91.1 (est 91.2; prev 90.2) – German IFO Expectations Feb: 88.5 (est 88.4; prev 86.4) – German IFO Current Assessment Feb: 93.9 (est 95.0; prev 94.1)

- Italian CPI Final (M/M) Jan: 0.1% (est 0.2%; prev 0.2%) – Italian CPI Final (Y/Y) Jan: 10.0% (est 10.1%; prev 10.1%) – Italian CPI EU Harmonised (M/M) Jan F: -1.5% (est -1.3%; prev -1.3%) – Italian CPI EU Harmonised (Y/Y) Jan F: 10.7% (est 10.9%; prev 10.9%)

- French Manufacturing Confidence Feb: 104 (est 103; prev 103) – French Business Confidence Feb: 103 (est 102; prev 102) – French Production Outlook Indicator Feb: 0 (prev -8) – French Own Company Outlook Feb: 14 (prev 17)

- Japan BoJ Announces Unscheduled Bond Buying Operation -Offers To Buy JPY300Bln Of 5-10 Year JGBs -Offers To Buy JPY100Bln Of 10-25 Year JGBs

Japanese PPI Services (Y/Y) Jan: 1.6% (exp 1.5%; prev 1.5%)

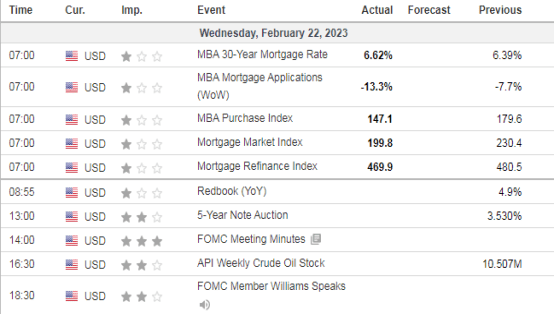

US DATA TODAY

COMMODITY HEADLINES OVERNIGHT

Metals

Gold tiptoes higher as investors focus on Fed minutes

Copper falls on Fed rate jitters; China demand in focus

Energy

Oil falls on worries interest rates will rise more and curb fuel demand

US natgas prices dip below $2/mmBtu for first time since Sept. 2020

Freeport LNG to restart operations at its natural gas liquefaction and export facility

Tellurian Reports Fourfold Increase in Natural Gas Production In 2022