Rate hikes galore

Pretty RED out there -China closed today and tomorrow

- Hong Kong: Hang Seng -Closed for Holiday

- China CSI 300 -Closed for Holiday

- Taiwan KOSPI +0.43%

- India Nifty 50 -0.41%

- Australia ASX -0.57%

- Japan Nikkei -1.32%

- European bourses in negative territory so far this morning

- USD -0.12%

TOP 5 STORIES OVERNIGHT

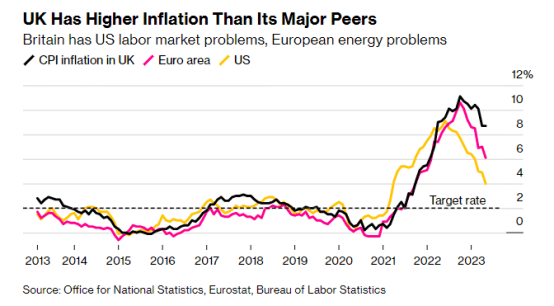

- Bank Of England Hikes Rates By 50Bps To 5.00%; (est 4.75%); Votes 7:2

BOE delivers surprise half-point rate hike to 5% — the highest in 15 years — with seven of nine policymakers voting in favor of the move

Pound jumps above $1.28, FTSE 100 extends drop beyond 1%, gilts little changed

- Available LME copper stocks fall to the lowest since 2021-Reuters

Copper available to the market in London Metal Exchange (LME)approved warehouses fell to the lowest level since October 2021 after large amounts of inventory were earmarked to leave the LME system, data from the exchange showed on Thursday.

Total stocks of copper in LME warehouses stand at 80,400 metric tons. Of that 62.5% or 50,275 metric tons has been set aside or cancelled for delivering out over coming weeks. This is compared with 42% previously.

This gave copper a boost overnight

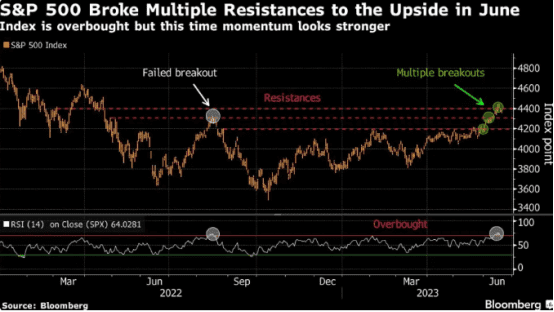

- Short Bets on US Stocks Hit $1 Trillion, Most Since April 2022 -BBG

Total US short interest, or the amount traders have spent betting against US equities, exceeded $1 trillion this month as the S&P 500 Index extended its advance, S3 Partners LLC data show. The tally reached the highest since April 2022 before retreating slightly with stocks down for a third straight day.

The contrarian bets signal that some traders have concluded the S&P 500’s (^GSPC) roughly 14% rally in 2023 will run out of steam, and they’re enduring steep losses as they wait for the market to turn in their favor. On paper, the positions are down about $101 billion this year, according to S3.

- Turkey delivers 650-bp rate hike to 15% but still underwhelms-Reuters

Turkey’s central bank hiked its key interest rate by 650 basis points to 15% on Thursday in a reversal of President Tayyip Erdogan’s low-rates policy, although the post-election tightening fell short of expectations.

In its first meeting under new Governor Hafize Gaye Erkan, the bank changed course after years of loose policy in which the one-week repo rate had dropped to 8.5% from 19% in 2021 despite soaring inflation.

“Monetary tightening will be further strengthened as much as needed in a timely and gradual manner until a significant improvement in the inflation outlook is achieved,” the bank’s policy committee said after delivering its first hike since early 2021.

It raised rates “in order to establish the disinflation course as soon as possible, to anchor inflation expectations, and to control the deterioration in pricing behavior,” it added, striking a more hawkish tone compared to its statements under former governor Sahap Kavcioglu.

The lira has been in free fall, and inflation is on the rise. Incredibly the markets actually expected 1000-bps rate hike, so 650 was underwhelming (LOL)

- Swiss central bank raises rates again, signals may need to do more-Reuters

The Swiss National Bank raised its policy interest rate by 25 basis points on Thursday as the central bank pressed ahead with its campaign to dampen stubborn inflation and left the door open for more tightening.

Chairman Thomas Jordan pointed to rising inflationary pressures and the danger of price increases becoming entrenched.

Although inflation has declined compared with a year earlier, there was still more work to be done, Jordan told reporters.

Still failed to get the Swiss Franc moving

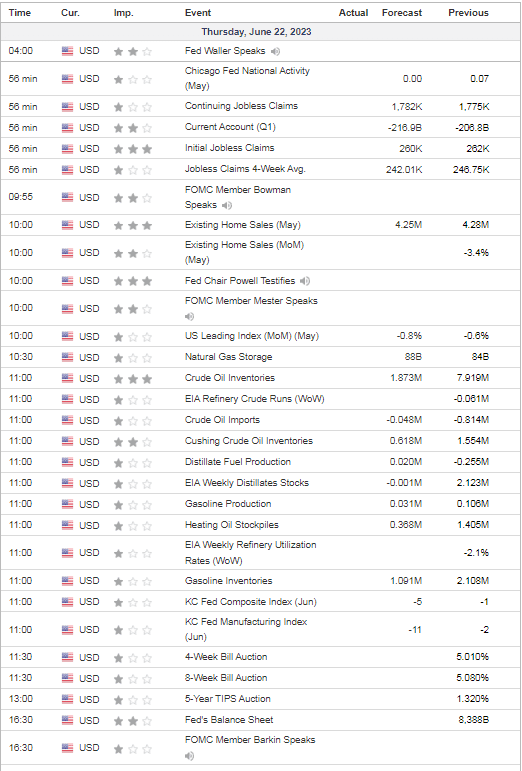

US DATA TODAY