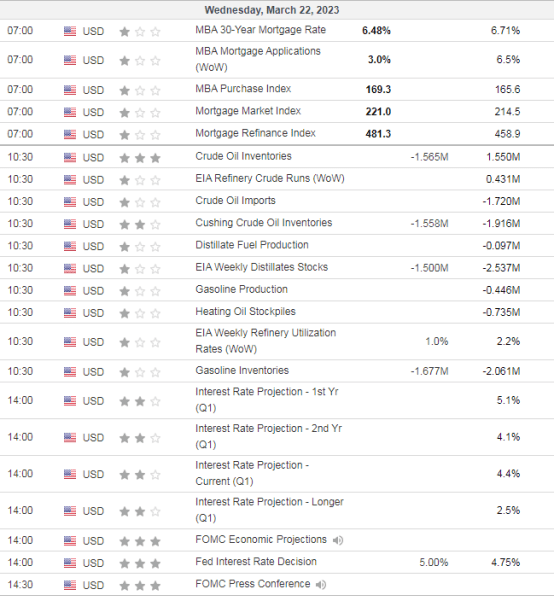

FOMC DAY!! 2:00PM ET DECISION/2:30PM ET PRESSER

Sea of Green again in Asia

- Hong Kong: Hang Seng closes UP +1.73%

- China CSI 300 +0.43%

- Taiwan KOSPI +1.20%

- India Nifty 50 +0.20%

- Australia ASX +0.81%

- Japan Nikkei +0.51%

- All European bourses broadly in positive territory with theeception of Italy, UK, Switzerland, and German Tech

- US indices pretty flat so far this morning in pre-market, USD -0.20%

Overnight Data/News

- PBoC Sets Yuan Mid-Point At 6.8715 / Dlr VS Last Close 6.8788

- China Liquidity Conditions Expected To Stay Ample – Securities Daily

- Bundesbank Chief Nagel: I Still Envision A Soft Landing In Germany, Eurozone

- UBS Offers To Buy Back Some Of Its Own Bail-In Notes – BBG

- UK CPI (Y/Y) Feb: 10.4% (exp 9.9%; prev 10.1%) – CPI Core (Y/Y) Feb: 6.2% (exp 5.7%; prev 5.8%) – CPI (M/M) Feb: 1.1% (exp 0.6%; prev -0.6%)

- UK PPI Output NSA (Y/Y) Feb: 12.1% (exp 12.4%; prev 13.5%) – PPI Output NSA (M/M) Feb: -0.3% (exp 0.1%; prev 0.5%) – PPI Input NSA (Y/Y) Feb: 12.7% (exp 12.0%; prevR 14.7%) – PPI Input NSA (M/M) Feb: -0.1% (exp -0.2%; prevR 0.4%)

- ECB’s Lagarde: Must And Will Bring Down Inflation To Target -Have Plenty Of Tools To Address Financial Stability Risk

- US MBA Mortgage Applications Mar-17: 3.0% (prev 6.5%) – MBA 30-Year Mortgage Rate Mar-17: 6.48% (prev 6.71%)

- JPMorgan Says Treasuries Coping Amid Worst Liquidity Since 2020 – BBG

- Russia Alters Oil Taxes To Capture Bigger Share Of Trades Above Price Cap – FT

US DATA TODAY

OVERNIGHT COMMODITY HEADLINES

Metals

Gold prices stable as safe haven appeal wanes ahead of Fed meeting

Energy

Fujairah: Oil product stockpiles climb for first time in a month

- S. refiners shift focus to distillates amid energy transition

Russia Extends Oil Production Cut Through June

Ecuador will need to cut oil output goal by 8% after force majeure -minister

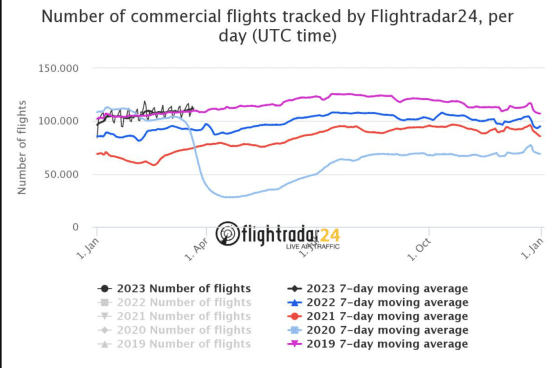

Number of commercial flights tracked by Flightradar24