Mixed markets in Asia…Europe RED

- Hong Kong: Hang Seng closed up +2.28% !!!

- China CSI 300 +1.81%

- Taiwan KOSPI -0.27%

- India Nifty 50 -0.29%

- Australia ASX -1.29%

- Japan Nikkei +0.89%

- European bourses all in negative territory so far this morning

- USD +0.25%

TOP STORIES OVERNIGHT

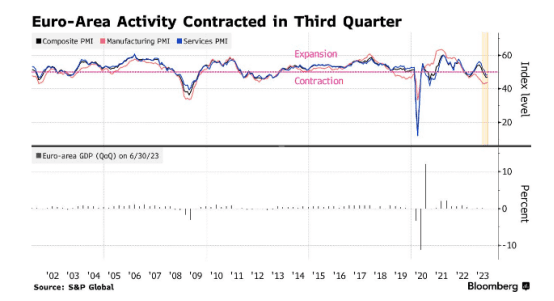

Weak Euro-Area PMI Data Suggest Economy Facing Contraction-BBG

Private-sector activity in the euro area has continued to shrink in September, suggesting the economy contracted in the current quarter.

An index based on surveys of purchasing managers by S&P Global showed a fourth consecutive month of falling output, hitting 47.1. While that’s a slight improvement on August, the reading is clearly below the 50 level that indicates contraction. Economists had predicted a drop to 46.5.

“We expect the euro zone to enter a contraction in the third quarter,” said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank. “Our nowcast, which incorporates the PMI indices, points to a drop of 0.4% compared to the second quarter.”

COMMENTS: Obviously this is pressuring European markets this morning

UAW Expected to Announce More Auto-Plant Strikes on Friday-BBG

General Motors Co., Ford Motor Co. and Stellantis NV are bracing for more walkouts Friday as the carmakers remain far apart from the United Auto Workers on key issues, including job security and pay parity for temporary workers.

UAW President Shawn Fain vowed to expand the strike to more plants if there wasn’t substantial headway made after the first week. He’s already taking a more aggressive stance than his predecessors — targeting all three of Detroit’s legacy automakers at the same time. He’ll announce the union’s next steps at 10 a.m. local time.

While the parties continued bargaining on a new contract this week, negotiators on both sides say there’s a long way to go. GM Chief Executive Officer Mary Barra told salaried staff on Sept. 20 that the UAW’s latest counteroffer was still too expensive. The companies are offering around 20% pay raises over four years, while the UAW is demanding a 36% boost. At Stellantis, some of the union’s most important demands have yet to be addressed, according to Mike Hayes, a member of the UAW’s bargaining committee.

COMMENTS: The longer this lasts, and the more production it affects, could lead to inflationary pressures if it creates a vehicle scarcity. Something to keep an eye on. In the meantime this will also pressure steel prices.

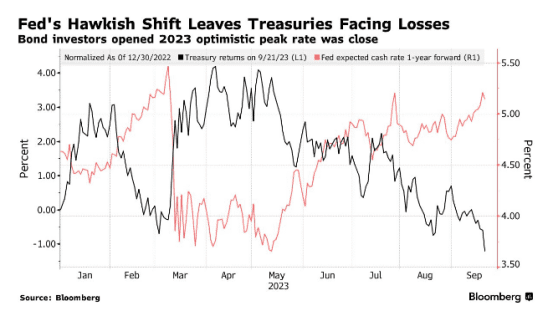

Another Yield High as US 10-Year Jumps Above Key 4.5% Level in Post-Fed Bond Rout-BBG

Treasury 10-year yields rose above 4.5% for the first time since 2007 as a more hawkish Federal Reserve adds to concern the bonds face a toxic mix of large US fiscal deficits and persistent inflation.

US government debt is headed for a third year of losses as bets on a rapid Fed pivot from aggressive interest rate hikes evaporate again after the central bank on Wednesday raised its projections for future borrowing costs.

The resilience of the US economy in the face of the steepest rate increases for a generation is spurring a flight from bonds, given the likelihood of a soft landing that would rule out rapid policy easing in the coming year. Surging oil prices and a massive fiscal deficit also have traders bracing for further selloffs after this week’s rout sent yields on every benchmark Treasury maturity to the highest levels in more than a decade.

COMMENTS: This is also helping to boost oil prices along with Russian diesel and export ban. 10 year yields and oil are closely correlated.

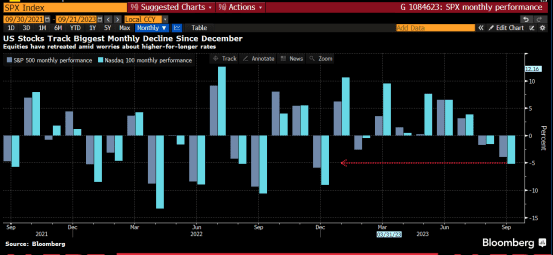

BofA Says Rate Worries Spark Biggest Stock Outflows This Year-BBG

Investors are dumping equities at the fastest pace since December as the prospect of higher-for-longer interest rates raises the risk of a recession, Bank of America Corp. strategists say.

Global equity funds had outflows of $16.9 billion in the week through Sept. 20, according to a note from the bank citing EPFR Global data. US stock funds led the exodus, while in Europe, redemptions reached 28 weeks.

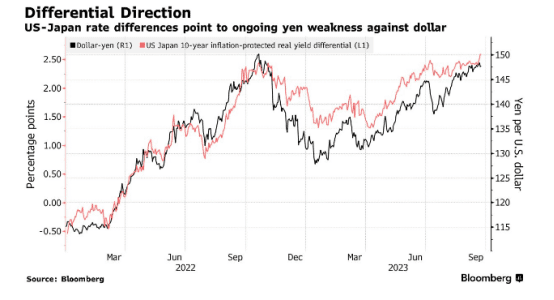

BOJ’s Ueda Tamps Down Speculation of Rate Hike, Pressuring Yen-BBG

Bank of Japan Governor Kazuo Ueda tamped down speculation of a near-term interest rate hike after the central bank chose to stick with its ultra-easy stimulus, a decision that renewed downward pressure on the yen.

The BOJ kept its negative interest rate and the parameters of its yield curve control program intact on Friday in an outcome predicted by all 46 economists surveyed by Bloomberg. It also maintained a pledge to add to its stimulus without hesitation if needed, a vow that offers yen bears a reason to keep betting against it.

The currency is now beyond the levels that prompted Japan to intervene in foreign-exchange markets last September. Measured against a broad basket of currencies and adjusted for inflation, it was at its weakest on record in August using data back to 1970.

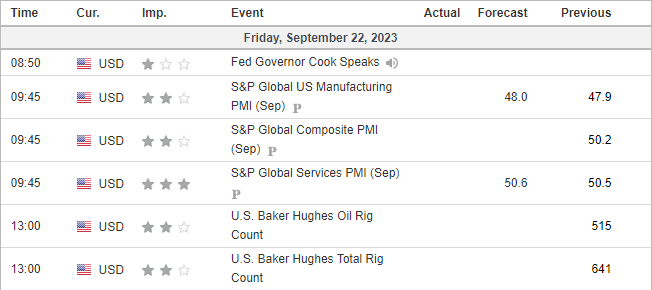

US DATA TODAY