NVDA Earnings after the bell

Pretty Green again out there …except Mainland China

- Hong Kong: Hang Seng closed up +0.31%

- China CSI 300 -1.64%!!!

- Taiwan KOSPI -0.41%

- India Nifty 50 -0.24%

- Australia ASX +0.14%

- Japan Nikkei +0.60%

- European bourses in positive territory so far this morning

- USD +0.32%

TOP STORIES OVERNIGHT‘

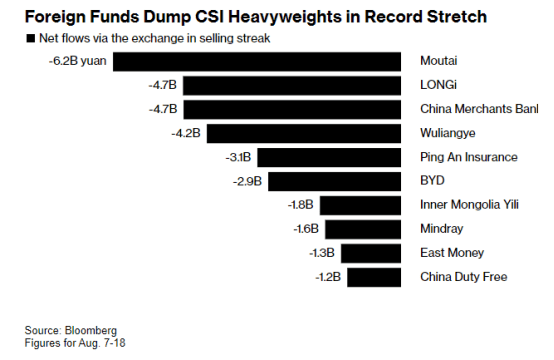

Global Funds Abandon China Blue Chips in $11 Billion Selloff-BBG

Global investors have been shedding China’s blue-chip stocks during the longest stretch of outflows on record, showing even the nation’s industry leaders are falling out of favor as a rout deepens.

Overseas funds have been fleeing the mainland market, offloading the equivalent of $10.7 billion in a thirteen-day run of withdrawals through Wednesday, the longest since Bloomberg began tracking the data in 2016. Their departure comes as a prolonged housing slump raises the risk of broader financial contagion, making the nation’s equity benchmark among the worst global performers this month with a nearly 8% loss.

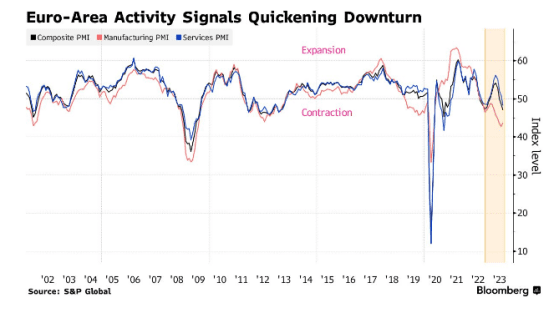

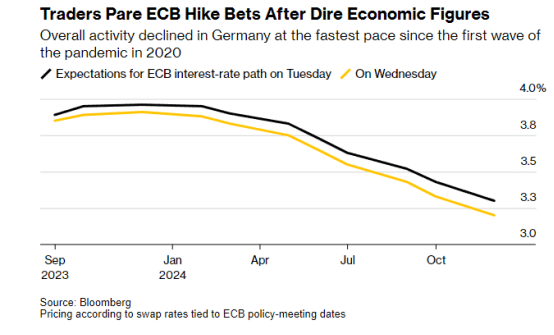

Euro Area’s Worsening Downturn Fuels Bets on ECB September Pause -BBG

The contraction of private-sector activity in the euro area intensified, leading investors to bet that the European Central Bank will pause its campaign of interest-rate hikes next month.

Services in August ceased being a bright spot and followed the industrial sector into a downturn in the region’s top two economies, prompting the shift in market wagers and sending bond yields and the euro tumbling.

The figures also brought warnings that output in the 20-nation bloc will shrink this quarter.

The flash Purchasing Managers’ Index for the region fell to 47, further below the 50 threshold indicating growth. Services activity shrank for the first time since end-2022, while the expectation was for continued expansion in a sector that had until recently seen robust demand

This is giving European stocks a boost this morning, and a sell off in EUR (DXY get a lift by default) and European bonds rallied, with the 10-year German yield falling as much as 12 basis points to 2.53%, its lowest in nearly two weeks.

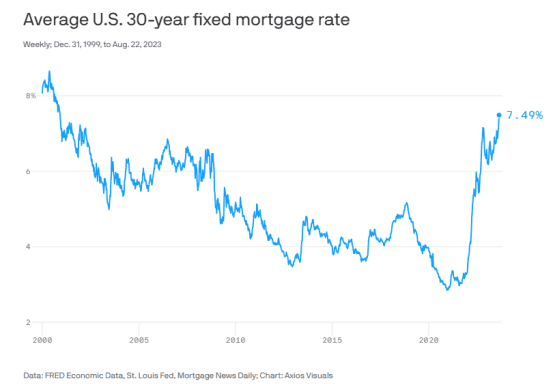

US Mortgage rates surge anew, inching closer to 8%-Axios

U.S. mortgage rates keep going up, inching closer toward 8%.

Driving the news: The average 30-year fixed mortgage rate hit 7.49% this week, Mortgage News Daily reports, only days after rates soared to their highest levels since 2001.

Why it matters: With mortgage rates at a two-decade high, the rising cost of homeownership puts it increasingly out of reach for many Americans.

- The trend is being exacerbated by upward pressure on broader market rates, which began with the Federal Reserve’s aggressive tightening campaign against inflation, which may or may not be done yet.

What’s happening: Yields on the U.S. 10-year Treasury bond, which influences mortgage rates and other forms of borrowing, are perched around 16-year highs.

- That’s scaring away potential first-time borrowers, and making current property owners increasingly unwilling to sell their homes, as Axios Macro’s Courtenay Brown reports.

Between the lines: Existing home sales slumped further in July as homeowners locked into lower-interest mortgages shy away from selling.

- Sales of previously owned homes are down 16.6% compared to July 2022, according to new National Association of Realtors data.

Cheniere signs LNG agreement with Germany’s BASF-Offshore Technology

The agreement will see Cheniere supply about 0.8 million tonnes per annum (mtpa) of LNG to BASF. The LNG will be purchased by the German company on a free-on-board (FOB) basis.

Cheniere will commence the LNG supply to BASF in mid-2026 and extend through 2043. This is subject to a positive final investment decision on the Train Seven of the Sabine Pass Liquefaction Expansion Project (SPL Expansion Project) in Louisiana

Looks like gas usage here to stay well beyond 2030! Cheneire is well places as it not only has production, but also distribution capabilities.

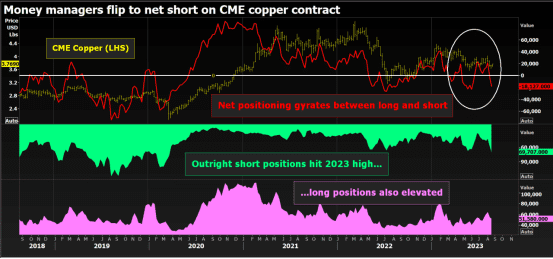

Copper trapped between old and new super-cycles-Reuters

Copper may be poised to embark on a new energy transition super-cycle but it is currently struggling to escape the gravitational pull of the old Chinese super-cycle.

The London Metal Exchange (LME) three-month copper price has been oscillating in a $7,800-8,870 per metric ton range since May as old and new price drivers compete.

Fund positioning on both the LME and the CME is equally caught between a waning China-centric super-cycle and the nascent green super-cycle.

Money managers flipped back to net short of the CME copper contract at the start of this month in a continuation of the positioning chop that has characterised the market since March.

The gyration in net positioning is partly a reflection of copper’s own choppy range-trading with many black box funds configured to react to changes in directional momentum.

It is also down to the ebb and flow of the Chinese recovery narrative.

This is why copper continues to be a chopfest, even with ultra low stocks and falling world production. It is still being used as a gauge of the health of China (global) economy rather than actual supply demand.

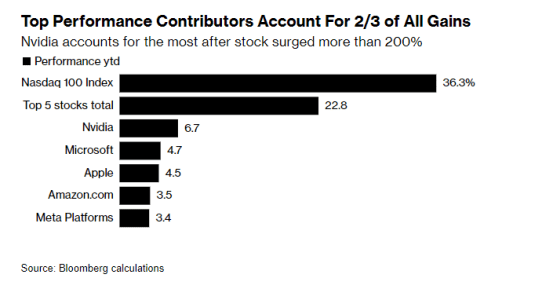

Nvidia Earnings Are High-Stakes Event for AI-Crazed Markets-BBG

Big Tech’s earnings season is wrapping up with a bang: Nvidia Corp., at the center of the artificial intelligence frenzy, is reporting results that could set the tone for global stock markets for the rest of the year.

The chipmaker has added more than $370 billion in market value since its last update, and is the biggest contributor to the Nasdaq 100’s 36% rally this year. Nvidia’s processors are the picks and shovels in the AI gold-rush that has fueled markets this year, making its report much more significant than a typical earnings release.

“What Nvidia says about guidance for the remainder of FY24 drives the sentiment around the entire AI thesis that has driven the market,” said Ben Reitzes, an analyst with Melius Research.

All eyes on Nividia to save the markets??

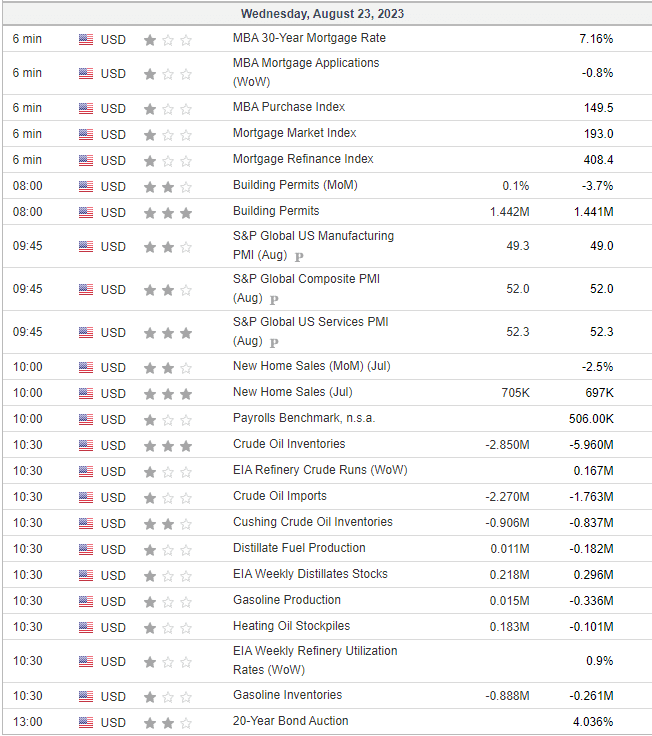

US DATA TODAY