Mixed Markets Overnight-Much Better Than Yesterday

- Hong Kong: Hang Seng closes down -0.35%

- China CSI 300 -0.08%

- Taiwan KOSPI +0.35%

- India Nifty 50 -0.25%

- Australia ASX -0.37%

- Japan Nikkei+0.46%

- European bourses broadly UP so far this morning with the exception of Greece, Spain, and UK (slightly down)

- US indices in positive this morning in pre-market, USD slightly down -0.06%

Overnight Data/News

- Eurozone CPI (M/M) Jan F: -0.2% (est -0.2%; prev -0.4%) – Eurozone CPI (Y/Y) Jan F: 8.6% (est 8.6%; prev 8.5%) – Eurozone CPI Core (Y/Y) Jan F: 5.3% (est 5.2%; prev 5.2%)

- Austria CPI Y/Y JanF: 11.2% (prev 11.1%) – Austria CPI M/M JanF: 0.9% (prev 0.8%

- Australia – Business investment hits 7-yr top in Q4, outlook upbeat

Q4 Private CapEx 2.2% q/q vs. expected 1.1% q/q

Q3 Private CapEx revised +0.6% q/q vs. prior -0.6% - South Korea – Bank of Korea holds rates steady, may not resume tightening

– BoK holds base rate at 3.50%, as expected

– No more rises needed if inflation forecast met, governor says

– Economic growth, inflation forecasts slightly cut - China PBoC To Inject CNY300Bln Via 7 Day Reverse Repos At 2.0%-PBoC Fixes USDCNY Reference Rate At 6.9028 (prev fix 6.8759 prev close 6.8900)

- Singapore – January core inflation rises at fastest pace in 14 years

– Jan CPI 0.2% m/m 6.6% y/y vs. expected 7.1% y/y

– Jan Core CPI 5.5% y/y vs. expected 5.7%

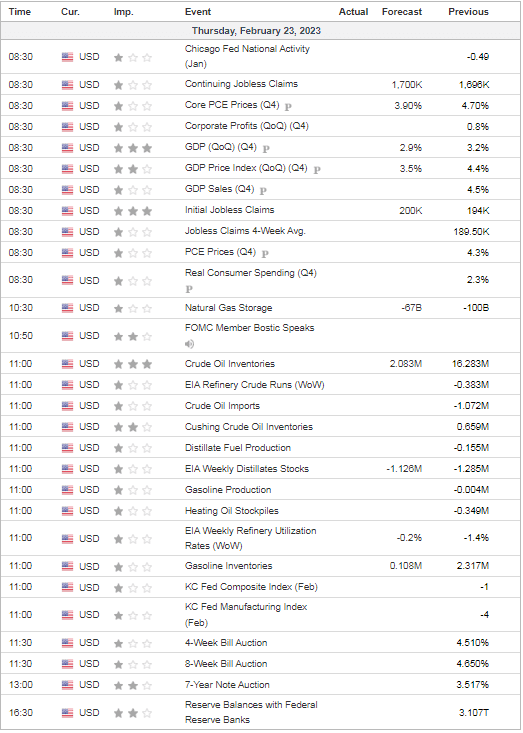

US DATA TODAY

Loaded with data today after a quiet few days

OVERNIGHT COMMODITY HEADLINES

Metals

Peru protesters temporarily lift mining highway blockade, sources say (Copper)

Energy

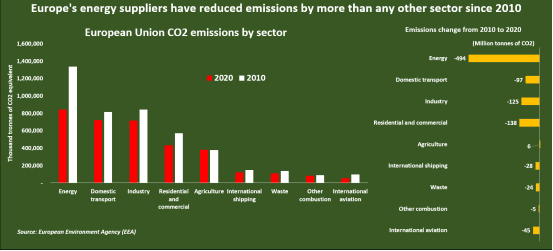

Europe’s energy suppliers have reduced emissions by more than

any other sector since 2010

US natgas jumps on colder weather view, short-covering

Exxon warns of Russia risks to its $2.5 billion Kazakhstan income

BNP Paribas sued in France over fossil-fuel financing

TotalEnergies CEO pledges pump prices will not exceed 1.99 eur/litre in 2023

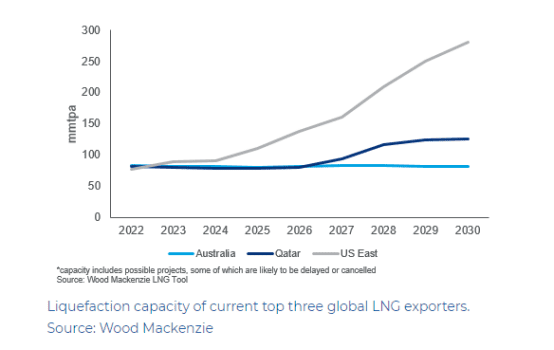

WoodMac: High demand could pave the way for $100B of new LNG projects in US– with the resumption of the Freeport facility, the US will surpass Qatar and Australia this year to export 89 million mtpa of LNG.

One Response

Thanks Tracy!