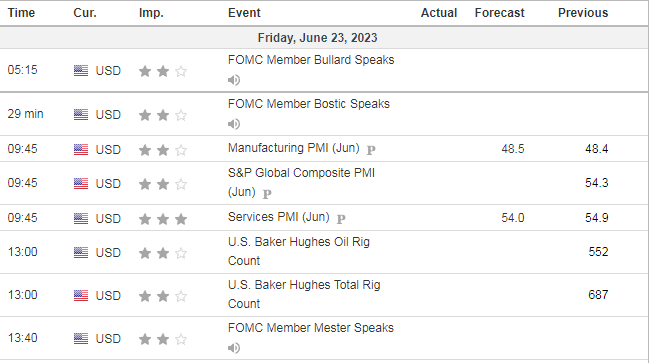

US Manufacturing PMI out today at 9:45AM

Sea of RED -Slew of bad data from Europe

- Hong Kong: Hang Seng closed down -1.71%

- China CSI 300 Closed for holiday

- Taiwan KOSPI -0.91%

- India Nifty 50 -0.54%

- Australia ASX -1.66%

- Japan Nikkei -2.56% !!!!!!

- European bourses all in negative territory so far this morning

- USD +0.60%

TOP 5 STORIES OVERNIGHT

- French Economy Probably Saw 0.5% Contraction in Second Quarter-BBG

Composite purchasing managers’ index drops to 47.3; est. 51

The French economy probably slumped in the three months through June, with purchasing manager indexes suggesting a 0.5% contraction from the previous quarter.

“Prior to the June reading, our nowcast model had signaled economic growth of 0% for the second quarter, with manufacturing contracting and services expanding,” said Norman Liebke, an economist at Hamburg Commercial Bank. The new June figures change the picture as “now not only the manufacturing sector but also the services economy is expected to contract, and economic growth turns negative overall along with it.”

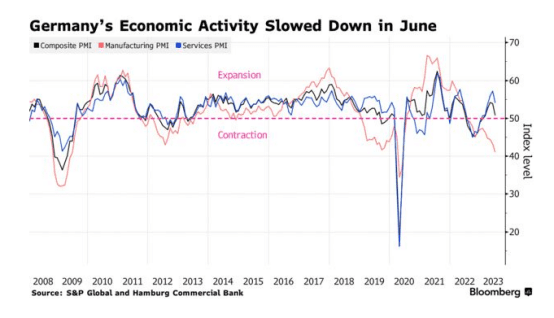

- Germany Loses Momentum as Services Slowdown Weighs on Economy -BBG

Composite purchasing managers’ index drops to 50.8; est. 53.3

Germany’s economic activity lost much more momentum than anticipated in June, driven by a slowdown in services and sustained weakness at the country’s factories.

While the private-sector economy grew for a fifth straight month, the rate of expansion was the weakest since February, according to business surveys by S&P Global. At 50.8 — weaker than predicted by economists in a Bloomberg survey — it stayed above the 50 level that separates expansion and contraction. The manufacturing gauge has been below that line since July.

- Deepening economic pain leaves ECB in policy dilemma

Euro zone business growth stalled this month as a manufacturing recession deepened and a previously resilient services sector barely grew, leaving the European Central Bank in a policy dilemma as it presses ahead with rate hikes to fight inflation.

HCOB’s flash Composite Purchasing Managers’ Index (PMI) for the 20 nations sharing the euro currency, compiled by S&P Global and seen as a good gauge of overall economic health, sank to a five-month low of 50.3 in June from May’s 52.8.

That was barely above the 50 mark separating growth from contraction and below all forecasts in a Reuters poll that saw a modest decline to 52.5.

The figures suggest that the bloc’s economy is at best stagnating after a recession in the previous two quarters and a recovery is nowhere on the horizon, even if robust holiday bookings suggest that the tourism sector could keep the bloc afloat in the near term.

“This speaks against a recovery of the economy in the coming months, which is expected by many,” Commerzbank economist Christoph Weil said. “We see our assessment confirmed that the euro area economy will contract again in the second half of the year.”

European recession fears weighing on global indices today.

- Siemens Energy’s wind turbine troubles to last years, shares tumble -Reuters

Costs to fix quality issues could exceed 1 bln euros

Shares down around 33%

FRANKFURT/BERLIN, June 23 (Reuters) – Siemens Energy (ENR1n.DE) had one third wiped off its market value on Friday after warning that the impact of quality problems at its Siemens Gamesa wind turbine business could cost more than 1 billion euros ($1.09 billion) and take years to fix.

The group scrapped its 2023 profit outlook late on Thursday after a review of its wind turbine division exposed deeper-than-expected problems.

Problems galore with these renewable intermittent power sources.

- Global equity funds see over $15 billion in outflows on rate hike worries

Global equity funds suffered substantial outflows during the seven days to June 21 amid concerns over borrowing costs staying higher for longer as the European Central Bank raised interest rates and the Federal Reserve signalled more hikes.

Investors withdrew a net $15.12 billion from global equity funds which had seen net inflows of $16.04 billion a week earlier.

The U.S. and European equity funds witnessed outflows of $16.47 billion and $1.81 billion, respectively, while investors pumped about $2.6 billion into Asian funds.

Healthcare and industrial sectors saw $1.14 billion and $174 million worth of net selling, respectively. Financials attracted about $710 million worth of inflows.

Meanwhile, global bond funds extended their inflows streak to a 14th straight week, with about $4.07 billion flowing in.

Global government and corporate bond funds attracted about $1.9 billion each. Meanwhile high yield, loan participation and convertible funds suffered outflows of about $400 million each.

Meanwhile, investors withdrew a net $15.13 billion from money market funds, their second straight week of outflows.

Among commodity funds, investors withdrew $498 million from precious metal funds, their fourth successive week of net selling. Energy funds also saw $176 million in outflows.

This is from Bank of America Global Fund Manager survey-what a difference a week can make! Last week we saw massive inflows to the US.

US DATA TODAY