Mostly RED

Japan’s Nikkei breaks run of eight consecutive days of gains -Japan’s official announcement on stricter SPE export controls from July 23 triggered declines in semiconductor names after strong gains last week.

- Hong Kong: Hang Seng closed down -1.25%

- China CSI 300 -1.41%

- Taiwan KOSPI +0.41%

- India Nifty 50 +0.11%

- Australia ASX -0.20%

- Japan Nikkei -1.91%%

- All European bourses in mixed territory so far this morning ..mostly red

- US indices mostly flat so far in pre-market, USD +0.34%

Overnight Data/News

- PBoC Sets Yuan Mid-Point At 7.0326 / Dlr VS Last Close 7.0308

- French HCOB Manufacturing PMI May P: 46.1 (exp 46.0; prev 45.6) – French HCOB Services PMI May P: 52.8 (exp 54.0; prev 54.6) – French HCOB Composite PMI May P: 51.4 (exp 52.0; prev 52.4)

- German HCOB Manufacturing PMI May P: 42.9 (exp 45.0; prev 44.5) – German HCOB Services PMI May P: 57.8 (exp 55.0; prev 56.0) – German HCOB Composite PMI May P: 54.3 (exp 53.4; prev 54.2)

- Eurozone HCOB Manufacturing PMI May P: 44.6 (exp 46.0; prev 45.8) – Eurozone HCOB Services PMI May P: 55.9 (exp 55.5; prev 56.2) – Eurozone HCOB Composite PMI May P: 53.3 (exp 53.5; prev 54.1)

- UK S&P Global/CIPS Manufacturing PMI May P: 46.9 (exp 48.0; prev 47.8) – UK S&P Global/CIPS Services PMI May P: 55.1 (exp 55.3; prev 55.9) – UK S&P Global/CIPS Composite PMI May P: 53.9 (exp 54.6; prev 54.9)

- UK Businesses In China Call For Regulatory Clarity – FT

- Dollar hits 6-mth high versus yen on higher-for-longer US rate expectations

- China’s effort to cut $10tn of ‘hidden debt,’ accumulated by local governments, faces uphill climb.

- Russian Prime Minister Starts China Visit In Sign Of Strong Ties – BBG

- EU Will Go Easy On Indian Resale Of Russian Fuel – RTRS

- Big Investors Rush Into Bonds After ‘Cataclysmic’ Year – FT

- Iosco Calls On Global Regulators To Be Faster And Bolder On Crypto Markets – FT

- HSBC Now Expects 25bp Rate Hikes In June, July And September, Taking ECB’S Deposit Rate Forecast To 4.0%

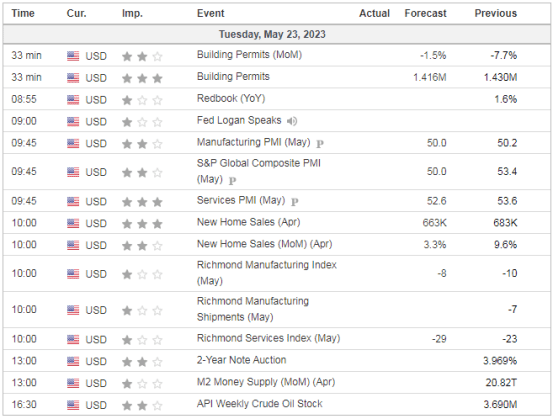

US DATA TODAY