Pretty Green out there

- Hong Kong: Hang Seng closed up 2.05%!!

- China CSI 300 +0.72%

- Taiwan KOSPI +1.28%

- India Nifty 50 -0.33%

- Australia ASX +0.29%

- Japan Nikkei +0.42%

- European bourses in positive territory so far this morning

- USD +0.16%

TOP STORIES OVERNIGHT

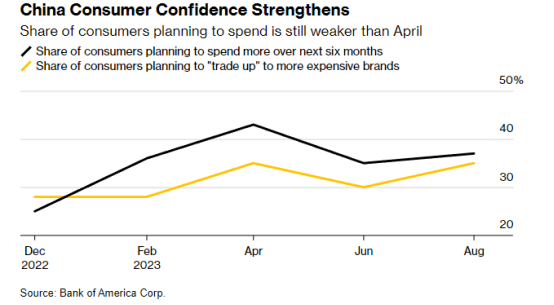

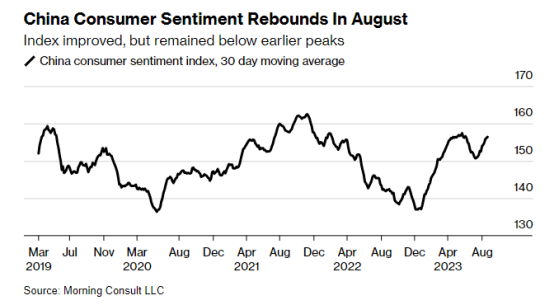

China’s Consumer Sentiment Starting to Improve, Surveys Show-BBG

Chinese consumer sentiment improved in August, snapping several months of decline, though it remains weak compared to earlier in the year, according to two surveys.

Economists will be watching closely if the trend continues since consumption, a key driver of China’s economy, has slowed in recent months because of waning confidence and a housing market slump.

The share of consumers planning to spend more over the next six months and “trade up” to more expensive brands increased in August compared with June, according to a bi-monthly survey from Bank of America Corp.

China’s transport sector continues steady recovery in July-Xinhua

China’s transport sector maintained a steady recovery in July, adding to evidence of the country’s continued economic recovery.

The country’s freight volume expanded 7.1 percent year on year to 4.74 billion tonnes in July, with the pace of increase accelerating from a rise of 4.3 percent in June, Sun Wenjian, spokesperson of the Ministry of Transport, said at a press conference Thursday.

Last month, the country’s port throughput rose 6.6 percent year on year to 1.43 billion tonnes. The container throughput reached 27.05 million twenty-foot equivalent units, up 2.6 percent year on year, according to Sun.

Passenger transport posted strong growth last month amid the summer travel rush, as college students return home for the summer vacation, while family visits and tourist trips also surge during the period.

The country’s transport sector handled a total of 910 million passenger trips in July, surging 47 percent from one year earlier.

Good news for energy markets

European Gas Prices Slump as Risk of Australian Strike Recedes-BBG

European natural gas prices tumbled on signs that a labor dispute at Australia’s biggest liquefied natural gas export plant will be resolved, easing fears about one of three possible strikes in the key exporting nation.

Benchmark futures collapsed as much as 21%, the most since March 2022, on Thursday. The prices erased some of the losses later as unions representing workers at the other two facilities in Australia voted in favor of industrial action, though strikes are still not guaranteed to go ahead.

Gas prices have been extremely volatile this month as traders await the outcome of threats of industrial action that could impact a tenth of global LNG supplies, at one point surging as much as 40% in response to the risks.

This may put pressure on US nat gas today as well

BRICS Asks Saudi, Iran, Other Nations to Join to Add Heft-BBG

Major emerging market nations invited top oil exporter Saudi Arabia, Iran, Egypt, Argentina, Ethiopia and the United Arab Emirates to join their bloc in a push to expand its global influence.

Leaders from Brazil, Russia, India, China and South Africa agreed to enlarge their BRICS group from Jan. 1 at a summit held this week in Johannesburg, South African President Cyril Ramaphosa said on Thursday. It will be the first expansion since 2010.

MAJOR MACRO EVENT

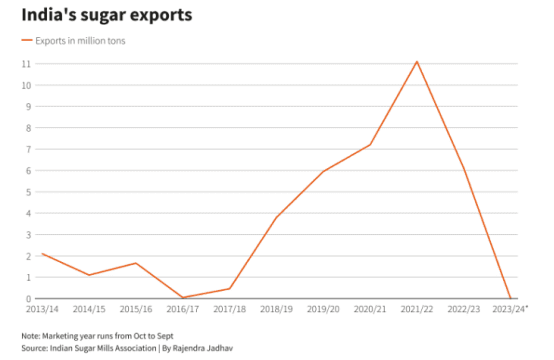

India set to ban sugar exports for first time in 7 years-Reuters

India is expected to ban mills from exporting sugar in the next season beginning October, halting shipments for the first time in seven years, as a lack of rain has cut cane yields, three government sources said.

India’s absence from the world market would be likely to increase benchmark prices in New York and London that are already trading around multi-year highs, triggering fears of further inflation on global food markets.

“Our primary focus is to fulfil local sugar requirements and produce ethanol from surplus sugarcane,” said a government source who asked not to be named in line with official rules. “For the upcoming season, we will not have enough sugar to allocate for export quotas.”

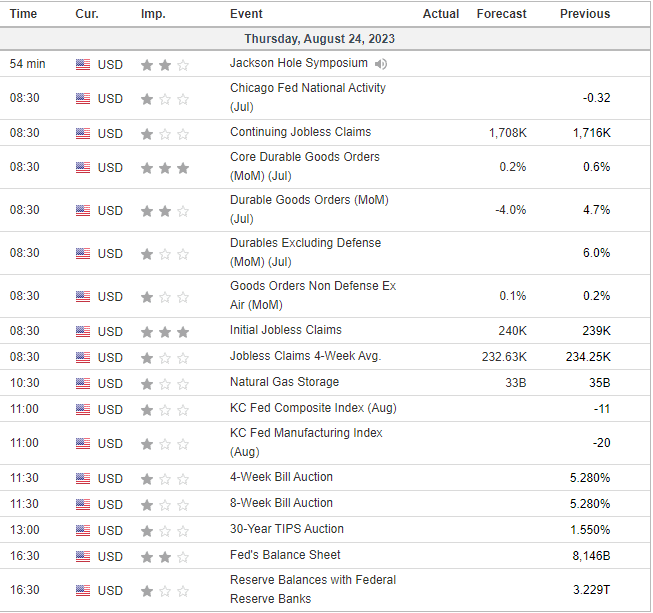

US DATA TODAY