WHAT A NIGHT!!!

Mostly RED

- Hong Kong: Hang Seng closed down -2.13%!!

- China CSI 300 -0.44%

- Taiwan KOSPI +0.72%

- India Nifty 50 -0.38%

- Australia ASX -0.20%

- Japan Nikkei -0.15%

- European bourses in mixed territory so far this morning

- USD +0.17%

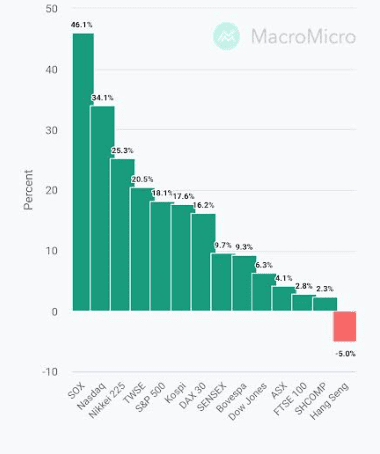

YTD stock markets performance

TOP STORIES OVERNIGHT

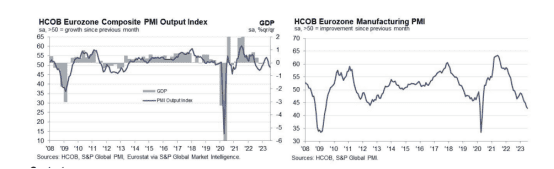

- Eurozone PMI’s were out and it was UGLY

HCOB Flash Germany Composite PMI Output Index(1) at 48.3 (June: 50.6). 8-month low.

HCOB Flash Germany Services PMI Business Activity Index(2) at 52.0 (June: 54.1). 5-month low.

HCOB Flash Germany Manufacturing PMI Output Index(4) at 41.0 (June: 43.6). 38-month low.

HCOB Flash Germany Manufacturing PMI (3) at 38.8 (June: 40.6). 38-month low.

HCOB Flash Eurozone Composite PMI Output Index(1) at 48.9 (June: 49.9). 8-month low.

HCOB Flash Eurozone Services PMI Business Activity Index(2) at 51.1 (June: 52.0). 6-month low.

HCOB Flash Eurozone Manufacturing PMI Output Index(4) at 42.9 (June: 44.2). 38-month low.

HCOB Flash Eurozone Manufacturing PMI(3) at 42.7 (June: 43.4). 38-month low

USD ripped and EUR tanked on the news

- China’s Politburo Signals Property Easing, Debt Risk Plan -BBG

China’s top leaders signaled they will ease property policies and adopt a plan to resolve local debt risks to help boost the economy as the recovery falters.

The Communist Party’s 24-member Politburo — its top decision-making body led by President Xi Jinping — vowed at a key economic policy meeting to optimize and adjust policies for the property sector. They also called for actively expanding domestic demand and strengthening “counter-cyclical” adjustments, according to a readout of the gathering published Monday by the official Xinhua News Agency.

“There were two key messages from the Politburo meeting: One, it brings domestic demand ahead of industrial policy, suggesting stronger counter cyclical measures,” said Xing Zhaopeng, senior China strategist at Australia & New Zealand Banking Group Ltd. “Two, it also stressed a big plan for local government debt disposal.”

This was HUGE news to the markets as analysts were not expecting much from this meeting.

CPC Politburo: Will ensure supply of energy and power for this summer. Will speed up issuance and usage of local govt special bonds. Will boost consumption of auto, electronics and household products, promote tourism consumption. Will actively expand domestic demand.

This headline got the energy markets particularly excited as oil moved into positive territory after being negative for most of the night.

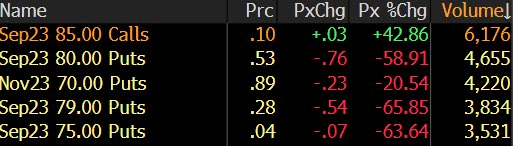

Most active option in Brent as we open the week are $85 calls

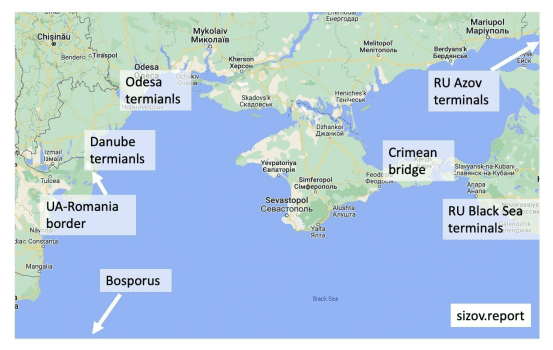

- Last night Moscow attacked two key Ukrainian grain terminals on the Danube (including in Reni, which lies 200 meters across Romania on the other bank of the river)-Andrey Sizov

The Danube is the key export route with monthly capacity of 2+ mmt.

Moscow is trying to cripple all the Black Sea options for Kyiv, leaving it completely depended on Eastern European overland routes

Chicago wheat is up 4.9% in the overnight on this, corn and soybeans have been dragged up as well.

- Twitter has officially rebranded as “X”

Elon Musk has changed Twitter’s logo, replacing its signature blue bird with a stylized X as part of the billionaire’s vision of transforming the 17-year-old service into an everything app. -BBG

Linda Yaccarino (CEO) tweeted: “X is the future state of unlimited interactivity – centered in audio, video, messaging, payments/banking – creating a global marketplace for ideas, goods, services, and opportunities. Powered by AI, X will connect us all in ways we’re just beginning to imagine.”

Most anticipated earnings this week

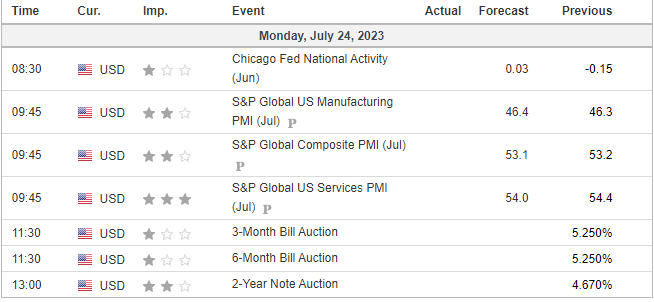

US DATA TODAY