Sea of red

Chinese Stocks Wipe Out 2023 Gains as Headwinds Intensify China’s benchmark stock index erased all its gains for the year as a weaker yuan and developers’ debt woes added to persistent worries over growth and geopolitics.

Outflows from foreign investors continued. They offloaded 4.5 billion yuan ($635 million) after a $1.1 billion selloff via trading links with Hong Kong on Tuesday.-BBG

- Hong Kong: Hang Seng closed down -1.62%

- China CSI 300 -1.38%

- Taiwan KOSPI flat

- India Nifty 50 -0.32%

- Australia ASX -0.04%

- Japan Nikkei -0.64%

- All European bourses in negative territory so far this morning

- US indices in negative territory so far in pre-market, USD +0.24%

Overnight Data/News

- PBoC Sets Yuan Mid-Point At 7.0560 / Dlr VS Last Close 7.0551

- RBNZ Hikes Official Cash Rate 25BPS As Expected To 5.50%

- Japan Machine Tool Orders (Y/Y) Apr F: -14.4% (prev -14.4%)

- UK CPI (Y/Y) Apr: 8.7% (est 8.2%; prev 10.1%) – UK CPI Core (Y/Y) Apr: 6.8% (est 6.2%; prev 6.2%) – UK CPI (M/M) Apr: 1.2% (est 0.7%; prev 0.8%)

- UK PPI Output NSA (M/M) Apr: 0.0% (est 0.2%; prevR 0.0%) – UK PPI Output NSA (Y/Y) Apr: 5.4% (est 5.8%; prevR 8.5%) – UK PPI Input NSA (M/M) Apr: -0.3% (est 0.2%; prev 0.2%) – UK PPI Input NSA (Y/Y) Apr: 3.9% (est 4.8%; prevR 7.3%)

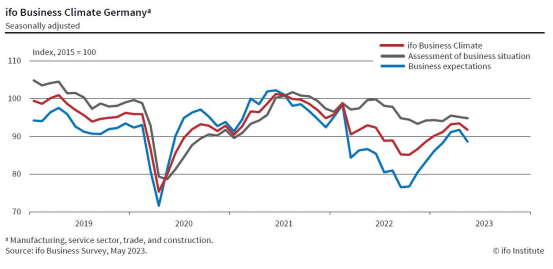

- German IFO Business Climate May: 91.7 (est 93.0; prev 93.6) – German IFO Current Assessment May: 94.8 (est 94.7; prev 95.0) – German IFO Expectations May: 88.6 (est 91.6; prev 92.2)

- South Africa CPI (M/M) Apr: 0.4% (est 0.5%; prev 1.0%) – South Africa CPI (Y/Y) Apr: 6.8% (est 7.0%; prev 7.1%) – South Africa CPI Core (M/M) Apr: 0.5% (est 0.5%; prev 0.8%) – South Africa CPI Core (Y/Y) Apr: 5.3% (est 5.4%; prev 5.2%)

- Investors Bet Fed Will Keep Interest Rates Higher For Longer – FT

- Big Drop In German Exports To China Raises Fears Over EU’s Economic Powerhouse – FT

- US Reluctance On Trade Deals Sends Latin America Towards China – FT

- US Regional Banks Swap $220bn In Deposits To Soothe Insurance Nerves – FT

- IMF’s Georgieva: Don’t Expect Rapid Shift In Dollar’s Reserves -‘Don’t Kiss Your Dollars Goodbye Yet’

- After six consecutive increases, business confidence fell this month in Germany on concerns about declining orders and rising interest rates.

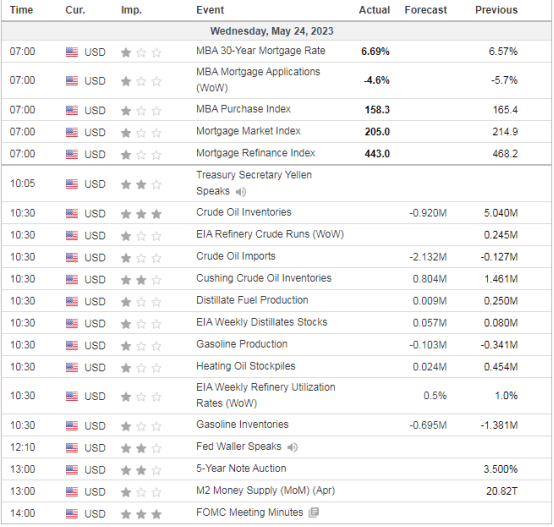

US DATA TODAY