Powell at Jackson Hole LINK to live stream at 10:05 AM ET

Another bad day for China

- Hong Kong: Hang Seng closed down -1.40%!!

- China CSI 300 -0.38%

- Taiwan KOSPI -0.73%

- India Nifty 50 -0.74%

- Australia ASX +0.34%

- Japan Nikkei +0.09%

- European bourses in positive territory so far this morning

- USD +0.08%

TOP STORIES OVERNIGHT

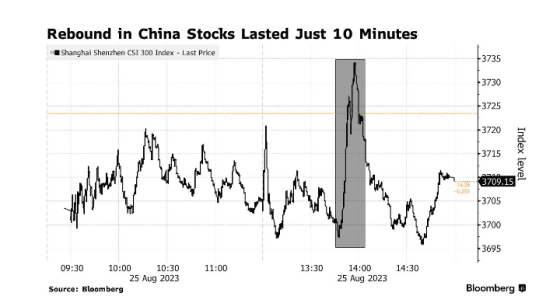

China Stimulus Rally Lasts Just 10 Minutes, Showing Trader Gloom -BBG

A short-lived rally in Chinese stocks after Beijing’s latest attempt to shore up growth is underscoring the depth of investor pessimism toward the world’s second-largest economy.

The Friday afternoon unveiling of property stimulus measures sparked an initial flurry of buying, with China’s benchmark CSI 300 Index reversing losses to climb as much as 0.3%. But the gauge resumed declines after about 10 minutes, sliding to a fresh session low before ending the day down 0.4%.

Read more: China Eases Home Purchase Rules in New Push to Boost Economy

A gauge of developers’ shares also gave up more than half of the gains spurred by the property news. Meanwhile, benchmarks in Hong Kong shrugged off a separate report by Reuters on China’s plans to cut the stamp duty on domestic stock trading by as much as 50%.

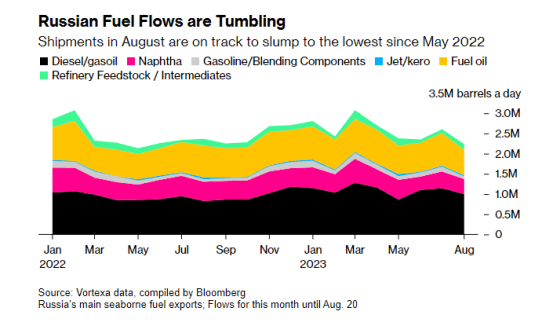

Russia’s Fuel Exports Head for 15-Month Low Amid Local Demand-BBG

Russia’s refined fuel exports are on course to slump to a 15-month low, amid strong domestic demand for road fuels and as some products exceeded Group of Seven price caps.

The country shipped 2.24 million barrels of oil products a day in the first 20 days in August, down 14% from July’s total, according to Vortexa Ltd. data compiled by Bloomberg. That’s the lowest since May 2022 and about 5% below year-earlier levels, when Europe was still the biggest market for Russian fuels.

Russian exports are being closely watched for clues on its crude output since Moscow decided to withhold official data. To aid local supplies, the government has recommended oil producers to redirect gasoline and diesel from exports to the domestic market. At the same time, several Russian refined fuels have breached price caps imposed by the G-7, complicating traders’ access to shipping services and insurance.

This is giving crude a boost this morning

London copper set for best week in a month-Reuters

London copper prices were on track for their biggest weekly gain in four on Chinese policy support and hopes of improving demand for the metal in the coming months.

Three-month copper on the London Metal Exchange CMCU3was up 0.2% at $8,374 per metric ton by 0608 GMT, while the most-traded October copper contract on the Shanghai Futures Exchange SCFcv1 shed 0.4% to 68,840 yuan ($9,450.46) a ton.

“(Copper will) continue to range-bound for a while, then rally towards the year-end,” said a metals producer, adding that an easing dollar and the delayed effect of Chinese stimulus measures are expected to support the rally.

EU cuts cereal and oilseed crop forecasts again -Reuters

The European Commission further reduced its outlook for European Union production of major cereal and oilseed crops this season, with maize seeing the sharpest reduction.

In a monthly supply and demand outlook, the Commission lowered its forecast for 2023/24 usable production of maize to 61.7 million tons from 63.0 million tons projected in July, though still well above last year’s drought-hit harvest of 52.0 million tons.

Maize, mostly harvested in autumn, has suffered from drought and heatwaves in southern Europe this summer, though crops further north have benefited from rain that disrupted wheat harvesting.

The Commission cut its forecast for 2023/24 EU usable production of soft wheat, the bloc’s main cereal crop, to 126.1 million metric tons from 126.4 million tons projected in July, still slightly above 2022/23 output of 125.7 million tons.

The EU barley production forecast for this season was trimmed by 0.1 million versus last month to 48.6 million tons, confirming a drop from 51.5 million tons in 2022/23.

For overall cereal production, the Commission said it had made the sharpest monthly revision for Romania, with a 3.2% reduction, followed by smaller cuts for France, Italy, Poland, Germany that offset increases for Spain and Hungary.

Giving grains a boost this morning

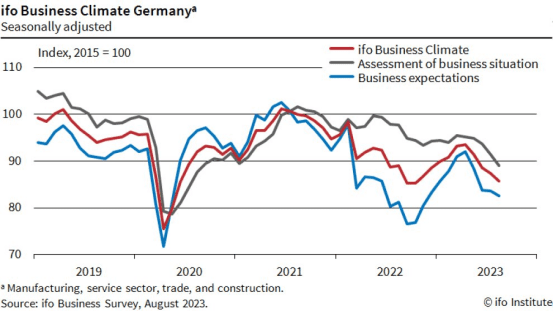

Surprisingly Strong Decline In German Business Confidence Fans Growth Fears-Livesquawk

German managers voiced less optimism about their lot for the fourth straight month to send a leading measure of business confidence to its lowest mark since October.

Germany’s Ifo economics institute said the results of this month’s poll of companies showed a decline in its headline business climate index to 85.7 points, which was short of the 86.8 market estimate and followed last month’s upwardly revised reading of 87.4.

The expectations component of the index – a measure for the coming six months – shrank to 82.6 versus the forecast of 83.7 and the upwardly revised 83.6 mark from July. The current conditions gauge dropped to 89.0 – the worst performance since August 2020 – and below the estimate of 90.0 and the upwardly revised reading of 91.4 last month.

“The German economy is not out of the woods yet,” Ifo said.

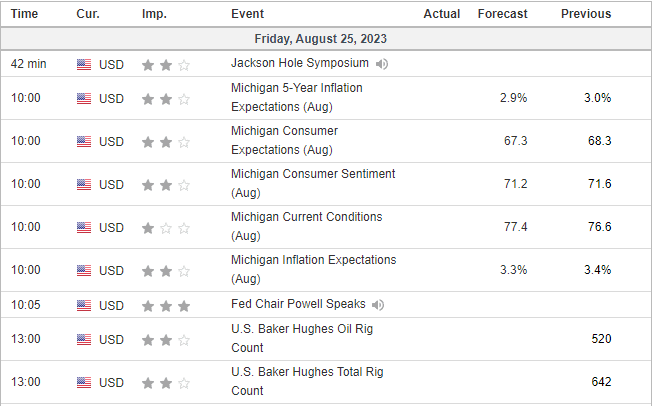

US DATA TODAY