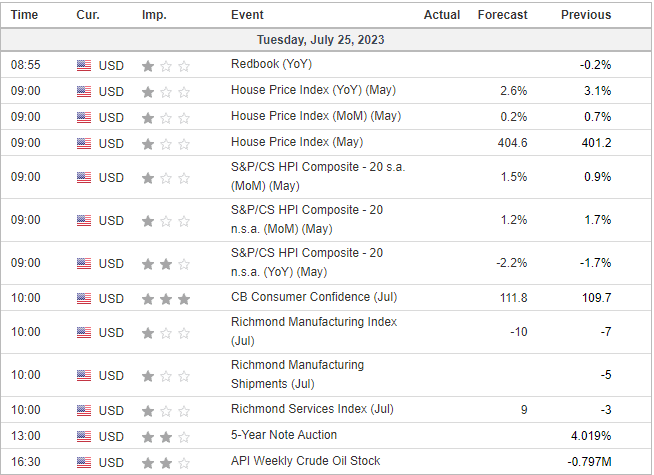

China markets got excited over yesterday’s China Politburo meeting (which I covered yesterday morning in depth)

- Hong Kong: Hang Seng closed UP 4.10%!!

- China CSI 300 +2.89%!!!

- Taiwan KOSPI +0.30%

- India Nifty 50 +0.03%

- Australia ASX -0.13%

- Japan Nikkei -0.31%

- European bourses in positive territory so far this morning

- USD +0.12%

TOP STORIES OVERNIGHT

- Chinese Traders Hope Xi’s Lifeline Will Sustain Rally -BBG

Xi Jinping’s pledge to revive growth is finally winning over some investors who’ve been burned time and again by China’s economic woes.

Even as skeptics pointed to a dearth of specifics in the latest promises from the ruling Politburo, traders cast off weeks of pessimism to drive gains across stocks, corporate debt and the yuan.

They’re betting a more forceful pro-growth tone from the top will be enough to fuel a tradeable rally — and may auger more success in tackling China’s wide array of challenges from mountains of local government debt to a slumping housing market.

“Clearly, markets have been disappointed as they anticipated more rapid improvements, but they are now beginning to rationalize their growth expectations,” said Andrew McCaffery, global chief investment officer at Fidelity International. “Our view is that this somewhat unexciting period will eventually give way to a more positive market tone.”

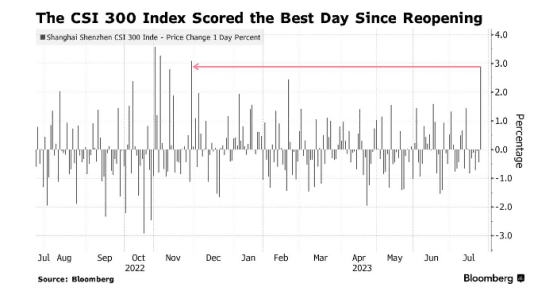

Panic Buyers Load Up on Rice Supplies as India Bans Exports -BBG

India’s move to ban certain rice exports has sparked some panic buying in various countries

Rice is vital to the diets of billions in Asia and Africa. India’s restrictions, which apply to shipments of non-basmati white rice, are aimed at controlling local prices, but they add to strains on global food markets that have already been roiled by bad weather and the worsening conflict in Ukraine.

“Over the past few days, people have started buying maybe twice as much rice as usual. So we had to restrict,” said Shishir Shaima, a manager of MGM Spices, an Indian grocery store in Surry Hills in Australia.

Govindasamy Jayabalan, President of the Malaysian Indian Restaurant Owners Association, said he’s concerned this will lead to a shortage of rice and increase the cost of making dishes such as thosai and rice vermicelli.

“We are very worried about this. Most of our restaurant customers are from the lower income groups,” he said. “It’s not that we want to increase food prices but this is putting us in a difficult situation.”

Rice has been on a tear lately!

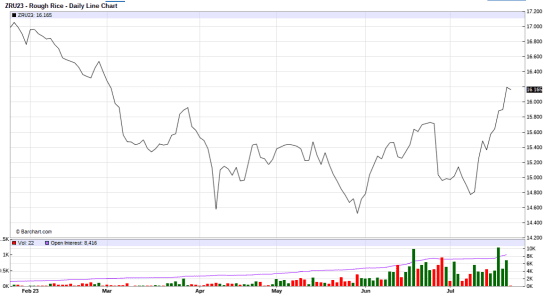

- German Business Moral Drops For Third Consecutive Month As Growth Concerns Mount-Livesquawk

German business confidence fell for a third straight month in July as the domestic economic situation turned “bleaker”, according to the Munich-based Ifo economic thinktank.

The headline business climate index for Germany dropped to 87.3 points this month, the worst showing since November and a result short of the market estimate of 88.0 and last month’s upwardly revised reading of 88.6.

Both components used to calculate the main reading faltered, with the expectations measure for the coming half year slipping to 83.5 from an upwardly revised mark of 83.8, just enough to beat the market estimate of 83.4. The current conditions component dropped to 91.3, which was well below the market forecast of 93.0 and last month’s reading of 93.7.

Ifo highlighted difficulties in the manufacturing sector. “Companies are receiving ever fewer new orders. Capacity utilisation fell by 1.4 percentage points to 83.0%. This marks the first time in over two years that it has fallen below its long-term average of 83.6%.”

EUR trading lover vs USD on this

- UK to run up highest debt interest bill in developed world -FT

The UK is on track to incur the highest debt interest costs in the developed world this year as persistently high inflation and an unusually large proportion of government bonds linked to price rises damage the public finances.

The Treasury will spend £110bn on debt interest in 2023, according to a forecast by Fitch. At 10.4 per cent of total government revenue, that would be the highest level of any high-income country — the first time the UK has topped the data set that goes back to 1995 — after an improvement by the prior leader Iceland.

Roughly a quarter of UK government debt is in the form of so-called index-linked bonds, whose payouts fluctuate in line with inflation, making the country a huge outlier internationally. Italy has the next highest share with 12 per cent of its bonds tied to inflation, while most countries have less than 10 per cent.

“We’ve had a very large inflation shock which is adversely affecting the public finances and that is obviously a key driver of the sovereign credit rating,” said Ed Parker, global head of research for sovereigns and supranationals at Fitch.

The agency reiterated in June its negative outlook on the UK’s double A minus credit rating, citing “the UK’s rising government debt and uncertain prospects for fiscal consolidation”.

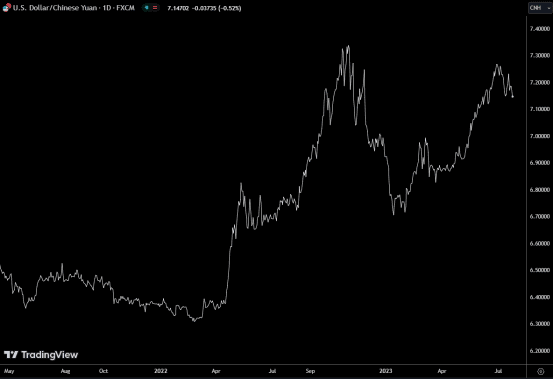

- China State Banks Seen Selling US Dollars to Prop up Yuan-Reuters

-China’s major state-owned banks were seen selling U.S. dollars to buy yuan in both onshore and offshore spot markets in early Asian trade on Tuesday, three people with direct knowledge of the matter said, moves aimed at supporting the Chinese currency.

China’s state banks usually trade on behalf of the central bank in the country’s foreign exchange market, but they could also trade on their own behalf.

The dollar sales come after China’s top leaders pledged on Monday to step up policy support for the economy amid a tortuous post-COVID-19 recovery, focusing on boosting domestic demand and signalling more stimulus steps.

Policymakers also said China will keep the yuan exchange rate basically stable at reasonable and balanced levels, and vowed to invigorate the capital market and restore investor confidence.

“It is interesting that the Politburo mentioned FX stability in the statement, for the first time in recent years,” analysts at HSBC said in a note.

“This means that smoothing yuan depreciation pressure may become more of a policy priority from now on. This is in line with the People’s Bank of China’s (PBOC) further tightening of FX policy recently.”

No surprise really, China does not really like the Yen over 7 to USD, but they have been having a hard time reigning it is with just fixing.

Yen strengthening in the overnight

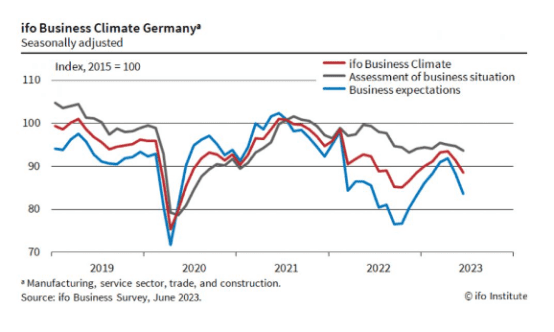

US DATA TODAY