Mostly Red in Europe and Asia-big rebound in Japan after yesterday’s selloff

- Hong Kong: Hang Seng closed down -1.92%

- China CSI 300 -0.22%

- Taiwan KOSPI -0.50%

- India Nifty 50 +0.28%

- Australia ASX -0.73%

- Japan Nikkei +1.43%

- European bourses mostly in negative territory so far this morning

- US indices mixed so far in pre-market, USD +0.20%

Overnight Data/News

- PBoC Sets Yuan Mid-Point At 7.0529 / Dlr VS Last Close 7.0605

- Singapore GDP Y/Y Q1F: 0.4% (est 0.2%, prev 0.1%) – GDP SA Q/Q Q1F: -0.4% (est -0.6%, prev -0.7%)

- German GDP SA (Q/Q) Q1 F: -0.3% (est 0.0%; prev 0.0%) – German GDP NSA (Y/Y) Q1 F: -0.2% (est 0.2%; prev 0.2%) – German GDP NSA (Y/Y) Q1 F: -0.5% (est -0.1%; prev -0.1%)

- German Private Consumption (Q/Q) Q1: -1.2% (est -0.7%; prevR -1.7%) – German Government Spending (Q/Q) Q1: -4.9% (est -0.4%; prevR 0.2%) – German Capital Investment (Q/Q) Q1: 3.0% (est 1.9%; prevR -2.6%)

- Norwegian Credit Indicator Growth (Y/Y) Apr: 5.3% (prev 5.2%) – Norwegian Unemployment Rate Trend Apr: 3.5% (prevR 3.5%)

- French Business Confidence May: 100 (est 101; prev 102) – French Manufacturing Confidence May: 99 (est 101; prev 101) – French Production Outlook Indicator May: -10 (est -5; prev -4) – French Own-Company Production Outlook May: 4 (prev 5)

- Spanish PPI (M/M) Apr: -2.0% (prevR -2.5%) – Spanish PPI (Y/Y) Apr: -4.5% (prevR -1.4%)

- South African PPI (Y/Y) Apr: 8.6% (est 9.0%; prev 10.6%) – South African PPI (M/M) Apr: 0.0% (est 0.4%; prev 1.0%)

- Traders Ramp Up Bets On Japan Inflation To Highest This Year _ BBG

- China’s Interbank Repo Turnover Hits Record, Market Expects More Easing – RTRS

- Power Of Siberia: China Keeps Putin Waiting On Gas Pipeline – FT

- Russia’s Novak Doesn’t See New Steps At June 4 OPEC+ Meeting

- BHP Confident China Property Recovery Will Boost Metals Demand – BBG

- US House Republicans Feel Close To A Debt-Limit Deal

- Dow futures fall 60 pts after Fitch warning; Nvidia powers tech sector higher

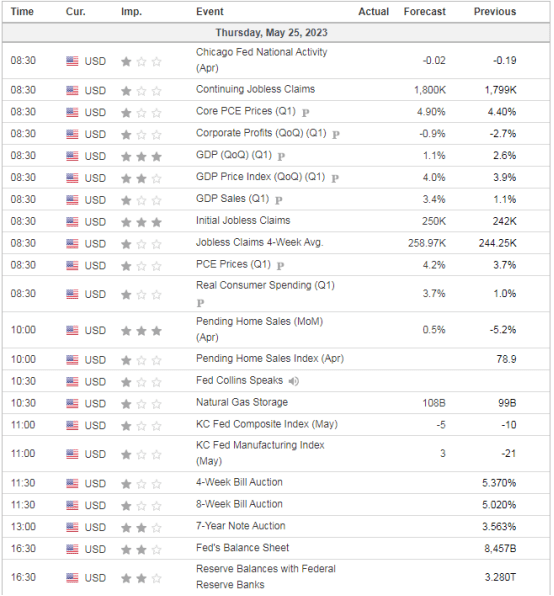

US DATA TODAY