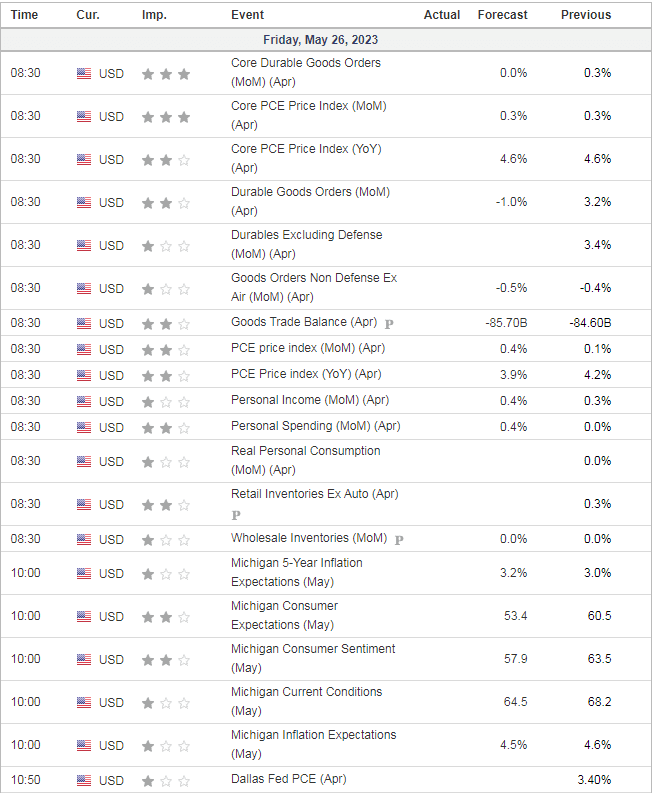

PCE and durable goods at 8:30 AM ET

Asia broadly green after yesterday’s selloff

Keep an eye on that yuan (it’s always the first bullet point under overnight data) …deval going on

- Hong Kong: Hang Seng closed for holiday

- China CSI 300 +0.01%

- Taiwan KOSPI +0.16%

- India Nifty 50 +0.95%

- Australia ASX -1.03%

- Japan Nikkei +0.22%

- European bourses mostly in positive territory so far this morning

- US indices in slight positive territory so far in pre-market, USD retreats -0.27%

Overnight Data/News

- PBoC Sets Yuan Mid-Point At 7.0760 / Dlr VS Last Close 7.0795

- Japan PPI Services Y/Y Apr: 1.6% (est 1.4%, prev 1.6%)

- Tokyo CPI Ex-Fresh Food Y/Y May: 3.2% (est 3.4%, pre 3.5%) – Tokyo CPI Y/Y May: 3.2% (est 3.4%, prev 3.5%)

- UK Retail Sales Inc Auto Fuel (M/M) Apr: 0.5% (est 0.3%; prevR -1.2%) – Retail Sales Inc Auto Fuel (Y/Y) Apr: -3.0% (est -2.8%; prevR -3.9%)

- UK Retail Sales Ex Auto Fuel (M/M) Apr: 0.8% (est 0.4%; prevR -1.4%) – Retail Sales Ex Auto Fuel (Y/Y) Apr: -2.6% (est -2.8%; prevR -4.0%)

- Spanish Total Mortgage lending (Y/Y) Mar: -11.5% (prev -1.9%) – Spanish House Mortgage Approvals (Y/Y) Mar: -15.7% (prev -2.0%)

- Italian Consumer Confidence Index May: 105.1 (est 105.0; prev 105.5) – Italian Manufacturing Confidence May: 101.4 (est 102.5; prevR 102.8) – Italian Economic Sentiment May: 108.7 (prevR 110.4)

- Inflation In Japan’s Capital Slows Slightly In May, But Remains Elevated – RTRS

- China Easing Bets Climb To Highest This Year As Growth Sputters – BBG

- Yield-Hungry Investors Push US Money Market Assets To Record $5.4tn – FT

- US Credit Squeeze Triggers Rise In Corporate Bankruptcies – FT

- China’s State Banks Seen Selling Dollars In Onshore FX Market – RTRS

- BoJ Will Keep YCC Until 2024, Three-Quarters Of Economists Say – RTRS

- US Deputy Treasury Secretary Adeyemo: We’re Making Progress On Debt Ceiling – CNN Interview

US DATA TODAY